MHProNews Q&A with Danny Ghorbani

The following is a reprint of a popular new periodic series of questions and answers (Q&A) published by MHProNews. The series aims to set key industry issues in its proper historic and factual context. MHProNews asked Danny Ghorbani to participate due to his unique and award winning 50-year history in manufactured housing.

– Danny Ghorbani

Danny Ghorbani is the former President and CEO of MHARR and the current Senior Advisor to the Association.

MHProNews Q & A with Danny Ghorbani Using MHARR’S White Paper to Evaluate the Veracity of MHI’s Public Relations Activities

MHProNews Questions

You may or may not have read or even noticed the increase in recent years in the volume of public relations materials that Manufactured Housing Institute (MHI) puts out. One specific “news” item that MHI published in late December 2022 is titled “MHI Priorities Are Addressed in Congress’ Year End Package.” My questions are:

and;

- What is your general view of this MHI’s “news” item, as well as MHI’s public relations and published self-promotion materials in general?

- How can industry members who are routinely bombarded with these MHI materials, intelligently evaluate their veracity as well as their actual benefit (if any) to the industry and consumers?

Danny Ghorbani Answers:

Thank you, Tony.

To be frank, I don’t particularly seek to read anything published by MHI. That being said, though, one can’t help but notice the tactics that MHI employs to saturate the industry with its braggadocious material. Here’s how the scheme works. MHI publishes a “fluff” news item and that is exposure number one. Then trusting state associations take that “fluff” and publish it in their own newsletters to provide exposure number two. And if a state association has local chapters (which many do), those chapters may publish the same material, or forward it to their members, and that is exposure number three. Then the same content is typically used for discussion at their assorted meetings, seminars, conferences, “congresses” and parties (just to name a few) and before you know it, the “fluff” piece and its contents are widely circulated.

Now, to be sure, MHI is entitled to say and do as it wishes, but you also are absolutely correct that in an industry as complex as ours, which is comprehensively regulated by the federal government, industry members exposed to such materials need some method or means to evaluate the veracity, accuracy and legitimacy of what they are reading and/or hearing, as well as their ULTIMATE BENEFIT (if any) to the industry and consumers.

In conjunction with the above — and as an aside — this is why I am a bit disappointed with my state association colleagues for not EQUALLY exposing in their newsletters the materials they routinely receive from MHARR in order to provide members with fully-accurate and fully- balanced information. But that is another subject for another time.

To return to your initial question, yes, I have had a quick glance at this supposed “news” item, and in my opinion, there is “no ‘there’ there” with respect to MHI’s “priorities” allegedly being included in Congress’ legislative package, as it fits the same old MHI pattern of “all talk and no [meaningful] action.” So, this is just the latest in an ongoing series of self-promotion and public relations efforts that MHI has been pursuing for years.

They are able to get away with this sleight-of-hand, because there has never before existed a workable tool that readers could use to fact-check the veracity of these claims and these MHI materials. This should change, though, following the July 2022 publication of MHARR’s latest White Paper, entitled “The Exploitation of Federal Housing Finance and Mortgage Assistance Programs and Potential Solutions.”

With this White Paper, industry members can compare the White Paper’s analysis and conclusions with MHI’s claims that its supposed “priorities” are included in Congress’ bloated $1.7 trillion taxpayer-funded spending bill. From that comparison, it becomes apparent that very little or none of that spending and related program activity will EVER, IN REALITY, REACH THE GROUND in the form of TANGIBLE BENEFITS that would result in a voluminous increase in manufactured home production and a corresponding increase in sales of NEW manufactured homes to and for the lower and moderate-income Americans who depend on HUD Code homes as their only source for affordable homeownership.

Sadly, though, MHI often uses such self-promotion and public relations activities to divert the industry’s attention from something else that it is either doing or failing to do…a sort of “razzle- dazzle” that magicians would use to distract audiences while performing “tricks.” A perfect example of this phenomenon is an item in the alleged “priorities” list, where MHI brags about a “directive to HUD to substantially engage with the DOE on [energy] efficiency standards for manufactured housing.” As I explained in the last Q & A about the DOE energy rule, this is nothing new, as coordination between DOE and HUD — and the MANUFACTURED HOUSING CONSENSUS COMMITTEE (MHCC), I might add — was already in the original enabling legislation, EISA (i.e., the Energy Independent and Security Act of 2007).

MHI, then, having made a serious error in “going along to get along” with DOE and energy rule PROPONENTS in their nonsensical “negotiated rulemaking” process and NOT joining with MHARR to ensure united industry opposition, now wants the industry to forget all of that because of this supposed directive? Particularly at a time when the horrible results of MHI’s ill-advised actions on the DOE energy rule are about to saddle the industry and consumers with thousands of dollars in extra regulatory compliance costs for each NEW home — which would further devastate our industry’s ability to increase production and expand its affordable housing market — MHI brags about the re-do of something that was already there and MHI failed to press for the good of ALL members of our industry?

The question thus arises, is MHI doing this in order to divert the industry’s attention from its repeated mistakes on the DOE energy rule from the beginning, or is MHI doing this in order to divert the industry’s attention from failing to take the lead on a legal challenge and injunction against DOE to force it back to the drawing board — something that MHI could and should have done as soon as DOE published its final rule in May 2022 but didn’t. Meanwhile, the clock is winding-down closer and closer to the May 31, 2023 implementation date for that miserable and unnecessary rule.

It goes without saying that if all of this self-promotion that MHI routinely publishes to tout its alleged “accomplishments” had ever reached the ground in actuality, our industry would have not been stuck near, but mostly below, a production level of 100,000 homes per year since 2007. In fact, the one time that MHI has accomplished something of substance to truly benefit the industry and consumers, is when it was FORCED twice by its members to fully cooperate and work closely with MHARR — once to develop and pass the landmark 2000 Reform Law and a second time to develop and pass the “Duty to Serve the Underserved Markets” provision of the Housing and Economic Recovery Act of 2008 (HERA).

Unfortunately, though, MHI didn’t FULLY commit itself (i.e., by using all the levers of power, including the federal courts and congressional oversight hearings) to the full and proper implementation of ALL provisions of these two beneficial laws (particularly and especially provisions related to post production matters), resulting in the continuing economic stagnation of the industry to date. MHI, therefore, talks a good game about these laws, but has never taken decisive action to force their full and proper implementation … particularly in the post-production realm.

In my view, MHI’s modus operandi regarding self-promotion needs to be understood and taken into account by those who might trustingly be inclined to accept such statements at face value. This is why MHARR’s White Paper would (and should) be a tremendous help to industry members as a tool to evaluate and decide for themselves the veracity of MHI claims and whether such activities would result in actual TANGIBLE BENEFITS that would ACTUALLY REACH THE GROUND and have a real-world impact for both the industry and consumers.

To close, then, after the pandemic of 2020 and with the Biden administration’s focus on federal housing, finance and mortgage assistance programs emphasizing affordable housing, it became apparent that self promotion opportunities flowing from these programs would be irresistible to MHI even though, as the White Paper explains in detail, very few or none of them ACTUALLY REACH THE GROUND for manufactured housing. Therefore, MHARR determined that an educational and “straight-talk” research paper was warranted. This led to the development and publication of the July 2022 MHARR White Paper. A comprehensive document, the White Paper methodically and factually explains why our industry and its consumers are — and continue to be — deprived of the benefit of virtually any and all federal programs and government largesse that might otherwise apply. The reasons for this major problem — and how they can be corrected — are all in the July 2022 MHARR White Paper…and MHI holds the key to correct all of them if the association so wishes, as virtually all relate to deficiencies impacting the post production aspects of new HUD Code homes (e.g., discriminatory zoning laws and consumer finance, among others) for which MHI collects hefty REPRESENTATION dues from industry members, thus making the correction of such matters a duty owed by MHI to its members.

The July 2022 MHARR White Paper, therefore, is a must read for any and all individuals who have the slightest interest in the advancement, success and prosperity of this great manufactured housing industry. For a copy of this document, readers should call (202/783-4087) or email the association at MHARRDG@AOL.COM.

