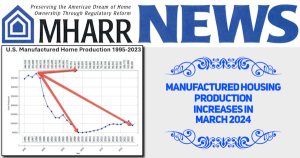

[vc_row][vc_column][vc_column_text]Washington, D.C., January 5, 2018 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that after ten years of dithering, the final “Duty to Serve Underserved Markets” (DTS) plans filed by Fannie Mae and Freddie Mac — approved by their regulator, the Federal Housing Finance Agency (FHFA) and publicly released on December 18, 2017 — are a prescription for yet more inaction, delay and a continuing indefensible failure to serve the vast majority of the national HUD Code manufactured housing market, contrary to the clear, direct and unequivocal mandate of Congress. Instead, the so-called DTS “compliance” plans represent an ongoing sop to the industry’s largest corporate conglomerate and its captive finance companies, which will continue to restrict the growth and expansion of the industry, while denying access to the nation’s most affordable housing and home-ownership resource to millions of lower and moderate-income American families. At the same time, the final plans will have the effect of forcing those who do remain in the HUD Code manufactured housing market into the higher-cost loans offered by those captive companies. This utter failure to implement DTS in a market-significant way, some ten years after its enactment, now warrants congressional intervention, oversight and, if necessary, amendments to the DTS law.

Despite the fact that personal property or “chattel” loans (i.e., loans secured by the home itself and not the land on which the home is sited) constitute 80% of all manufactured home consumer purchase loans according to data compiled by the U.S. Census Bureau – a figure that itself has grown by a factor of 25% since 2007 – the DTS “compliance” plans filed by Fannie Mae and Freddie Mac (scheduled to take effect on January 1, 2018, barring any further action by FHFA) provide for nothing more than token “pilot programs” for the securitization and secondary market support of such loans over the three-year period that the plans cover.

Freddie Mac, for its part, projects purchases of 200 to 500 manufactured home chattel loans in year two (2019) of its final three-year DTS plan, and another 600-1,500 in year three (2020), subject, in its entirety, to separate approval by FHFA, which may or may not occur. Fannie Mae, meanwhile, projects purchases of 1,000 manufactured home chattel loans in both year two (2019) and year three (2020) of its DTS “implementation” plan. With approximately 90,000 HUD Code manufactured homes projected to be sold in 2017, even if no market growth were assumed during the years covered by the three-year DTS plans (i.e., 2018-2020), that period would see retail sales of approximately 270,000 HUD Code manufactured homes, with approximately 216,000 (i.e., 80%) of those homes financed through chattel loans, again, assuming no change in the composition or economic characteristics of the overall market.

Against this baseline, the chattel loan programs envisioned by Fannie Mae and Freddie Mac – even at maximum projected capacity — would serve 4,000 purchasers, or a mere 1.85% of the manufactured housing market through 2020 – more than a decade after the enactment of DTS. Chattel loan purchases at these levels, as was detailed in MHARR’s July 10, 2017 written comments opposing the proposed DTS implementation plans filed by the two government-sponsored mortgage giants in May 2017, would constitute a microscopic portion – far less than one-one-hundreth of one percent — of the total mortgage portfolios of both Fannie Mae and Freddie Mac, representing: (1) a blatant, continuing failure by Fannie Mae and Freddie Mac to serve the manufactured housing market; (2) a continuation of blatant, baseless discrimination against the lower and moderate-income Americans who rely on affordable, non-subsidized manufactured housing the most; (3) a continuing abuse of – and failure to comply with – the Enterprises’ mission and role as prescribed by their respective charters; and (4) a flagrant failure by FHFA, as the Enterprises’ regulator and conservator, to enforce full compliance with the statutory DTS mandate.

To rationalize this pathetic, totally inadequate level of support for the nation’s most affordable non-subsidized housing resource in direct violation of the DTS mandate and at a time when the U.S. Department of Housing and Urban Development’s (HUD) 2017 Worst Case Housing Needs report to Congress shows a resurgence in “worst case” housing needs (i.e., Americans “who pay more than one-half of their income to rent, [or] live in severely inadequate conditions, or both”) to near-record levels, the Enterprises both cite a lack of recent, relevant “data and information” concerning the performance and other characteristics of manufactured housing chattel loans. The Enterprises, then, as MHARR has stressed before, effectively seek to avoid their mandatory “duty” to comply with DTS (in any market-significant manner) by citing a lack of data that flows directly from their own previous (and ongoing) failure – in violation of their respective charters — to serve the manufactured housing market, which DTS was designed to remedy. Put differently, the GSEs, for ten years – and potentially indefinitely into the future – seek to avoid any market-significant compliance with the remedy to their failure to serve the manufactured housing market, by relying on the very failure to serve that market that DTS seeks to remedy.

This claim is not only disingenuous – as the Enterprises have had ten years since the enactment of DTS to seek and access chattel-relevant data through either timely FHFA-approved pilot programs of their own (which could have been devised and implemented immediately after the enactment of DTS) and/or via public sources that do exist (including published shareholder reports by Berkshire Hathaway Corporation, the corporate parent of the industry’s two largest higher-cost consumer lenders, Vanderbilt Mortgage Corporation (Vanderbilt) and 21st Mortgage Corporation (21st Mortgage) which, together, in 2016, admitted to originating 35% of all new manufactured housing loans) – but potentially has more sinister implications as well, which are only accentuated by the contents of the two final DTS plans.

