“A Supreme Court Gift to the Manufactured Home Industry”

MHARR – ISSUES AND PERSPECTIVES

By Mark Weiss

SEPTEMBER 2024

“A SUPREME COURT GIFT TO THE MH INDUSTRY”

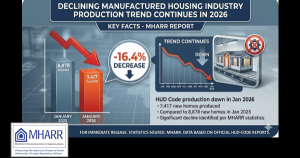

By now, thanks to MHARR research and analysis, as presented in a March 1, 2024 Talking Points Paper entitled, “Summary of the Three Main Bottlenecks Suppressing Manufactured Housing Production, Marketing and Sales,” industry members are aware of the principal regulatory bottlenecks that are preventing the industry from producing and selling hundreds-of-thousands of affordable mainstream homes annually, notwithstanding the fact that the industry is today building its best homes ever. Fortunately, however, the U.S. Supreme Court has recently issued a landmark decision that if used wisely and forcefully by the industry and especially its post-production sector, could help to eliminate these bottlenecks and others that could emerge in the future.

Specifically, on June 28, 2024, the United States Supreme Court announced its decision in Loper Bright Enterprises v. Raimundo. In that case, the Court overruled forty years of judicial deference to Executive Branch interpretations of ambiguous statutes under Chevron USA, Inc. v. Natural Resources Defense Council, Inc., stating: “Courts must exercise their independent judgment in deciding whether an agency has acted within its statutory authority…. [C]ourts need not and under the [Administrative Procedure Act] may not defer to an agency interpretation of the law simply because a statute is ambiguous.” (Emphasis added). It is important to note that the Court’s reference to the Administrative Procedure Act (APA) is not coincidental. Rather, the APA lies at the heart of the Loper Bright ruling, wherein the Court further noted: “The APA … codifies … judicial practice dating back to Marbury [v. Madison]: that courts decide legal questions by applying their own judgment. *** The deference that Chevron requires of courts reviewing agency action cannot be squared with the APA.” (Emphasis added).

So, what does all this mean for the HUD Code manufactured housing industry? To many, the Loper Bright decision will sound like legal gibberish with no real world impact. For a comprehensively federally-regulated industry like manufactured housing, though, the elimination of Chevron deference in regulatory legal challenges could mean quite a lot.

Any time a person or a business considers litigation, there is an important calculus that must be performed. Because litigation is so costly, and represents such a significant allocation of resources, any prudent potential litigant needs to consider and weigh, as objectively as possible, the probable cost and time outlays of litigation versus the likelihood of prevailing or not prevailing in court, and the likely future consequences and implications of each. For a comprehensively federally-regulated industry like manufactured housing, this type of calculus is crucial to ensuring that regulatory or other disputes with federal government agencies are addressed in the most efficient and cost-effective manner possible, that industry resources are not wasted on unrealistic windmill tilting, and that legitimate efforts do not backfire in ways that could cause future harm disproportionate to their current value.

For the past forty years, this type of litigation calculus has had to account for Chevron deference, which gave the government a distinct advantage in regulatory litigation. Under the Chevron doctrine, a court reviewing federal action under the APA (which requires a court to set aside agency action that is arbitrary, capricious or an abuse of discretion) was essentially bound to defer to the administering agency’s interpretation of a controlling statute or statutory term, if either were found to be “ambiguous.”

Over the long term, the elimination of this type of deference will have both “defensive” and “offensive” implications for the industry and its ongoing efforts to ensure that federal regulation is fair, reasonable and, most importantly, cost-effective for American consumers of affordable housing. Its defensive impacts will become clear, over time, as HUD and other agencies make regulatory decisions and consider standards, practices and procedures that affect the industry and its consumers. The elimination of Chevron deference in those contexts, will allow the industry to take more aggressive credible positions in rulemaking (and related) proceedings and interactions, and have, potentially, a greater impact in preventing or moderating harsh or damaging regulatory proposals.