Danny D. Ghorbani

202/262-2170

DannyGhorbani@aol.com##

MHProNews Q & A with Danny Ghorbani about DOE’s Final Manufactured Housing Energy Rule

MHProNews Question

Have you seen and read MHI’s recent proposal and plan of action finally opposing the U.S Department of Energy’s (DOE) final manufactured housing energy rule? And if you have, given your knowledge of this important rule and of the industry at large, do you think it a good or a bad proposal? In sharing your insights and given the complexity of the DOE final MH energy rule, will you please explain to our readers some of the key relevant, factual and accurate information about this hot-button topic?

Danny Ghorbani Answer:

Thank you, and yes, I have read the information that MHI released in May, as well as a

couple of related interviews that have been published since. Thus, based on that information, once again MHI’s “solution” falls way short of the target regarding a critical and devastating problem that it has helped to create and perpetuate, and which is now on a fast track to be implemented in less than a year to the detriment of the manufactured housing industry and moderate and lower-income American consumers who depend on our industry as their primary source of affordable homeownership. I will try to further explain my thoughts on this matter.

The DOE final manufactured housing energy rule, which was published on May 31, 2022 and will be enforced on June 1, 2023 is a very complex energy regulation resulting from the manufactured housing energy provisions of the Energy Independence and Security Act of 2007 (EISA). It is an extremely harsh, unnecessary, and unnecessarily costly and expensive overkill-regulation for today’s modern, energy-efficient manufactured homes, which, as explained below, should have been dead in its tracks, if MHI had not collaborated and cooperated with DOE and the rules’ proponents from the beginning of the DOE rulemaking process.

That DOE rule, if enforced in its current final version, would drastically affect the very existence of our homes as we know them today and potentially wipe-out nearly 80% production of our industry’s most affordable models, placing them out of the reach of our consumers. And even though we were able to include plenty of guard rails and safety provisions in EISA during the latest stages of the legislative process, DOE has completely ignored them because MHARR was the only stakeholder that tried to hold DOE accountable for compliance with those provisions through the entire rulemaking process, but to no avail.

There are two sequences of actions and/or lack thereof that aptly define MHI’s role in bringing the industry to this critical stage, and one action that might potentially rescue the industry before disaster strikes on June 1, 2023, that is, of course, if MHI decides to cooperate. These sequences are:

A – MHI’s long standing collaboration, cooperation and complicity with DOE and the rule’s proponents at various times since the rulemaking process began over a decade ago;

B – MHI’s belated “deathbed conversion” and ongoing attempt at vindication (albeit, still on the wrong track) once the extremely destructive aspects of the DOE final rule began to be exposed, uncovered and gradually understood (thanks to MHARR) by industry members and consumers, thus forcing MHI to reverse course with its incomplete, half-hearted, “CYA” proposal and plan of action that it now is peddling in Washington, D.C.;

C – What must MHI and the industry actually do in order to make the best out of a fastmoving, terrible and destructive rule before they run out of time, as the clock continues to run?

Now, let’s carefully address and examine all of the above.

A – In my opinion, it is a known fact that MHI worked and closely collaborated with DOE from day one of the rulemaking process for EISA. What is not literally and universally known, is the degree to which such collaboration and complicity facilitated the rule’s advancement at every stage of the rulemaking process until recently. Nor is MHI’s recent hasty reversal of its support for the continuing advancement of the DOE’s destructive rule, any indication as of yet that MHI is truly inclined to fight the final rule and not just posture as MHProNews so aptly puts it, offers a “head fake” to buy and/or waste valuable time, divide the industry’s efforts and resources, while simply running-out the clock. Given MHI’s corrective proposals and plan of action, it is disturbing that MHI still has not admitted that, at the very least, it made mistakes during the rulemaking process and is now willing to help correct matters. In short, MHI can continue to run from its actions that resulted in this destructive DOE regulatory rule, but it cannot run from the existing facts, accurate information and documented material that actually exist and will help to educate manufactured housing industry stakeholders.

In conjunction with this and for the benefit of industry members and consumers, shown below is a brief chronology of MHI’s actions or lack thereof that have been instrumental in facilitating and advancing DOE’s destructive rule since the early stages of the rulemaking process all the way to its later stages. Furthermore, and for better understanding by the readers and stakeholders, this document also includes the corresponding actions by MHARR, the only national organization that has aggressively, constantly, and persistently opposed the DOE’s energy rule from the beginning, based on the DOE’s non-compliance with the key protective provisions of EISA and every step thereafter. One can only imagine what the final DOE’s energy rule would have looked like had MHI, supposedly the national representative of “all segments” of our industry, had also aggressively, constantly, and persistently done the same thing. No doubt that the industry and consumers would certainly be in better shape than they are right now.

B – The above factual outline document becomes even more relevant and important in helping industry members, consumers and opponents of the rule to better understand why MHI has made a 180-degree reversal of its more-than-one decade of support, cooperation and complicity with DOE to advance this destructive regulation to its final stage, all with what MHProNews has correctly labeled as a mish-mash of a proposal. So, with its proverbial cover of cooperation and assistance in advancing the rule blown, MHI throws everything at the wall except litigation, perhaps hoping that something might stick. But with MHARR’s aggressive, constant, persistent, and vigilant opposition to the DOE energy rule, added to the MHARR’s methodical, detailed, and thorough education of the rule’s stakeholders about the destructive nature of the rule, (see, the chronology document numbers 18, 19 & 20 above), MHI’s attempt at vindication via its latest proposal is inadequate and incomplete at best and is arguably worthless and devoid of real and serious solution at worst.

Regardless, MHI is already in a “hole” on the DOE’s egregious final rule, but keeps digging itself, the industry, and consumers a deeper hole by continuing to underestimate the knowledge and intelligence of the DOE energy rule’s stakeholders. This is because based on the MHI’s announced proposal and plan of action, that “plan” mainly consists of two efforts, namely:

- 1- H.R. 7651 – proposed new legislation backed and fully supported by MHI; and

- 2- A proposed revised energy standard that MHI wishes HUD would adopt in lieu of the DOE’s MH energy rule, currently in its countdown to implementation stage.

Regarding number 1, above, aside from MHI’s big talk and wishful thinking, the presumptuous nature of such a proposal is simply silly. For example, the odds that a Democrat-controlled Congress, White House and DOE will easily dispose a rule in its final stage is slim to none. MHI’s history and record on its ability to implement the industry’s beneficial laws (DTS, FHA Title I, Enhanced Preemption, etc.) are quite poor. Nearly all of MHI’s stated requirements warranting a new law (i.e., DOE must fully consult with HUD & MHCC, DOE must document that the rule is cost-effective based on the impact of homebuyer price and cost increases, the standards must fully take into consideration MH construction methods and transportation requirements, the standards must be adopted by HUD as part of the HUD Code, circumstances under which DOE can use the IECC, etc.) were either explicitly or implicitly incorporated in the EISA. So, where has MHI been all these years…during the rulemaking process when all such objections should have been addressed by MHI and used as reasons for OPPOSING THE RULE FROM THE BEGINNING AND AT EVERY FOLLOWING STEP, AS MHARR DID FROM THE BEGINNING OF THE RULEMAKING PROCESS TO DATE (see the chronology document’s numbers 1-13 above) — AND WITHOUT ANY HELP FOR MHARR’s EFFORTS WHATSOEVER FROM MHI.

Finally, it is quite doubtful that MHI’s proposal to pass a new law to fix the DOE’s final energy rule will actually work. This is because the final rule’s proponents and DOE’s allies who have worked relentlessly for years to use and abused the weak manufactured housing industry’s so-called representative of “all segments” of the industry (see the chronology document above) in order to put their collective foot in the door for their larger targets (i.e., the greater housing and building industries) WILL NOT simply sit still allowing MHI to wiggle its way out of their trap. Thus, the MHI plans will not only fail to achieve what it was intended to do, but it would actually help the proponents of the final rule by dividing, diluting, and weakening the efforts of the rule’s opponents. It would also waste valuable time, money, and other resources, and make the implementation of this horrendous rule a reality resulting in the destruction of manufactured homes as the main source of modern, energy efficient, unsubsidized, and affordable housing for Millions of American families — a legacy that each and every member of our industry must and will despise.

