“Fannie Mae and Freddie Mac Have Learned Nothing From Their Subprime Debacle”

For the vast majority of lower and moderate-income Americans seeking to enter the housing market via the most direct and affordable means – i.e., through the purchase of a mainstream, inherently affordable HUD Code manufactured home – the Duty to Serve Underserved Markets (DTS) mandate, enacted by Congress twelve year ago as part of the Housing and Economic Recovery Act of 2008 (HERA), has been a cruel joke. The ineffectual and arguably deceitful so-called “implementation” of DTS by Fannie Mae, Freddie Mac and their erstwhile federal regulator, the Federal Housing Finance Agency (FHFA), has left the overwhelming majority of actual and potential manufactured homebuyers completely “unserved.” As a result, they have been – and continue to be — at the mercy of a small number of higher-interest rate lenders, backed by Berkshire Hathaway Corp. and other “big money” sources, that do not need or want securitization or secondary market support from Fannie Mae and Freddie Mac. Meanwhile, other independent lenders, due to the lack of DTS support, have stayed out of the HUD Code consumer lending market. This, combined with the virtual destruction of the Federal Housing Administration’s Title I manufactured housing program in the wake of the Government National Mortgage Association’s punitive “10-10” rule, has resulted in a mainstream manufactured housing financing market that is not fully competitive and thus sustains the higher interest rates charged by the lending affiliates of the industry’s largest conglomerates, all to the detriment of affordable housing consumers and the broader industry.

The sad reality, therefore, for both the industry and its consumers, is that the alleged “implementation” of DTS for the manufactured housing market – as planned and carried out by Fannie, Freddie and FHFA – has been, and continues to be after more than a decade, a dismal failure.

The evidence not only demonstrates that DTS, in its current iteration, has failed, but that it was – and has been – essentially “designed” to fail by Fannie, Freddie and their FHFA “regulators.” As a result, both Fannie and Freddie, and FHFA, in order to comply with the DTS law, as enacted by Congress, need to go back to the “drawing board” and fundamentally re-think, re-envision and revamp their approach to DTS based on the current-day realities of the HUD Code market, and not what Fannie and Freddie would prefer to see emerge in place of the current market and the current homes the industry offers to consumers. Fannie and Freddie, then, rather than continuing their effort to put lipstick on the proverbial “pig” that is their current failed approach to DTS, need to candidly acknowledge their failure and develop DTS implementation programs for mainstream, affordable manufactured housing that is not focused on changing those homes to be “more like” site-built homes, but is instead designed to “serve the masses” – i.e., each and every qualified potential purchaser — based on the current market and the industry’s current products. And the fact that this has not happened already – after 12 years of supposed DTS “implementation” within the manufactured housing market — proves that Fannie and Freddie have learned absolutely nothing from their “subprime” debacle and related market meltdown, or are knowingly repeating the same mistake(s) as explained further below.

In this regard, an objective look at the evidence showing the failure of DTS with respect to the HUD Code market over the past decade-plus is quite revealing, particularly in light of efforts by Fannie, Freddie and their supporters/apologists within the industry, to downplay or ignore that data and information.

For example, according to recently published reports, Fannie Mae financed a grand total of six of the Manufactured Housing Institute’s highly-touted “new class” of more costly “hybrid” manufactured homes in 2019, of which, exactly two counted for DTS credit. (See, Fannie Mae 2019 DTS Compliance Report, 2019 Manufactured Housing Loan Product, p.5: “In 2019 we [Fannie Mae] purchased six MH Advantage Loans, of which two were eligible for Duty to Serve credit.”) Freddie Mac, for its part, apparently financed none of the supposed “new class” of manufactured homes in 2019.

Meanwhile, together, both Fannie and Freddie provided DTS support for precisely zero manufactured homes financed through personal property (or “chattel”) loans in 2019, continuing their sterling record of doing exactly nothing under DTS for the vast bulk (approximately 80%) of manufactured homebuyers for the umpteenth year in a row, and for the entire twelve years that have passed since Congress’ enactment of the DTS mandate.

Nevertheless, both Fannie and Freddie will tell you — and as FHFA unbelievably certified to Congress a few months ago — both Enterprises are supposedly acting “in full compliance” with DTS vis-à-vis manufactured housing and consumer purchase loans for mainstream HUD Code manufactured housing. And if you believe that, there’s a bridge for sale in New York City.