From an “offensive” perspective, the elimination of Chevron deference could alter the status quo (and the litigation calculus) on all three of the principal bottlenecks (i.e., discriminatory zoning exclusion, inadequate Duty to Serve implementation and baseless energy regulation) that are currently suppressing (or imminently will suppress) industry growth and expansion. The answer, ultimately, will depend on how skillfully this fundamental change in the law is wielded by industry organizations and advocates. That being said, how could the elimination of Chevron deference impact the three major bottleneck issues suppressing the industry (assuming that it is not eventually – albeit unlikely — reinstated via legislation)?

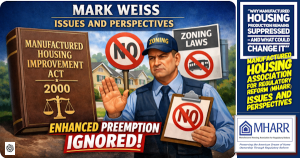

Discriminatory Zoning Exclusion: The devastating impact of such anti-affordable housing state and local edicts on both consumers and the industry has already been addressed extensively by MHARR and should not be a matter of dispute within the industry. Meanwhile, the most efficient and cost-effective remedy for this abuse has been in plain sight for decades. As MHARR has explained repeatedly, the Manufactured Housing Improvement Act of 2000 (2000 Reform Law) added language to the federal preemption provision of the National Manufactured Housing Construction and Safety Standards Act of 1974 that addresses this issue. First, the 2000 Reform Law provides that federal preemption under the 1974 Act, as amended, is to be “broadly and liberally” construed. Second, the 2000 Reform Law extends the scope of preemption to encompass not only state and local safety and construction standards that are not identical to the federal standards, but to all state and/or local “requirements” that impair the comprehensive federal “superintendence” of the industry.

MHARR, for its part, has always contended that this language provides HUD with ample authority to preempt state or local zoning mandates that arbitrarily exclude HUD Code manufactured housing. HUD, however – without any public explanation — has chosen not to use this authority to ensure that affordable manufactured homes are “available” to all Americans, as affirmatively required by the 2000 Reform Law.

So, what would/could happen if this matter were to be taken to federal court? The issue presented would be the meaning (i.e., the scope) of the “enhanced” preemption language of the 2000 Reform Law. While MHARR, for one, would argue that the 2000 amendment is unambiguous in requiring HUD to preempt state or local zoning “requirements” that exclude HUD-regulated manufactured homes, HUD would likely argue that the 2000 Reform Law “enhancements” are ambiguous while refusing to protect its own code (which is equal to and, in some respects, superior to local building codes); the homes that HUD itself regulates; and their residents, from local infringement, discrimination and exclusion.

Under Chevron, this “do nothing” position might well have been accepted by a reviewing court, even if the “industry” position were viewed as being just as persuasive or even more persuasive, simply because HUD is HUD and a court, under Chevron, would have to “defer” to HUD’s interpretation. With the elimination of Chevron deference, though, even if the “enhanced preemption” provision were deemed “ambiguous,” HUD’s “do-nothing” interpretation would not automatically emerge as the winner. Rather, the court would engage in an independent review of the 2000 amendment, free of any forced deference to HUD, and could well conclude – given that a prime purpose of the 2000 Reform Law is to ensure the “availability” of affordable manufactured homes for “all Americans” – that “enhanced preemption” means what it says and that the word “requirements” does, in fact, mean all state and local “requirements” that would (or do) discriminatorily exclude manufactured homes from entire communities.

With the elimination of Chevron deference, then, the industry argument for enhanced federal preemption of exclusionary zoning mandates – which was good to begin with – has gotten that much stronger. And that, in turn, means that the industry can – and should — put even greater pressure on HUD to enforce that preemption of exclusionary zoning requirements, or otherwise face litigation to compel compliance with the exact letter and intent of the 2000 Reform Law.

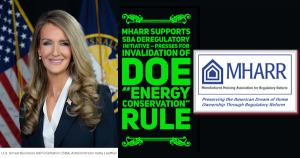

DOE Energy Regulation: While the disastrous U.S Department of Energy (DOE) energy conservation standards for manufactured homes published in 2022 are already the subject of ongoing litigation in federal court under the Administrative Procedure Act, which seeks an injunction against enforcement of the standards on the ground that they are already arbitrary, capricious and/or an abuse of discretion, that litigation has yet to proceed to a full argument and determination on the merits. Thus, the relevant question becomes – can the Loper Bright decision and the elimination of Chevron deference be used in that case to enhance the arguments that have already been asserted against the DOE standards? The short answer, in MHARR’s view, is “yes.”