Regarding the above number 2, MHI’s proposal to HUD to adopt its revised energy standards in lieu of the DOE’s rule at this late date when the clock is running on the enforcement of the rule. MHI could and should have offered this proposal much earlier during the rulemaking process (see the chronology document’s items 1-7) instead of naively going along with DOE’s “draft” proposed energy rule, which has ultimately morphed into the current DOE’s monstrous final energy rule. That being said, I do appreciate MHI’s optimism for trying this with HUD as long as it would admit its past mistakes and blunders on the energy rule which have helped DOE to advance its destructive rule to its final stage. Unfortunately, though, I am afraid that this, too, is just more wishful thinking by MHI, perhaps trying to redeem itself.

C – One positive aspect of MHI’s ongoing “deathbed conversion” with its recent activities to finally oppose (albeit, still without a comprehensive and doable plan of action) this terrible DOE rule and thereby potentially redeem itself, is that it has raised the absolutely negative profile of the DOE’s horrendous manufactured housing energy rule, as well as the upcoming disaster that the industry and consumers would face if the current final rule is not blocked.

This small flickering ray of hope can and must be utilized by all the opponents of the DOE’s final MH energy rule, to rally the industry, and consumers to fiercely fight DOE’s rule through a major industry litigation. Such a legal action should start with an injunction to block the current final rule and thereby send DOE back to the drawing board for a new rulemaking process to properly implement ALL of EISA’s relevant provisions.

Knowing the successful history of our industry, as I do, with the hardworking, knowledgeable, intelligent, decent, and trusting people who have made and continue to make our industry as great as it is, I am hopeful that this suggested course-correction by MHI engaging legally in this battle will become a reality soon.

I am hopeful that enough of the cooler heads will prevail at MHI, with manufacturers and state association leaders stepping forward once again (i.e., as Walt Young, Chairman of Champion Homes Builders and Will Ehrle former President and General Counsel of the Texas Manufactured Housing Association did at a very critical time in late 1990s). Their leadership in bringing MHI around to fully support and advance MHARR’s efforts for a major reform of our law helped rally the industry for the passage of the landmark legislation – “The Manufactured Housing Improvement Act of 2000.” That law, now referred to as the 2000 Reform Law, put MHI on the right track. And with this current destructive energy rule that the industry and consumers are facing, it is time for the history to repeat itself before it is too late. ##

Danny D. Ghorbani

202/262-2170

DannyGhorbani@aol.com##

MHProNews Q&A with Danny Ghorbani about Manufactured Housing Institute Homes on the Hill at Innovative Housing Showcase 2022

MHProNews Second Q&A with Danny Ghorbani

MHProNews Question

Please share your perspective and experience that compares and contrasts the recent Innovative Housing Showcase (IHS 2022) and the so-called Manufactured Housing Institute Homes on the Hill to a prior event that occurred in the 1970s when Skyline Homes placed factory-built homes near the U.S. Capitol Building and the National Mall in Washington, D.C.

Danny Ghorbani Answer:

Thanks, Tony.

Please wake me up the first time one of these national officials, and more specifically a HUD Secretary actually takes action to correct a discriminatory and/or exclusionary zoning law against manufactured housing and, in fact, advances our homes that it regulates, certifies and fully controls. Remember, Jack Kemp was the HUD Secretary who correctly identified and coined the phrase NIMBY (Not In My Back Yard) for this problem in a report to then President George H.W. Bush. [POTUS 41-R]. Here we are decades later, and HUD hasn’t done anything of substance to correct the NIMBY problem…even after we gave HUD the additional power and authority with the “Enhanced Preemption” provision of our 2000 Reform Law [i.e.: the Manufactured Housing Improvement Act of 2000].

The bottom line is that when we erected and staged the HOUSE ON THE HILL as our industry’s very first exclusive “village” (i.e., not as a second fiddle to site builders and NAHB) in Washington, D.C. in 1970s, there were very sound and badly needed reasons and purposes for our industry (by then, a comprehensively federally regulated industry) to showcase its products in the nation’s capital. In part, these were to educate the U.S. Congress, government agencies, and other decision-makers about our then-latest homes which were being offered to the public at large. We did that because:

1- The industry had completed its transition from “trailers” to “mobile homes;”

2- The 1974 federal law was in its third year of implementation, and HUD was already moving on the wrong track enforcing it;

3- We wanted to make sure that Congress, government agencies, and all other decision-makers would accord our manufactured homes full parity with all other types of housing in all federally supported, assisted and funded housing, mortgage and finance programs.

And the evolutionary history of our industry clearly shows that, thanks to the creation of MHARR in 1985, not only many of those purposes were achieved, but, in the process, we also discovered that the 1974 federal law was badly flawed and in dire need of comprehensive reform to address today’s modern, quality, energy efficient, and affordable manufactured homes. That was in conjunction with reform of existing law and new laws needed for manufactured home consumer finance.

The fact of the matter is that none of those badly needed reasons and purpose exists today because Congress has mandated great laws for production, marketing, and consumer financing of our industry’s modern manufactured homes.

In short, Congress has generously done its job for our industry and our consumers…we made sure of that. That said, the only other thing that Congress can and should do is Congressional Oversight Hearings, which the industry (i.e., its so-called post-production representation) is scared to death to ask for, but that is a story for another time.

So, the continuing failure of full and proper implementation of these great laws by our industry has blunted and stymied the growth of manufactured housing.

And while a good dog and pony show is always a welcome event in the nation’s capital, the industry has much bigger fish to fry these days.

Therefore, the industry must keep its collective eye on the big prize, which is first and foremost the full and proper implementation of its existing laws, particularly as they pertain to discriminatory and/or exclusionary zoning laws and consumer finance, all of which we worked and fought so hard to achieve, but continue to languish unused.

As I have said many times before, posturing, public relations, photo-ops, rubbing shoulders, big talks, etc. are cheap and low-hanging fruits that are easy to pick…but what our industry and our consumers desperately need is heavy-lifting, hard work, fighting spirit, tough and aggressive attitude and productive ACTION(S), which, unfortunately, is not happening as of yet because of the incompetence of those who are entrusted by the hardworking and trusting members of our manufactured home industry to advance them.”

Danny D. Ghorbani

202/262-2170

DannyGhorbani@aol.com##

DISCRIMINATORY AND EXCLUSIONARY ZONING LAWS

MHProNews Q&A with Danny Ghorbani

MHProNews First Question

Discriminatory and exclusionary zoning laws against manufactured housing throughout the United States are causing hardships for affordable housing seekers as well as pressures, loss of business and related anxieties among industry members. That is particularly true among the industry’ independent retailers, specific communities, developers and finance companies. Similar to our previous Q&A regarding consumer financing for mainstream HUD Code manufactured homes, there are several questions on this key issue that needs to be addressed and understood. But to begin with, I’d appreciate it if you would provide our readers with a thumbnail sketch as to the overall aspects and importance of discriminatory and exclusionary zoning. Also explain why the industry has been locked in its current predicament with zoning and placement for so long?

Danny Ghorbani Answer:

Tony, you just put the proverbial stick in a beehive!

You are right on target with your question, which puts the spotlight squarely on an issue that should be right at the top of the industry’s “must-do” list of reform priorities, but, unfortunately, is not. The reality is that if there is one factor that continues to block the progress and advancement of the manufactured housing industry from achieving its full potential as the only source of affordable, non-subsidized and quality homeownership for millions of moderate and lower income Americans, it is — by far — the imposition of discriminatory and exclusionary zoning laws on the industry’s homes and the purchasers of those homes by state and local governments. It is very simple to grasp this from a potential homebuyer’s point of view, because if he/she cannot place a manufactured home on a piece of land, the potential consumer will simply not buy it. Thus, the industry’s huge zoning predicament.