And, beyond that? Well, there’s actually more from the world of damning statistics to round out the picture. According to FHFA’s own “dashboard” of DTS data, Fannie Mae and Freddie Mac, together, served a grand total of 30% of the manufactured housing real estate borrowers who were making an initial new home purchase (i.e., not re-financing borrowers) in 2017. For 2018 and 2019, the comparable figure is 34% each year. Given the fact that the real estate segment of the manufactured housing market, according to U.S. Census Bureau data, constituted approximately 17% of the overall manufactured housing market in 2017 and 2018, and 19% in 2019, that means Fannie and Freddie, for new home purchasers under DTS, have supported no more than 5.0 to 6.4% of the total HUD Code market comprised of new home purchasers.

Put differently, this means that more than a decade after Congress instructed the GSEs to finally begin serving the affordable manufactured housing market in a market-significant way – following decades of refusal, evasion and malign neglect – Fannie and Freddie (with the blessing and consent of FHFA) have left 94 to 95% of the total manufactured housing finance market for new homes completely unserved – with no real change in sight anytime soon. You wouldn’t know that, though, from the self-congratulatory hot air and chest-thumping emanating from Fannie, Freddie and their supporters/apologists within the industry. Supposedly, then, serving 5 or 6% of the market (at best) and leaving 94 or 95% unserved, qualifies as “compliance” with the law. Try making that kind of argument to your nearest friendly taxing authority – that paying a tiny fraction of your bill is “compliance” – and see how far you get.

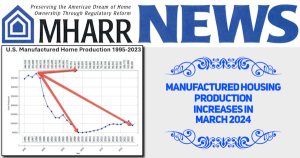

And what kind of impact does all this have on the industry and Americans in need of inherently affordable, non-subsidized housing and homeownership? The statistics, again, paint a bleak picture. According to the August 30, 2020 edition of “Housing Market 2020,” the National Association of Realtors (NAR) “report for July [2020] shows national sales growth of single-family [i.e., site-built] homes, townhomes, condominiums and co-ops, lept 24.7% from June’s to a new sales total of 5.86 million homes in July” and “July’s 24.7% leap is on top of June’s big jump of 20.7%….” In sharp contrast to the site-built market, which has apparently shaken off the economic effects of the Covid-19 pandemic and is expanding significantly, manufactured housing production for the last two HUD-reported months of May and June, 2020, were both down from the corresponding months in 2019, with May 2020 down 22% and June down by 2.5%. So, while the site-built housing market is recovering and posting new gains, the HUD Code housing market continues to underperform – particularly in relation to the growing national need for affordable housing and homeownership.

Not surprisingly, viewing all of this from the perspective of the individual manufactured housing consumer, things are just as bad – if not worse – than they are collectively over the entire market. Most significantly, in the absence of DTS support by Fannie and Freddie for the vast bulk of the manufactured housing market – and particularly the largest segment of the market, served by personal property loans — manufactured homebuyers, according to a new report published by Freddie Mac (“Manufactured Home Loan Performance (For Originations Between 2009 and 2019”) — are paying unnecessarily and disproportionately higher interest rates for their home loans. As is stated by the Freddie Mac report: “More than 90% of the [manufactured housing] personal property loans reported in the 2018 HMDA [Home Mortgage Disclosure Act report] are … higher-cost originations.” Worse yet, what is not revealed by this particular statistic, is just how many lower and moderate-income American families have been — and are being — totally excluded from homeownership because the cost of purchasing a manufactured home, the nation’s most affordable type of housing, is made much less affordable because of the unavailability of anything other than a higher-interest loan to finance its acquisition. Yet, Fannie, Freddie and FHFA, tell Congress with a straight face, and would have Congress believe, that DTS is being properly and lawfully implemented – a flat-out fiction.

Moreover, if you are looking for confirmation of this evidence and the conclusions that MHARR has drawn with respect to the failed “implementation” of DTS, there is no need to look beyond the words of departing FHFA Duty to Serve Manager, Jim Gray, who, in an August 31, 2020 farewell note to DTS stakeholders, candidly acknowledged: “[W]e have not made as much progress [under DTS] as many of us would have liked; so much remains to be done to reach these [DTS] markets.” While this acknowledgment by the de facto head of DTS implementation at FHFA is accurate as far as it goes, it unfortunately misses the most important and significant point. And that is simply that DTS, as it has been “implemented” to date by Fannie and Freddie, is not designed to work within the existing HUD Code market and, as currently constituted, cannot and will not work in that market to reach the “masses” of potential purchasers or, put differently, to provide support for the mainstream HUD Code market on a market-significant basis – as MHARR has asserted and maintained for some time.