Even a cursory review of the final standards rule published by DOE on May 31, 2022, shows that DOE did not hesitate to use its alleged “discretion” to interpret multiple aspects of manufactured housing energy standards mandate set forth in the Energy Independence and Security Act of 2007 (EISA). Repeatedly in its final standards rule, DOE refers to “discretion afforded by the [EISA] statute;” “ample discretion to adapt the [International Energy Conservation Code]” (IECC) and decisions relating the way “DOE interprets the [EISA] statute.” Needless to say, if the relevant EISA provision were clear and unequivocal, there would be no need for DOE to “interpret” anything or use its “discretion” to “import” concepts, conclusions and requirements that are not part of the IECC and are, to the contrary, totally alien to the IECC, which is not designed for and does not address manufactured homes. As a result, it is obvious from DOE’s own statements that the application of both EISA and the IECC to the unique structural aspects of manufactured housing is ambiguous. The question, then, becomes whether the “interpretations” underlying DOE’s “final” manufactured housing energy standards, without any deference by the court to DOE whatsoever – are arbitrary, capricious or an abuse of discretion.

Needless to say, for a multitude of reasons set forth by MHARR in its regulatory comments on the DOE proposed standards, in its August 2022 call for industry litigation to stop the DOE standards (see, August 2022 MHARR Issues and Perspectives, “Why the DOE Energy Rule Should be DOA”), and as asserted by the plaintiffs in the pending federal court litigation, DOE’s interpretations, assumptions and conclusions in the final standards rule are not reasonable, are not a reasonable construction of the EISA statute, and are, in fact, affirmatively unreasonable, lacking in any factual or legal basis, and should be rejected. Consequently, to the extent that proper application of Loper Bright could prevent any potentially outcome-determinative deference to DOE “interpretations” by the court in the energy standards case, the implications of that decision should be affirmatively asserted in that action, and not left to chance.

Non-Implementation of the Statutory Duty to Serve: Lastly, among the major bottlenecks suppressing the HUD Code industry, MHARR has extensively detailed the failure of Fannie Mae, Freddie Mac and the Federal Housing Finance Agency (FHFA) to implement the statutory Duty to Serve Underserved Markets (DTS) with respect to the vast bulk of the mainstream manufactured housing consumer financing market served by personal property or “chattel” loans. Under the most recent (2025-2027) DTS proposed plans submitted by the two Government Sponsored Enterprises (GSEs), moreover, the chattel sector – representing nearly 80% of all new manufactured home consumer purchase loans – would continue to be denied any DTS secondary market or securitization support.

This is clearly unacceptable, but Fannie Mae, Freddie Mac and FHFA have effectively been given “a pass” on DTS chattel implementation by the Manufactured Housing Institute (MHI) which, through CEO Lesli Gooch, at an FHFA DTS “listening session” on July 18, 2023, stated: “The Duty to Serve statute does not require Fannie and Freddie to purchase [manufactured housing] personal property loans, but does say explicitly that they – quote – may ‘consider’ such loans….” Worse yet, the GSEs have been so emboldened that no provision to serve manufactured home chattel loans in any manner is included in the 2025-2027 DTS implementation plans recently submitted for FHFA review.

This MHI comment, which should never have been made, refers to section (d)(3) of the DTS statute, which states, “In determining whether an enterprise has complied with the duty under subparagraph (A) of subsection (a)(1), the Director may consider loans secured by both real and personal property.” (See, 12 U.S.C. 4565(d)(3)). (Emphasis added). And while a claim by the GSEs’ (and/or FHFA) that this language is permissive, rather than mandatory (not previously asserted by them publicly), might have carried the day in litigation before the elimination of Chevron deference, those chances have arguably diminished under Loper Bright. In that regard, the reasons why DTS chattel is not, in fact, permissive, have been explored by MHARR previously, in both written and verbal comments offered to FHFA. Quite simply, Congress’ reference to serving both real estate and personal property loans within the manufactured housing market, must be interpreted in context and in light of Congress’ undoubted intent.