This, added to the continuing lack of readily available consumer finance at affordable and truly competitive interest rates, have devastated the growth of the industry and placed potential homebuyers in an untenable situation, with no end in sight. These two glaring failures have created a bottleneck in the marketplace between manufacturers, who can easily expand their production and meet any and all consumer demands for today’s quality manufactured homes, and potential home buyers who are ready and willing to purchase these homes, but can’t finance and place them. In short, our industry’s very unique network of distribution (i.e., retailers and consumer finance) and placement (i.e., communities) that has served consumers very well, and has given the industry a distinct advantage over other types of housing (i.e., site-built) in the affordable housing marketplace, are slowly being “squeezed” and are gradually disappearing.

So, while industry manufacturers can and do aggressively fight and win regulatory battles at the national level regarding the production of their homes (thanks to the formation of the Manufactured Housing Association for Regulatory Reform — MHARR — in 1985), the industry is impotent, hapless and unable to fight and win its battles regarding post-production issues – i.e., issues arising after the home leaves the factory, because there is no collective, independent national entity out there that is willing and able to fight specifically for the Post Production sector.

The lack of such a collective, independent national representation for the industry’s post production sector (comprised of retailers, communities, developers and finance companies) — particularly in this age of specialized representation — should be unacceptable to these constituencies. And this is particularly the case for an industry which is comprehensively federally-regulated under a law that empowers and establishes a unique partnership between the federal and state governments, and which is based on the three main principles of federal preemption, a uniform code and uniform enforcement that have served to establish our industry as the nation’s main source of affordable housing.

Is there any wonder then that the industry’s zoning situation and consumer financing are such a shambles? The industry’s production has been stuck under 100,000 homes annually since 2006 not because manufacturers cannot produce the modern, high-quality, affordable homes that consumers want (and need), but because zoning and consumer financing for such mainstream manufactured homes are in disarray and chaos.

Who is fighting for the industry’s post-production constituency, or even speaking for them? If there is such a voice, as the Manufactured Housing Institute (MHI) repeatedly claims that it is and collects dues for it, then it must admit and accept responsibility that it has failed – and, frankly, failed miserably — to fulfill its duties and obligations, as evidenced by the prevailing terrible results.

How did the industry get to this point? Unfocused, unprepared, bumbling and without any vision or plan of action to fight – matched with a determination to win?

To overcome the industry’s zoning and consumer financing woes, this so-called post production representation needs to do more than hold meetings, issue talking points, engage in “photo ops,” or publish newsletters full of braggadocio and boasts, but bereft of any tangible results. There also needs to be fewer legislative and other alleged “partnerships” with the industry’s foes and competitors (i.e., site-built housing) who would do anything and everything in their power to taint, diminish and cut-down-to-size the manufactured housing’s exceptionalism as the Nation’s main source of affordable housing. These sorts of shallow activities may sound and look good in promotional materials sent to its membership, but they’ve done absolutely nothing tangible to correct the industry’s persistent twin problems of zoning and consumer financing — again, as demonstrated by the prevailing terrible results.

The good news is that — as with the consumer finance that we discussed previously — there are those in the industry who have taken action and continue to press hard and fight aggressively against these discriminatory and exclusionary zoning laws. For example, there are several industry state associations that have individually done a great job on these zoning matters. And I know for a fact that MHARR, (even as a “manufacturers only” association and with absolutely no post-production funding support) has — and continues — to hammer this issue on a national stage, utilizing the “enhanced preemption” language of the 2000 reform law, which MHARR (in partnership with the late Will Ehrle, then president and general counsel of the Texas Manufactured Housing Association) was largely instrumental in writing.

The relevant details of all these issues can and will be addressed in future Q&A sessions, but, for the time being, let this answer to your initial question serve as a wake-up call — that unless something very drastic occurs to change and reverse the dynamics of the industry’s rapidly-accumulating losses in zoning and consumer financing, the industry’s retailers, communities, developers and financing companies, can rest assured that their views, interests and advancement are being poorly served.

Danny D. Ghorbani

202/262-2170

DannyGhorbani@aol.com##

DISCRIMINATORY AND EXCLUSIONARY ZONING LAWS

MHProNews Q&A with Danny Ghorbani

MHProNews Second Question

In your answer to our previous Question No. 1 concerning discriminatory and exclusionary zoning laws, you stressed that the industry's best and strongest weapon to fight against such laws is the "enhanced preemption" language of the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 reform law). I know from my personal communications with several retailers, community owners, and consumers that they often do not understand the connection between "enhanced preemption" and the discriminatory zoning laws that continue to block the progress of the industry in reaching its full potential. In addition, there are increasing signs that government authorities, and other people within and outside the manufactured home industry, have begun exploiting and abusing this lack of knowledge to depress Manufactured Housing’s Post Production Sector. Based on that and given your extensive knowledge of the industry going back over 50 years, will you please elaborate on this matter and explain to our readers the genesis, evolution, and history of this "enhanced preemption" language? Also, please explain how the industry arrived at this stage creating such a potentially strong weapon to win in exclusionary battles? In conjunction with this question, we have noticed that you and many knowledgeable people closely affiliated with MHARR are increasingly using the two words “zoning” and “placement” together when referring to zoning matters. So, will you explain the reason(s) as to why you and others are increasingly doing this?

Danny Ghorbani Answer:

I will answer the last part of your question first, because, in my opinion, these two words i.e., zoning and placement, which represent two different functions, processes and procedures, are actually very closely related when it comes to their use in conjunction with manufactured housing developments and communities. Then, my answer to the first part of your question will use the interaction of these two concepts, and their respective functions, processes, and procedures, in order to fully explain the genesis, evolution, and history of the “enhanced preemption” language of the 2000 Reform Law.

To start, the process of “placement” which, in essence, means delivering a manufactured home (MH) to a home-ready site on a piece of land and completing the necessary work to make the home livable, whether it be on a privately-owned land for one home, or a piece of land for one home in a manufactured housing community, is a derivative or function of the zoning law for that specific site. MHs cannot be placed on any given site (i.e., on any piece of land) unless and until a specific zoning law for that site would allow it.

In the United States, zoning laws are written, approved, and enforced by local government authorities, who control and collect taxes on the land that the specific zoning law is intended for. So, while the actual placement of an MH is a technical/engineering/construction process, it cannot occur unless and until the zoning law, which is a governmental process, allows it.

Now, let’s focus on the beginning of our industry 80-90 years ago, when it emerged as a basic “trailer house” industry, and both state and local authorities had to start understanding and dealing with it. Given the size, design, and appearance of the early “trailers,” there were limited choices for these authorities as to where such vehicles should be parked, or “had” to be parked, when not moving. This is important to understand because the authorities’ initial decisions did not automatically and/or routinely start with discriminatory and exclusionary laws and regulations against the trailers of yesteryear. To the contrary, their decisions were accommodating, thus allowing homeowners who also owned trailers (nearly all affluent people, who would purchase trailers for travel and pleasure), park their units on their own property when not moving. Furthermore, for convenience, they also allowed the development and construction of basic “trailer” parks, where park owners could collect rent for each site from people who were traveling and needed a temporary location to park their trailer, or from homeowners who also owned trailers, but did not wish to park them at their own homes. Needless to say, and for obvious reasons, such “trailer parks” had to be built on the outer perimeters of cities and towns, and their design, engineering, and construction were quite basic and simple (e.g., mostly rib-design with streets intersecting at 90-degree angles and trailer sites very close to each other on each side of the street).

As the popularity of trailers continued to increase, and purchases soared, it did not take long before local government authorities in charge of zoning laws began to realize they had to act consistently with public demand and the necessities of the situation. I personally doubt that early decisions by those authorities had anything to do with or were based on any discrimination against the then trailer industry because, as I indicated earlier, most of the trailers of early years were purchased by financially well-to-do people and the authorities were simply addressing “placement” issues to accommodate those owners.