As MHARR and other manufactured housing stakeholders have pointed out, the full, market-significant implementation of DTS would have two directly-related salutary effects on the manufactured housing lending market. First, it would increase the number of lenders in that market, as confirmed repeatedly by potential lenders currently waiting on the sidelines. Second, by increasing the number of lenders – making the chattel market more competitive – and by simultaneously reducing the marginal risk of loss borne by those lenders, the full implementation of DTS by FHFA and the Enterprises would substantially increase the availability of manufactured home chattel loans, while simultaneously reducing their cost, through reductions in the higher interest rates charged by such lenders.

The actions of Vanderbilt and 21st Mortgage and their representatives, however – both in relation to DTS and other matters affecting the manufactured housing industry – appear to indicate that they do not wish to see the increase in competition and lower loan prices that would result from the full implementation of DTS, and that those lenders instead would prefer to continue to benefit from a market that currently is less than fully competitive. Even worse, the final DTS plans submitted by Fannie Mae and Freddie Mac (and other related statements by both entities) indicate that they share that goal and seek to effectively negate DTS.

First, as an objective matter, Vanderbilt and 21st, through their trade organization, the Manufactured Housing Institute (MHI), have pursued – as an organizational priority – statutory amendments to the Dodd-Frank finance reform law which would allow them to charge higher interest rates for manufactured housing loans without those loans being subjected to specific requirements applicable to “high-cost” loans. Greater market competition and lower interest rates driven by the full implementation of DTS would be wholly inconsistent with this objective and would potentially threaten the current market-dominant position of these lenders.

Second, as indicated both directly and anecdotally by multiple sources, those market-dominant lenders have failed to provide data allegedly sought by the Enterprises regarding the performance of the large number of manufactured home chattel loans that they currently hold, thus providing a ready excuse and rationale (repeatedly asserted in the final DTS plans) for the Enterprises to “slow-roll” and/or minimize the implementation of DTS to the point of irrelevance. And, indeed, every day that goes by without the full, market-significant implementation of DTS by Fannie Mae, Freddie Mac and FHFA, is a gift to Vanderbilt and 21st Mortgage, their corporate parent, Clayton Homes, Inc., its corporate parent, Berkshire Hathaway Corp., and Berkshire Hathaway scion, Warren Buffet

Third, and most importantly, it appears from multiple aspects of the Enterprises’ final DTS “implementation” plans that Fannie Mae and Freddie Mac have – and actively continue to – coordinate with these entities, as well as their affiliates and surrogates, to undermine the full and timely implementation of DTS. This activity began with an off-the-record meeting between FHFA officials and such surrogates in 2014. Following those reports, MHARR and industry trade journalists sought copies of any and all materials connected with the meeting from FHFA, which were never provided. That coordination now appears to continue in the final so-called DTS implementation plans with multiple elements that discriminate against or ignore the interests, rights and concerns of smaller industry businesses, or put Vanderbilt / 21st Mortgage / Clayton / Berkshire Hathaway / MHI companies, affiliates or surrogates in key positions to influence the implementation or character of DTS. These include, but are not limited to:

- Wholly inadequate purchases of manufactured home chattel loans through meager “pilot programs” (as detailed above);

- Denigrating the quality of all manufactured homes by designating a new “MH Select” program (developed through the involvement of a former MHI Vice President) for certain “quality manufactured homes” based on criteria that exceed certain HUD standards (including “back door” energy criteria promoted by an MHI affiliate, the “Systems Building Research Alliance” – SBRA);

- Fannie Mae announcing that it will become a (presumably dues-paying) “member of the Manufactured Housing Institute,” (presumably utilizing, in that case, funds subject to FHFA/federal government conservatorship);

- Fannie Mae announcing that it will create a “manufactured housing advisory council” that will include “one industry trade association” and multiple other members, but only one “smaller” manufacturer;

- Freddie Mac “partnering” with “Next Step Network, Inc.,” a beneficiary of extensive grants from Clayton and MHI to, among other things, conduct a “working group,” the “Smart MH Task Force,” comprised of lenders, retailers, housing finance agencies, trade associations and non-profit housing agencies to “provide market intelligence and data to inform loan product needs and suggested variations to grow the market,” but without ensuring either a balance of interests or the inclusion of small businesses or small business representatives within that “working group.”

All of these (and other) elements of the so-called “final” DTS implementation plans – an absurd ten years in the making — will function not as ways of providing market-significant support for manufactured housing consumer loans, but as ways of maintaining the less-than-fully-competitive status quo, the market dominance and advantages of the current market-dominant lenders, and continuing the de facto exclusion of competing lenders and full-fledged free market competition. They are not means to implement DTS, but rather to ensure that it remains virtually meaningless to the market, to smaller industry businesses and, most importantly, to the vast bulk of potential purchasers of affordable manufactured homes.

Instead, at multiple crucial junctures, the Enterprises’ final DTS plans place representatives, affiliates and surrogates of the industry’s largest corporate conglomerates and its market-dominant lenders in a position to further delay and further skew to the benefit of those entities, the so-called implementation of the Duty to Serve, thereby ensuring that it will not reach market-significant proportions during the initial plan periods or – potentially – ever.

The implementation plans, accordingly, do not comply with the DTS mandate, will facilitate continued baseless discrimination against lower and moderate-income consumers, will harm the manufactured housing industry as a whole — and its smaller businesses in particular — and are, therefore, unacceptable.

Based on all this, the manufactured housing industry and consumers should mobilize and hold FHFA, Fannie Mae and Freddie Mac accountable before Congress for wasting the last ten years regarding DTS, and seeking congressional intervention, oversight, and – if necessary – correction of the DTS mandate to ensure its immediate implementation on a market-significant basis. MHARR, for its part, will begin this process as a top priority for 2018.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.[/vc_column_text][/vc_column][/vc_row]