First, if Congress did not want to include personal property loans within DTS, it could (and would) have expressly said so. The fact that it did not is the initial step in determining its intent.

Second, under the standard cannons of statutory construction, Congress is assumed to be aware of all relevant facts upon which it legislates. In this instance, Congress can be assumed to have been aware of the fact that personal property loans predominate (and have long predominated) within the mainstream HUD Code manufactured housing financing market and that “serving” that market without including chattel loans, would be a hollow, virtually meaningless promise and directive for manufactured housing consumers. Moreover, Congress, in fact, did know specifically about the importance of chattel loans within the manufactured housing consumer finance market because MHARR and others made that fact known both to Rep. Julia Carson, the main proponent of section (d)(3), as well as to other involved members of Congress.

Third, and perhaps most importantly, the “Duty to Serve” is, by its very name, a “duty” – i.e., a mandatory obligation. The personal property inclusion clause must be read and interpreted within that specific context. Put differently, would it have been reasonable – or sensible – for Congress to establish a binding, affirmative duty to serve the manufactured housing consumer financing market, without conclusively and mandatorily including within that “duty” the largest single segment of the HUD Code market? The answer, clearly is “no.” Therefore, while the term “may” in a statute is customarily deemed permissive or optional in nature, the better construction in this case is that Congress intended for the manufactured housing market to be served in its entirety, in a meaningful and market-significant way, and that level of support can only be accomplished by serving chattel as well as real estate loans.

Consequently, in a post-Chevron world, a legitimate and forceful argument can (and should) be made that the GSEs must serve the manufactured housing chattel lending market under DTS and that any failure to do so violates the DTS mandate.

In summary, the Loper Bright decision, and its elimination of Chevron deference, has changed the regulatory landscape for the industry and particularly its post-production sector. That fundamental change should lead to a reassessment of both strategy and tactics regarding the industry bottlenecks that currently exist — and those which might present themselves in the future. The industry as a whole must demand a sober and thoughtful consideration of these changes and a forceful follow-up to free the industry and its consumers from unnecessary and destructive regulatory burdens which have – and which continue to – devastate its unlimited potential to provide mainstream, affordable homeownership for American consumers of affordable housing.

Mark Weiss

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

“MHARR-Issues and Perspectives” is available for re-publication in full (i.e., without alteration or substantive modification) without further permission and with proper attribution

MHARR – ISSUES AND PERSPECTIVES

By Mark Weiss

SEPTEMBER 2024

“A SUPREME COURT GIFT TO THE MH INDUSTRY”

By now, thanks to MHARR research and analysis, as presented in a March 1, 2024 Talking Points Paper entitled, “Summary of the Three Main Bottlenecks Suppressing Manufactured Housing Production, Marketing and Sales,” industry members are aware of the principal regulatory bottlenecks that are preventing the industry from producing and selling hundreds-of-thousands of affordable mainstream homes annually, notwithstanding the fact that the industry is today building its best homes ever. Fortunately, however, the U.S. Supreme Court has recently issued a landmark decision that if used wisely and forcefully by the industry and especially its post-production sector, could help to eliminate these bottlenecks and others that could emerge in the future.

Specifically, on June 28, 2024, the United States Supreme Court announced its decision in Loper Bright Enterprises v. Raimundo. In that case, the Court overruled forty years of judicial deference to Executive Branch interpretations of ambiguous statutes under Chevron USA, Inc. v. Natural Resources Defense Council, Inc., stating: “Courts must exercise their independent judgment in deciding whether an agency has acted within its statutory authority…. [C]ourts need not and under the [Administrative Procedure Act] may not defer to an agency interpretation of the law simply because a statute is ambiguous.” (Emphasis added). It is important to note that the Court’s reference to the Administrative Procedure Act (APA) is not coincidental. Rather, the APA lies at the heart of the Loper Bright ruling, wherein the Court further noted: “The APA … codifies … judicial practice dating back to Marbury [v. Madison]: that courts decide legal questions by applying their own judgment. *** The deference that Chevron requires of courts reviewing agency action cannot be squared with the APA.” (Emphasis added).