With constant improvements in the design of “trailers,” resulting in more convenience, such as more spacious interiors, modern facilities, better construction and appearance, the industry continued to respond to increased consumer demand for trailers that could accommodate longer stays. Manufacturers thus began building larger trailers that would gradually evolve into permanent living dwellings. This required construction of more and more parks that could accommodate these larger “trailers.”

Then, with the country’s post-World War II economy booming, and with a shortage of housing for growing families, a gradual evolution of these trailers to what was then referred to as “Mobile Homes” began. The production of mobile homes increased rapidly to 100-120,000+ homes annually in late 1950s. And when growing public demand for new mobile homes pushed production to 150,000+ homes annually in 1963 and gradually to around 216,000+ homes annually in 1965, the industry realized that it had a “placement” problem that it had to address and resolve. The problem was that the then-new and fully equipped modern mobile homes, upon leaving the factory, needed new and more modern parks (they were still called “parks” then) designed to accommodate their placement as permanent dwellings, instead of the vehicle-like “trailers” that preceded them. The perception of both the public and public authorities, however, was that the site to place the then-new “mobile homes” was still the old “trailer” parks, and they both resented pressure to change. Thus, the birth of discriminatory zoning laws, which — in my view and in the view of many with the knowledge of the history of our industry — were based on where these parks were going to be placed and not against how the new mobile homes were built (i.e., the code and standard by which mobile homes were built).

In short, while there was a gradual evolution in building the actual units — from trailers to the then new mobile homes — there never existed an actual and corresponding evolution for the “placement” of those mobile homes until the mid-late 1960s, when the industry realized it had a HUGE zoning and placement problem, which needed to be confronted head-on and resolved decisively if the industry were to survive…and the industry did just that, and here is how it did it.

The manufactured housing industry was then represented by one national association, called the Mobile Home Manufacturers Association (MHMA). It was a real and functional national association in every sense, representing ALL sectors of the industry including manufacturers, suppliers, service, finance, land-development, RVs, retailers, parks, and communities. And unlike the “wannabe” association of today, its mission was to serve ALL its members and fight aggressively to advance what was best for the whole industry and its consumers. And while it is true that the association was usually led by the largest manufacturer(s), those leaders would devise management policies for the association that would specifically benefit smaller industry businesses. Their guiding leadership philosophy was to “live and let live” aimed at particularly helping the industry’s smaller businesses. As an aside, the then MHMA’s successful association management and philosophy was the template that the founders of MHARR used in creating that association in 1985 to address and advance the views and interests of the industry’s production sector,

So, it was in mid-1960s that the industry had to seriously deal with its first huge zoning and placement problem. It did not take too long for the industry to realize that the root of the problem was that given the negative perception and stigma of “trailer parks” in existence then, not only were state and local authorities against the construction of new and modern developments and communities, but many professionals including architects, engineers and site planners were giving a cold shoulder to the industry’s needs. As a result, MHMA’s Board of Directors decided to fight back, by devising, establishing, and implementing a creative new and truly revolutionary program to deal with these emerging zoning and placement problems. And that, incidentally, is when MHMA hired me as the Project Engineer to advance that program. As a young man, I agreed and accepted that position because I thought the program itself would be extremely challenging, worthwhile, and exciting.

It was an ambitious effort, designed to first address and resolve the “placement” problem. The program created MHMA’s own professional team comprised of in-house engineers, architects, economists, lawyers, public relations specialists, and a separate group of architects/planners on retainer with the association. The team was assigned responsibility for providing land owners who would build new and modern mobile home developments and communities, with complete, professional and ready-to-use construction packets containing a site-plan, a feasibility and market study, a set of design and engineering drawings with the corresponding specifications for contractors’ bidding purposes, and a point by point response to address arguments against new mobile home developments and communities at zoning and placement hearings throughout the United States. All a landowner interested in building a new development had to do was to provide us with an accurate and up to date topography map of the land, hire a local registered civil engineer to stamp and seal the packet and supervise the construction of the development, and pay the association at-cost-only for the work.

The program took off like a rocket. We could not keep up with the demand, as new and modern mobile home development and community projects designed and engineered by MHMA began to be built throughout the country. And the industry’s production of mobile homes began to soar, reaching 300-400,000+ homes annually between late 1960s to mid-1970s. We designed and engineered well over 200,000 mobile home sites during that period. It was not long, though, before the program’s undeniable and overwhelming success became alarming to the same two groups that I described earlier.

First, professional architects, engineers and planners who were not interested in mobile home developments, but were witnesses to the success of MHMA, began to take a fresh look at such projects as a new and lucrative business. Thus, when their respective national organizations began objecting to and threatening MHMA with legal challenges to stop the program because, in their view, the association was competing with them under the umbrella of a non-profit organization, MHMA’s Board of Directors welcomed their interest, declared victory and fully complied with their request by dismantling the program and turning the business over to independent professionals.

That was a wise decision, because all the industry wanted was to get those professionals interested and engaged in treating the design and engineering of our new and modern mobile home developments for the “placement” of new, modern mobile homes, the same as they did with site-built developments. It was a mission well accomplished and a victory for the industry in resolving the “placement” part of its problem. It was a victory that fundamentally changed the negative image of the old “trailer” parks to new developments and communities for the then-new mobile homes, and paved the way for today’s new, modern, landscaped, well-designed and engineered communities with curvilinear streets, clubhouses, common grounds for social gatherings, social programs, often larger-size sites, individual and common area swimming pools, etc. — developments and well-managed communities for the placement of today’s new and modern manufactured homes. It was – and is — a victory that the representation of the Post Production Sector (PPS) of our industry today has completely failed to utilize against discriminatory zoning laws based on “placement.” There is no longer any denying that TODAY’s MODERN MANUFACTURED HOUSING DEVELOPMENTS AND COMMUNITIES ARE JUST AS GOOD, IF NOT BETTER, THAN MANY SITE-BUILT HOME DEVELOPMENTS, yet the PPS’ so-called “national” representation continues to fail on their issues/problems such as consumer finance and zoning.

Second, though – and much more important and difficult — is the fact that state and local authorities who did not favor new mobile home developments, were then joined by the ever-present-anti-industry “usual suspects” such as home builders, apartment builders, realtors, building trade unions and contractors, code and standards officials and others, who always find a way to hurt our industry, even today under the guise of “partnering” with the industry’s newcomers and naive “officials.” They began to penetrate local zoning boards, and having witnessed the industry’s continuing success with placement, moved the proverbial goal posts, changing the subject to a battle over codes and standards. They argued that mobile homes were built to a “different” code and standards, which, in their view, was “inferior” to the building code used for site-built homes, thus beginning the flurry of discriminatory and exclusionary zoning laws against our industry, mostly based on how the then- “mobile homes” were built.

As is well known, until 1976, mobile homes were built in compliance with the ANSI A119.1 standard for plumbing and structure, and the NFPA 501B standard for electrical issues – which were enforced through a self-policing system managed by MHMA. The association’s Standard Division had a group of inspectors on its payroll that would go to members-only factories and production facilities, inspect the production process for full compliance with the industry’s two codes, and issue an MHMA seal that had to be placed on each home before it left the factory. While the system was rigorously enforced and worked well, with manufacturers fully complying with the two codes, the negative perception of a self-policing system persisted. As such it was successfully exploited by industry foes, basically questioning the quality and protection that the industry was offering to homebuyers.

The resulting negative publicity began to consume the industry, and when government officials and consumer groups aggressively intensified their demands for better quality-built homes and more consumer protection, climaxing with the infamous CBS “60 Minutes” hit job on the industry, MHMA recognized that, once again, the industry had a major fight on its hands that had to be addressed and fully resolved. It didn’t take very long, though, for the visionary manufacturers of MHMA to devise and implement an ingenious plan of action to once again win the fight.

They determined that in order to: (1) work much closer with the state and local authorities; (2) establish a strong code; and (3) establish a strong corresponding enforcement system to meet and exceed the expected quality and consumer protection that were being demanded, the industry had to be federally regulated. Thus, MHMA began the legislative process that led to the successful enactment of the Mobile Home Construction and Safety Standards Act of 1974. The centerpiece of the 1974 law was the establishment of what I usually refer to as “the three pillars of strength” of today’s manufactured homes i.e., federal preemption, a uniform federal code, and a system of uniform federal enforcement. Furthermore, the 1974 law (as amended in 2000) takes into account the uniqueness and exceptionalism of MHs, which result in their unparalleled affordability and the savings that they offer to homebuyers, which no other type of factory-built housing (FBHs) can match.

It is important for industry members to understand these very unique and unmatched characteristics of our homes that fully and completely distinguish today’s MHs from any and all other types of Factory Built Homes (FBHs). I warn the industry of this because, in my opinion, there are people within our industry and some government authorities who gradually are trying to join these two different types of homes (i.e., federally regulated MHs and locally regulated FBHs) at the proverbial hip. Just as it was, and continues to be, with the continuing failure to fully and properly implement the Duty to Serve Law (DTS) for consumer finance, this new scheme is a sad commentary, an absurd idea, and a disingenuous attempt to create a hybrid class of MHs at the expense of — and detriment to — mainstream MHs. And no matter how hard they try to blur the existing bright line of demarcation between MHs and FBHs, the industry as a whole MUST try to understand its negative ramifications and MUST reject it.

Another important aspect of the 1974 law was the establishment of federal preemption based on a full partnership between federal and state governments. It created, for the first time, a federal means by which the industry and consumers would have a fair chance to fight discriminatory and exclusionary zoning laws based on the way that MHs are built, as the industry had already won the battle over “placement.” The original preemption language of the 1974 law reads, in part:

SUPREMACY OF FEDERAL STANDARDS

WHENEVER A FEDERAL MOBILE HOME CONSTRUCTION AND SAFETY STANDARD ESTABLISHED UNDER THIS CHAPTER IS IN EFFECT, NO STATE OR POLITICAL SUBDIVISION OF A STATE SHALL HAVE ANY AUTHORITY EITHER TO ESTABLISH, OR TO CONTINUE IN EFFECT, WITH RESPECT TO ANY MOBILE HOME COVERED, ANY STANDARD REGARDING THE CONSTRUCTION OR SAFETY APPLICABLE TO THE SAME ASPECT OF PERFORMANCE OF SUCH MOBILE HOME WHICH IS NOT IDENTICAL TO THE FEDERAL MOBILE HOME CONSTRUCTION AND SAFETY STANDARD.

While this preemption language was supposed to help the industry and consumers with discriminatory zoning laws, it, and many other sections of the 1974 law, were either totally or selectively ignored by the US Department of Housing and Urban Development (HUD), which has jurisdiction over MHs. In fairness to HUD, though, it did complain that the preemption language of the 1974 law did not go far enough to warrant HUD’s involvement with its implementation. Subsequently, in 1985, a group of manufacturers walked away from MHI (formerly MHMA) and created MHARR because of MHI’s continuing failure to aggressively press for the full and proper implementation of ALL aspects of the 1974 federal law (including the preemption language), which by then had been in effect for nine years (1976-1985), with absolutely terrible results — and dealing with that law became a top priority for the new association.

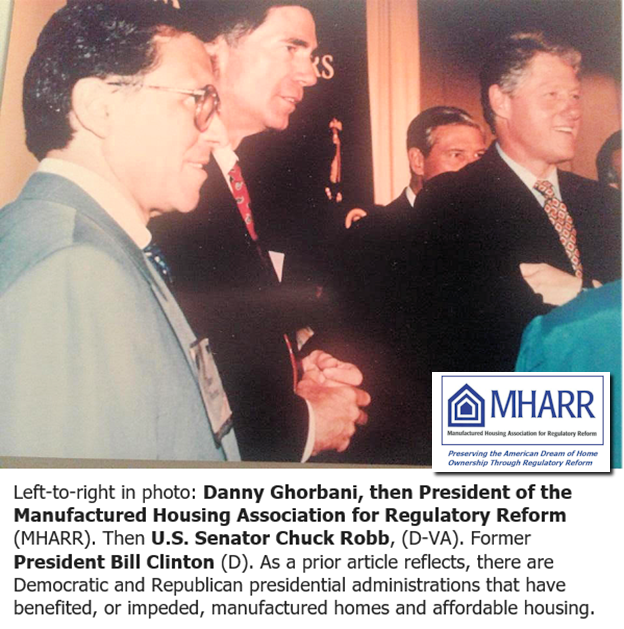

As the President and CEO of MHARR, my marching orders were quite clear. I was told by those visionary manufacturers to try and work with HUD in order to fully and properly implement the 1974 law, make notes of any and all deficiencies we could detect in the law (e.g., the preemption language) for improvement, try federal courts if we could not work with HUD, and, if all else failed, try to amend, revise and reform the 1974 law for the better, going forward. It was a tall order, but we hit the ground running, and succeeded in advancing the industry and consumers’ cause in many areas. We finally determined, though, that the 1974 federal law was basically for the “mobile” homes of yesteryear and needed major revisions and reforms for new, modern manufactured homes. MHARR thus took the lead in a joint effort with several key state associations in 1990 (while it took MHI and the rest of the states eight-wasted years to reach the same conclusion and join MHARR’s coalition in 1998) to fully and comprehensively change the 1974 law to what is now known as the Manufactured Housing Improvement Act of 2000, signed by President Bill Clinton into law on Wednesday December 27, 2000. This landmark legislation liberated our industry and forever changed our manufactured “product” from “trailers” and “mobile” homes to today’s modern, affordable, and legitimate manufactured homes.

Getting back to federal preemption, a major improvement of the 2000 reform law, among numerous other improvements to the 1974 law, is the preemption language of the 2000 reform law, that is commonly referred to as “enhanced preemption.” That language now reads in part:

SUPREMACY OF FEDERAL STANDARDS

WHENEVER A FEDERAL MANUFACTURED HOME CONSTRUCTION AND SAFETY STANDARDS ESTABLISHED UNDER THIS CHAPTER IS IN EFFECT, NO STATE OR POLITICAL SUBDIVISION OF A STATE SHALL HAVE ANY AUTHORITY EITHER TO ESTABLISH, OR TO CONTINUE IN EFFECT, WITH RESPECT TO ANY MANUFACTURED HOME COVERED, ANY STANDARD REGARDING CONSTRUCTION OR SAFETY APPLICABLE TO THE SAME ASPECT OF PERFORMANCE OF SUCH MANUFACTURED HOME WHICH IS NOT IDENTICAL TO THE FEDERAL MANUFACTURED HOME CONSTRUCTION AND SAFETY STANDARD. FEDERAL PREEMPTION UNDER THIS SUBSECTION SHALL BE BROADLY AND LIBERALLY CONSTRUED TO ENSURE THAT DISPARATE STATE OR LOCAL REQUIREMENTS OR STANDARDS DO NOT AFFECT THE UNIFORMITY AND COMPREHENSIVENESS OF THE STANDARDS PROMULGATED UNDER THIS SECTION NOR THE FEDERAL SUPERINTENDENCE O THE MANUFACTURED HOUSING INDUSTRY AS ESTABLISHED BY THIS CHAPTER. SUBJECT TO SECTION 5404 OF THIS TITLE, THERE IS RESERVED TO EACH STATE THE RIGHT TO ESTABLISH STANDARDS FOR THE STABILIZING AND SUPPORT SYSTEMS MANUFACTURED HOME SITED WITHIN THE STATE, AND FOR THE FOUNDATIONS ON WHICH MANUFACTURED HOME SITED WITHIN THAT STATE ARE INSTALLED, AND THE RIGHT TO ENFORCE COMPLIANCE WITH SUCH STANDARD, EXCEPT THAT SUCH STANDARDS SHALL BE CONSISTENT WITH THE PURPOSES OF THIS CHAPTER AND SHALL BE CONSISTENT WITH THE DESIGN OF THE MANUFACTURER.