So, what does all this mean for the HUD Code manufactured housing industry? To many, the Loper Bright decision will sound like legal gibberish with no real world impact. For a comprehensively federally-regulated industry like manufactured housing, though, the elimination of Chevron deference in regulatory legal challenges could mean quite a lot.

Any time a person or a business considers litigation, there is an important calculus that must be performed. Because litigation is so costly, and represents such a significant allocation of resources, any prudent potential litigant needs to consider and weigh, as objectively as possible, the probable cost and time outlays of litigation versus the likelihood of prevailing or not prevailing in court, and the likely future consequences and implications of each. For a comprehensively federally-regulated industry like manufactured housing, this type of calculus is crucial to ensuring that regulatory or other disputes with federal government agencies are addressed in the most efficient and cost-effective manner possible, that industry resources are not wasted on unrealistic windmill tilting, and that legitimate efforts do not backfire in ways that could cause future harm disproportionate to their current value.

For the past forty years, this type of litigation calculus has had to account for Chevron deference, which gave the government a distinct advantage in regulatory litigation. Under the Chevron doctrine, a court reviewing federal action under the APA (which requires a court to set aside agency action that is arbitrary, capricious or an abuse of discretion) was essentially bound to defer to the administering agency’s interpretation of a controlling statute or statutory term, if either were found to be “ambiguous.”

Over the long term, the elimination of this type of deference will have both “defensive” and “offensive” implications for the industry and its ongoing efforts to ensure that federal regulation is fair, reasonable and, most importantly, cost-effective for American consumers of affordable housing. Its defensive impacts will become clear, over time, as HUD and other agencies make regulatory decisions and consider standards, practices and procedures that affect the industry and its consumers. The elimination of Chevron deference in those contexts, will allow the industry to take more aggressive credible positions in rulemaking (and related) proceedings and interactions, and have, potentially, a greater impact in preventing or moderating harsh or damaging regulatory proposals.

From an “offensive” perspective, the elimination of Chevron deference could alter the status quo (and the litigation calculus) on all three of the principal bottlenecks (i.e., discriminatory zoning exclusion, inadequate Duty to Serve implementation and baseless energy regulation) that are currently suppressing (or imminently will suppress) industry growth and expansion. The answer, ultimately, will depend on how skillfully this fundamental change in the law is wielded by industry organizations and advocates. That being said, how could the elimination of Chevron deference impact the three major bottleneck issues suppressing the industry (assuming that it is not eventually – albeit unlikely — reinstated via legislation)?

Discriminatory Zoning Exclusion: The devastating impact of such anti-affordable housing state and local edicts on both consumers and the industry has already been addressed extensively by MHARR and should not be a matter of dispute within the industry. Meanwhile, the most efficient and cost-effective remedy for this abuse has been in plain sight for decades. As MHARR has explained repeatedly, the Manufactured Housing Improvement Act of 2000 (2000 Reform Law) added language to the federal preemption provision of the National Manufactured Housing Construction and Safety Standards Act of 1974 that addresses this issue. First, the 2000 Reform Law provides that federal preemption under the 1974 Act, as amended, is to be “broadly and liberally” construed. Second, the 2000 Reform Law extends the scope of preemption to encompass not only state and local safety and construction standards that are not identical to the federal standards, but to all state and/or local “requirements” that impair the comprehensive federal “superintendence” of the industry.

MHARR, for its part, has always contended that this language provides HUD with ample authority to preempt state or local zoning mandates that arbitrarily exclude HUD Code manufactured housing. HUD, however – without any public explanation — has chosen not to use this authority to ensure that affordable manufactured homes are “available” to all Americans, as affirmatively required by the 2000 Reform Law.

So, what would/could happen if this matter were to be taken to federal court? The issue presented would be the meaning (i.e., the scope) of the “enhanced” preemption language of the 2000 Reform Law. While MHARR, for one, would argue that the 2000 amendment is unambiguous in requiring HUD to preempt state or local zoning “requirements” that exclude HUD-regulated manufactured homes, HUD would likely argue that the 2000 Reform Law “enhancements” are ambiguous while refusing to protect its own code (which is equal to and, in some respects, superior to local building codes); the homes that HUD itself regulates; and their residents, from local infringement, discrimination and exclusion.