So, there is the answer to your question about the genesis, evolution, and history of the “enhanced preemption” language of the Manufactured Housing Improvement Act of 2000 — the industry’s best and strongest weapon to fight against discriminatory and exclusionary zoning laws. As to how this can be done, that is another question for another time, which I will be happy to answer and thoroughly explain.

In the meantime, the nagging question for the industry’s national Post Production Sector representation, which collects hefty dues from such members continues to be: “Can it or does it even know how to use this best and strongest weapon (i.e., the enhanced preemption) to fight against discriminatory and exclusionary zoning laws, and win this issue once and for all? And if the answer is yes, then why the continuing failure to do so?

Danny D. Ghorbani

202/262-2170

DannyGhorbani@aol.com##

DISCRIMINATORY AND EXCLUSIONARY ZONING LAWS

MHProNews Q&A with Danny Ghorbani

MHProNews Third Question

At the conclusion of your answer to our MHProNews Question No. 2, and after you provided the genesis, evolution, and history of the “enhanced preemption” language of the Manufactured Housing Improvement Act of 2000 (the MHIA or 2000 Reform Law), you refer to it as “the industry’s best and strongest weapon to fight against discriminatory and exclusionary zoning laws.” Will you please elaborate with specific details for our readers as to “how” this can be done, and further as to “who” should lead such a fight?

Danny Ghorbani Answer:

Thanks, Tony.

As I explained in greater detail in my answer to your Question No. 2, continuing discriminatory and exclusionary zoning laws against the manufactured housing industry and its consumers are no longer a result and/or a byproduct of manufactured homes’ “placement” on a piece of land (i.e., in the case of a single and self-contained lot) and/or a collective group of individual properties confined to and contained within a given area (i.e., in the case of developments, communities, planned unit developments, resorts, etc.). I explained that the manufactured home industry has already fought and won those battles, as evidenced by today’s modern, quality and up-to-date manufactured housing communities and developments which are equal to — if not better than — their site-built counterparts. Those discriminatory and exclusionary laws adopted by local governments against manufactured housing were subtle and nearly all based on one or a combination of prevailing characteristics such as income, race, socio-economic, life-style, class, site-work, aesthetics of the home, etc. Very few, if any, local governments would dare to do that today, subtle or otherwise. And if they did, they would likely find themselves on the losing side of a legal challenge.

The zoning battleground has been shifting for years, especially since the enactment of the 2000 Reform Law. States, local governments, and zoning boards these days are much smarter than our industry gives them credit for. They have studied and learned the intricate details of the 2000 Reform Law and nearly all of them understand it and its far-reaching ramifications better than most people in our own industry. While they rarely admit it openly or publicly, they now know that our homes are no longer the trailers and mobile homes of yesteryear, but modern, high-quality dwellings to be lived in permanently, just like any other type of housing.

So, today’s zoning boards, which include, among others, site-builders, realtors, suppliers, financiers, planners, union members and site-developers, just to name a few, have been slowly, quietly, and subtly using the differences between the Federal manufactured housing code (i.e., the HUD Code) and other types of building codes (i.e., International Residential Code and/or its various derivatives) as their main weapon to keep manufactured homes out of their jurisdictions. They have gradually switched their reason(s) for not allowing manufactured homes in their jurisdictions away from the characteristics and/or profile of the homeowner, to the home itself.

Thus, a new and different version of the “Not In My Backyard – NIMBY” argument (a phrase made famous by the late HUD Secretary, Jack Kemp), is now being applied against manufactured homes. According to their various arguments, manufactured homes are not permitted in their jurisdictions because they are built in compliance with a HUD Code that is not on par with – or is allegedly inferior to — other types of homes and the code(s) they are built to, which are allowed in their jurisdictions.

The zoning battle ground now is about the parity, or the lack thereof, between these two codes, and such zoning laws, in reality, are challenging the HUD Code and manufactured homes, which carry the “good housekeeping” seal of approval of the United States Government.

Given the fact that industry manufacturers, since the enactment of the 2000 Reform Law, are building their best homes ever, how did the industry get to this point? The answer may well be found in the fact that while the representation of the industry’s post-production sector was, is, and continues to be, either non-existent, incompetent or dysfunctional, the post-production assets, benefits and advantages flowing from the 2000 Reform Law continue to be spinned, twisted, misused and abused by its foes, competitors and outright enemies. They continue to do their homework, learning how to argue and deviously use those same assets, benefits, and advantages of the 2000 Reform Law against the industry. They continue to chip away at such assets, benefits, and advantages that various law(s) grant the industry and consumers, once today’s modern and quality manufactured homes leave the factory (e.g., enhanced preemption, fair zoning, availability of consumer finance at comparable rates, parity with other types of housing in all the government-sponsored housing, finance and community programs, just to name a few). As an aside to this particular matter, these folks are the same people that the Manufactured Housing Institute (MHI), the industry’s so-called post production representation, constantly brags about “working with” and forming groups and coalitions on one matter or another — never mind that these people have their knives out, ready to cut our industry’s throat when it really matters and counts, like when they serve on the zoning boards.

In any event, how should our industry utilize the “enhanced preemption” of the 2000 Reform Law to fight and win the zoning battle? It’s not an easy task, but is do-able, if — and this is a big if –, there is the will to do so, and here is how.

To begin with, the industry should review, renew, and refresh its knowledge and understanding of all the relevant factors about the federal law and related regulations, as well as their intended and/or not intended ramifications in order to fight the discriminatory and exclusionary zoning laws against manufactured homes. They should then be streamlined to identify the collective combination and application of the factors that will help to devise a master plan of action and a corresponding strategy that can be utilized to rid the industry and consumers of all discriminatory and exclusionary zoning laws, once and for all. Some of these factors may sound and/or look quite basic, but I strongly doubt if many people have given them any thought as part and parcel of the big picture for a successful plan of action and strategy.

Below are some of these relevant factors, not listed in any particular order:

- Manufactured housing is the only segment of the housing industry in the United States which is fully and comprehensively regulated by the federal government.

- The U.S. Department of Housing and Urban development (HUD) is the federal agency primarily in charge of manufactured housing law(s) and regulation.

- Manufactured homes are built in compliance with a federal performance-based uniform code (HUD Code).

- HUD Code and standards are enforced through a uniform set of federal enforcement regulations.

- HUD Code standards and regulation preempt all other state and local building codes and regulations.

- Federal law establishes a partnership between the federal and state governments in dealing with manufactured housing-related matters.

- HUD was created in 1960s as a federal agency in charge of the nation’s housing-related matters, nearly all of which were site-built housing at the time.

- While the HUD Code is a base code, producers can and routinely do build manufactured homes over and above this code, and in accordance with the homebuyer’s preference and/or home aesthetics required by local zoning laws.

- The 2000 Reform Law has fully and completely transformed the original 1974 law from a transitional law for the “mobile homes” of the past, to a law for today’s modern, high-quality, legitimate manufactured homes designed for permanent living.

- Non-federally owned lands in the U.S. are controlled, maintained, and managed by state and local governments.

- Federal law and regulations mandate a balance between consumer safety and the affordability of the home, making manufactured homes the best available source of unsubsidized homeownership for American consumers.

- To date, HUD has failed to fully, properly, and comprehensively implement all provisions of the 2000 Reform Law, particularly its critical “enhanced preemption” provision.

- The biggest casualties of HUD’s continuing failure to fully, properly, and comprehensively implement the “enhanced preemption” language of the 2000 Reform Law, are the homebuyers (particularly moderate and lower-income homebuyers) who are deprived of the best source of affordable homeownership.

- The biggest winners from HUD’s continuing failure to fully, properly, and comprehensively implement the “enhanced preemption” language of 2000 Reform Law, are state and local governments with discriminatory and exclusionary zoning laws against the manufactured housing industry and consumers, as well as the industry’s competitors.

- Together with the “purpose” and “findings” of the 2000 Reform Law, the “enhanced preemption” language of the 2000 Reform Law was carefully crafted to, among other things, acknowledge, reinforce, strengthen, and fully establish two main principles of the “preemption” provision of the original 1974 law, namely:

- To acknowledge vast improvements in the construction and safety of manufactured homes (production), and the gains in public acceptance and utilization of manufactured homes in the U.S. housing market (post production).