Under Chevron, this “do nothing” position might well have been accepted by a reviewing court, even if the “industry” position were viewed as being just as persuasive or even more persuasive, simply because HUD is HUD and a court, under Chevron, would have to “defer” to HUD’s interpretation. With the elimination of Chevron deference, though, even if the “enhanced preemption” provision were deemed “ambiguous,” HUD’s “do-nothing” interpretation would not automatically emerge as the winner. Rather, the court would engage in an independent review of the 2000 amendment, free of any forced deference to HUD, and could well conclude – given that a prime purpose of the 2000 Reform Law is to ensure the “availability” of affordable manufactured homes for “all Americans” – that “enhanced preemption” means what it says and that the word “requirements” does, in fact, mean all state and local “requirements” that would (or do) discriminatorily exclude manufactured homes from entire communities.

With the elimination of Chevron deference, then, the industry argument for enhanced federal preemption of exclusionary zoning mandates – which was good to begin with – has gotten that much stronger. And that, in turn, means that the industry can – and should — put even greater pressure on HUD to enforce that preemption of exclusionary zoning requirements, or otherwise face litigation to compel compliance with the exact letter and intent of the 2000 Reform Law.

DOE Energy Regulation: While the disastrous U.S Department of Energy (DOE) energy conservation standards for manufactured homes published in 2022 are already the subject of ongoing litigation in federal court under the Administrative Procedure Act, which seeks an injunction against enforcement of the standards on the ground that they are already arbitrary, capricious and/or an abuse of discretion, that litigation has yet to proceed to a full argument and determination on the merits. Thus, the relevant question becomes – can the Loper Bright decision and the elimination of Chevron deference be used in that case to enhance the arguments that have already been asserted against the DOE standards? The short answer, in MHARR’s view, is “yes.”

Even a cursory review of the final standards rule published by DOE on May 31, 2022, shows that DOE did not hesitate to use its alleged “discretion” to interpret multiple aspects of manufactured housing energy standards mandate set forth in the Energy Independence and Security Act of 2007 (EISA). Repeatedly in its final standards rule, DOE refers to “discretion afforded by the [EISA] statute;” “ample discretion to adapt the [International Energy Conservation Code]” (IECC) and decisions relating the way “DOE interprets the [EISA] statute.” Needless to say, if the relevant EISA provision were clear and unequivocal, there would be no need for DOE to “interpret” anything or use its “discretion” to “import” concepts, conclusions and requirements that are not part of the IECC and are, to the contrary, totally alien to the IECC, which is not designed for and does not address manufactured homes. As a result, it is obvious from DOE’s own statements that the application of both EISA and the IECC to the unique structural aspects of manufactured housing is ambiguous. The question, then, becomes whether the “interpretations” underlying DOE’s “final” manufactured housing energy standards, without any deference by the court to DOE whatsoever – are arbitrary, capricious or an abuse of discretion.

Needless to say, for a multitude of reasons set forth by MHARR in its regulatory comments on the DOE proposed standards, in its August 2022 call for industry litigation to stop the DOE standards (see, August 2022 MHARR Issues and Perspectives, “Why the DOE Energy Rule Should be DOA”), and as asserted by the plaintiffs in the pending federal court litigation, DOE’s interpretations, assumptions and conclusions in the final standards rule are not reasonable, are not a reasonable construction of the EISA statute, and are, in fact, affirmatively unreasonable, lacking in any factual or legal basis, and should be rejected. Consequently, to the extent that proper application of Loper Bright could prevent any potentially outcome-determinative deference to DOE “interpretations” by the court in the energy standards case, the implications of that decision should be affirmatively asserted in that action, and not left to chance.

Non-Implementation of the Statutory Duty to Serve: Lastly, among the major bottlenecks suppressing the HUD Code industry, MHARR has extensively detailed the failure of Fannie Mae, Freddie Mac and the Federal Housing Finance Agency (FHFA) to implement the statutory Duty to Serve Underserved Markets (DTS) with respect to the vast bulk of the mainstream manufactured housing consumer financing market served by personal property or “chattel” loans. Under the most recent (2025-2027) DTS proposed plans submitted by the two Government Sponsored Enterprises (GSEs), moreover, the chattel sector – representing nearly 80% of all new manufactured home consumer purchase loans – would continue to be denied any DTS secondary market or securitization support.

This is clearly unacceptable, but Fannie Mae, Freddie Mac and FHFA have effectively been given “a pass” on DTS chattel implementation by the Manufactured Housing Institute (MHI) which, through CEO Lesli Gooch, at an FHFA DTS “listening session” on July 18, 2023, stated: “The Duty to Serve statute does not require Fannie and Freddie to purchase [manufactured housing] personal property loans, but does say explicitly that they – quote – may ‘consider’ such loans….” Worse yet, the GSEs have been so emboldened that no provision to serve manufactured home chattel loans in any manner is included in the 2025-2027 DTS implementation plans recently submitted for FHFA review.

This MHI comment, which should never have been made, refers to section (d)(3) of the DTS statute, which states, “In determining whether an enterprise has complied with the duty under subparagraph (A) of subsection (a)(1), the Director may consider loans secured by both real and personal property.” (See, 12 U.S.C. 4565(d)(3)). (Emphasis added). And while a claim by the GSEs’ (and/or FHFA) that this language is permissive, rather than mandatory (not previously asserted by them publicly), might have carried the day in litigation before the elimination of Chevron deference, those chances have arguably diminished under Loper Bright. In that regard, the reasons why DTS chattel is not, in fact, permissive, have been explored by MHARR previously, in both written and verbal comments offered to FHFA. Quite simply, Congress’ reference to serving both real estate and personal property loans within the manufactured housing market, must be interpreted in context and in light of Congress’ undoubted intent.

First, if Congress did not want to include personal property loans within DTS, it could (and would) have expressly said so. The fact that it did not is the initial step in determining its intent.

Second, under the standard cannons of statutory construction, Congress is assumed to be aware of all relevant facts upon which it legislates. In this instance, Congress can be assumed to have been aware of the fact that personal property loans predominate (and have long predominated) within the mainstream HUD Code manufactured housing financing market and that “serving” that market without including chattel loans, would be a hollow, virtually meaningless promise and directive for manufactured housing consumers. Moreover, Congress, in fact, did know specifically about the importance of chattel loans within the manufactured housing consumer finance market because MHARR and others made that fact known both to Rep. Julia Carson, the main proponent of section (d)(3), as well as to other involved members of Congress.

Third, and perhaps most importantly, the “Duty to Serve” is, by its very name, a “duty” – i.e., a mandatory obligation. The personal property inclusion clause must be read and interpreted within that specific context. Put differently, would it have been reasonable – or sensible – for Congress to establish a binding, affirmative duty to serve the manufactured housing consumer financing market, without conclusively and mandatorily including within that “duty” the largest single segment of the HUD Code market? The answer, clearly is “no.” Therefore, while the term “may” in a statute is customarily deemed permissive or optional in nature, the better construction in this case is that Congress intended for the manufactured housing market to be served in its entirety, in a meaningful and market-significant way, and that level of support can only be accomplished by serving chattel as well as real estate loans.

Consequently, in a post-Chevron world, a legitimate and forceful argument can (and should) be made that the GSEs must serve the manufactured housing chattel lending market under DTS and that any failure to do so violates the DTS mandate.

In summary, the Loper Bright decision, and its elimination of Chevron deference, has changed the regulatory landscape for the industry and particularly its post-production sector. That fundamental change should lead to a reassessment of both strategy and tactics regarding the industry bottlenecks that currently exist — and those which might present themselves in the future. The industry as a whole must demand a sober and thoughtful consideration of these changes and a forceful follow-up to free the industry and its consumers from unnecessary and destructive regulatory burdens which have – and which continue to – devastate its unlimited potential to provide mainstream, affordable homeownership for American consumers of affordable housing.

Mark Weiss

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

“MHARR-Issues and Perspectives” is available for re-publication in full (i.e., without alteration or substantive modification) without further permission and with proper attribution