- To facilitate and advance HUD’s ability to fully, properly, and comprehensively enforce this section (i.e., preemption) of the law with its state partners and their respective local governments.

- There should be parity between manufactured housing and all other types of housing in all government sponsored housing, finance, and community programs.

- As a minority segment of the housing industry, nothing has or will ever be given to the manufactured housing industry and its consumers the easy way. They have to fight hard for every inch of their gains and benefits day in and day out in order to earn anything, even when the odds are fully in their favor (g., laws and mandates by U.S. Congress in favor of the industry and consumers)

A careful analysis of the above relevant factors, all rooted in truth, would clearly provide a path of “how” the enhanced preemption provision of the 2000 Reform Law can and must be used as the industry’s best and strongest weapon to fight and win the battle against discriminatory and exclusionary zoning laws.

All one has to do is to connect the proverbial dots among these existing factors and apply them to devise a plan of action and a corresponding strategy on behalf of a class of beneficiaries who have been harmed, in a major, aggressive and relentless legal challenge, all the way to the United States Supreme Court for a landmark decision to end decades of ugly, disgusting and debilitating discrimination and exclusion against the industry and its consumers.

This is a fairly straightforward undertaking given the fact that, by law, HUD is in charge of — and responsible for – the construction and safety of manufactured homes in full compliance with its own code and regulation. HUD thus not only has a responsibility, but a duty to make sure that its state partners and their respective local governments do not use the HUD Code and regulation as a tool to discriminate against manufactured housing by excluding them from all or part of their jurisdictions.

Ideally, HUD should voluntarily be the plaintiff in such a legal challenge because it must stand-up for its code, its regulations, and its process, as well as its final product.

Given the fact, though, that HUD is a creation of the site-built housing industry and its allies, I would not hold my breath waiting for it to do so. But, HUD should be encouraged, cajoled or, in the worst case, forced to take action.

And this brings us to the second part of your question as to “who” should lead this fight.

Under normal circumstances, the ideal entity would be the industry’s national and independent post-production association, if one actually existed.

Unfortunately, though, this is not the case. Those of us who were fully involved and engaged in leading the twelve-year-struggle through the legislative process and the ultimate enactment of the 2000 Reform Law were well aware and concerned all along that this would be a difficult bridge (i.e., post production matters vis-a-vis the 2000 reform Law) to cross at some point in the future. We were confident that the “production” provision of the law would be in good hands, given the long-established commitment of MHARR as its guardian.

The suspicion and concern, however – which continues to date – is as to who would protect, defend, and advance the implementation of the critical “post-production” provisions of the law, such as preemption, zoning, consumer finance, and parity with other types of housing, just to name a few.

Simply put, the industry currently does not have such an entity, and this is why all the post production matters are in a free fall and getting worse.

That being said, maybe all is not lost because MHI, which continues to collect dues and serves as the industry’s de-facto post production representation, knows only too well that these post production problems, and particularly the discriminatory and exclusionary zoning laws, not only are not being resolved, but are getting worse, blocking progress and prosperity for its own members and the broader industry as well.

You may recall that I ended my answer to your Question No. 2 by asking MHI if it knows how to fight and win the industry’s zoning battles. Now, here we have shown and given them the exact blueprint as to “how” to do this and maybe MHI can even “do it” because even a broken clock gives the right time twice a day.

Danny D. Ghorbani

202/262-2170

DannyGhorbani@aol.com##

DUTY to Serve

MHProNews Q&A with Danny Ghorbani

MHProNews First Question

MHProNews. It’s now been roughly 12 years since the “Duty to Serve” (DTS) mandate was passed by Congress as part of the Housing and Economic Recovery Act (HERA) of 2008. HERA’s DTS mandate required that Fannie Mae and Freddie Mac make financing affordable housing preservation, rural, and for HUD Code manufactured homes. Can you provide our readers some insight into the history of this matter and specifically how it relates to the ongoing failure of the GSEs to fully implement that law in accordance with its terms. In framing your reply, let’s set aside community financing and FHFA’s role in this for now, and focus on the what some call posturing and confusion which we’ve seen from the GSEs instead

Danny Ghorbani Answer:

This may or may not come as a surprise to you and your readers, but in my opinion, the two Government Sponsored Enterprises (GSEs) i.e., Fannie Mae and Freddie Mac, don’t have very much interest in the Manufactured Housing industry, and I doubt they would ever get involved in manufactured housing in a market-significant way (i.e., large volume), securitizing loans for mainstream affordable HUD code manufactured homes. And, more specifically, they are even less interested in securitizing the industry’s most affordable homes that are financed through personal property (chattel) loans and represent nearly 80% of our industry’s homebuyers — mostly moderate and lower income American families.

To be sure, they continue to go through the motions. They’ve “engaged” with the industry, attending and sponsoring industry events, shows, seminars and meetings on top of meetings, sweet-talking the industry and even some consumer organizations. They’ve provided targeted programs for the high-end/expensive homes built by the industry’s largest conglomerates. They’ve done endless public relations, pushing all the right buttons, etc., etc., etc. — anything and everything except securitizing loans (be it mortgage type, but more importantly chattel) for mainstream, affordable HUD Code manufactured homes in a market-significant way for moderate and lower income American homebuyers — which, incidentally, is the main reason for their (i.e., Fannie and Freddie) existence…as stated in their respective charters.

My long held belief and opinion regarding their outlook and lack of interest in manufactured housing is based on personal observations and experience in dealing with them going back nearly forty years. There is a history here that not very many stakeholders (especially the newcomers and “wanna-be”-experts) are aware of, and cannot be ignored going forward if Fannie and Freddie are to be held accountable in full and complete compliance with their statutorily-mandated duty to serve the manufactured housing industry and the moderate and lower income families who rely on manufactured housing as the only means to own a home of their own. This history goes way back before we formed the Manufactured Housing Association for Regulatory Reform (MHARR) in 1985, when I was with Manufactured Housing Institute (MHI) for nearly two decades, and my many responsibilities included the management of the industry’s Annual National Show and Exposition in Louisville, KY every January. We used to bring GSE personnel to the show to see the new model homes, attend meetings and seminars, talk to industry folks, answer their questions…any and all relevant matters that would engage them with the industry in the hope that they would initiate some type of market-significant securitization of manufactured home loans. Again, and as usual, they did all the right things, as noted earlier, but nothing substantive ever happened.

Now, fast forward to the mid-2000s when the lack of an aggressive, independent National Post Production Association resulted in major set-backs for the industry in consumer financing for its homes (not to mention failures on such critical matters as SAFE Act and Dodd-Frank, which continue to haunt the industry to date), thus drawing MHARR into the consumer finance arena. The Association’s collective knowledge of the relevant consumer finance history, institutional memory and experience with Fannie and Freddie became quite effective in demonstrating to both Houses of Congress that they had to mandate an end to Fannie Mae and Freddie Mac’s discrimination against the Manufactured Housing Industry and its consumers, and start serving this industry as a “DUTY” — thus the enactment of “Duty to Serve Underserved Markets” (DTS) as part of the Housing and Economic Recovery Act of 2008 (HERA).

Unfortunately, though, nearly twelve years after the passage of DTS, because of the continuing absence of an aggressive, dedicated and independent national association representing the interests of retailers, communities and finance entities, coupled with the deployment of multiple schemes, excuses and creative methods of dodging by Fannie and Freddie, and given their very weak and ineffective regulator, the Federal Housing and Finance Agency (FHFA), the two GSEs have been able to stymie the full and proper implementation of the law, thus, once again, depriving moderate and lower income American families of homeownership, while forcing them into what former Congressman Barney Frank used to refer to as “predatory lending.”

Based on all of this, do Fannie Mae and Freddie Mac really look like two organizations that are truly interested in securitizing market-significant volumes of affordable loans for moderate and lower income American homebuyers in accordance with their own charters and the mandate handed to them by DTS law? The simple answer is a resounding “no.”