What has instead occurred, for anyone willing to acknowledge and confront the facts as they are – not as some would like to portray them – is that the institutional resistance within Fannie Mae and Freddie Mac to serving the vast, overwhelming bulk of the truly affordable, mainstream HUD Code manufactured housing market, remains as strong as ever, notwithstanding DTS. This institutional resistance is manifested not only by Fannie and Freddie’s outright refusalto serve the mainstream HUD Code chattel market in any respect, but also in their parallel effort to divert as much of DTS as possible (within the manufactured housing market) to much higher cost

“ChoiceHome” and “MH Advantage” hybrid homes. This is nothing more than a “do-over” of the same hubris and arrogance that led to the subprime crisis and the near-collapse of Fannie and Freddie, as they sought – together with certain lenders – to put people into overpriced mortgages (and homes) that they simply could not afford. The result, once again, is that the credit-worthy lower and moderate-income Americans who Fannie and Freddie were created to serve, are once again kicked to the side, while both mortgage giants seek and pursue a more “upscale” clientele.

So, as so often happens, Congress has provided the industry and its consumers with a good law – a law that could and should be a game-changer for the entire HUD Code market — but the Washington, D.C. “swamp” (as with the 2000 reform law), is doing its utmost to twist, distort and negate that law with the tacit acceptance, or even outright enthusiasm, of some supposedly “representing” the industry’s post-production sector (i.e., retailers, communities, finance companies, etc.). This is unacceptable. DTS is not a device for changing the fundamental nature of HUD Code manufactured housing or further degrading competition within the manufactured housing market. It is, rather, a remedy, mandated by statute, directing both Fannie Mae and Freddie Mac to finally serve lower and moderate-income manufactured housing consumers in a manner and in numbers that are consistent with their respective Charters and their fundamental mission to promote homeownership among all segments of society.

It has long been said that the first step in solving a problem is to recognize that there is a problem in the first place. In this instance, Fannie Mae and Freddie Mac, despite having already been through the subprime debacle – promoting excessive loans on over-priced homes to people who clearly could not afford them – are now, through the same type of hubris and arrogance, seeking to avoid DTS support for truly affordable HUD Code homes, while trying, and failing, to push the market toward much higher-priced, non-mainstream, “hybrid homes. Instead, Fannie, Freddie and their regulators at FHFA, should – and must – acknowledge the unavoidable reality that their job under DTS, at least as far as manufactured housing is concerned, is not getting done, and that has to fundamentally change as soon as possible, given the fact that they, together, have already wasted twelve years.

Mark Weiss

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

“MHARR-Issues and Perspectives” is available for re-publication in full (i.e., without alteration or substantive modification) without further permission and with proper attribution to MHARR.

For the vast majority of lower and moderate-income Americans seeking to enter the housing market via the most direct and affordable means – i.e., through the purchase of a mainstream, inherently affordable HUD Code manufactured home – the Duty to Serve Underserved Markets (DTS) mandate, enacted by Congress twelve year ago as part of the Housing and Economic Recovery Act of 2008 (HERA), has been a cruel joke. The ineffectual and arguably deceitful so-called “implementation” of DTS by Fannie Mae, Freddie Mac and their erstwhile federal regulator, the Federal Housing Finance Agency (FHFA), has left the overwhelming majority of actual and potential manufactured homebuyers completely “unserved.” As a result, they have been – and continue to be — at the mercy of a small number of higher-interest rate lenders, backed by Berkshire Hathaway Corp. and other “big money” sources, that do not need or want securitization or secondary market support from Fannie Mae and Freddie Mac. Meanwhile, other independent lenders, due to the lack of DTS support, have stayed out of the HUD Code consumer lending market. This, combined with the virtual destruction of the Federal Housing Administration’s Title I manufactured housing program in the wake of the Government National Mortgage Association’s punitive “10-10” rule, has resulted in a mainstream manufactured housing financing market that is not fully competitive and thus sustains the higher interest rates charged by the lending affiliates of the industry’s largest conglomerates, all to the detriment of affordable housing consumers and the broader industry.

The sad reality, therefore, for both the industry and its consumers, is that the alleged “implementation” of DTS for the manufactured housing market – as planned and carried out by Fannie, Freddie and FHFA – has been, and continues to be after more than a decade, a dismal failure.

The evidence not only demonstrates that DTS, in its current iteration, has failed, but that it was – and has been – essentially “designed” to fail by Fannie, Freddie and their FHFA “regulators.” As a result, both Fannie and Freddie, and FHFA, in order to comply with the DTS law, as enacted by Congress, need to go back to the “drawing board” and fundamentally re-think, re-envision and revamp their approach to DTS based on the current-day realities of the HUD Code market, and not what Fannie and Freddie would prefer to see emerge in place of the current market and the current homes the industry offers to consumers. Fannie and Freddie, then, rather than continuing their effort to put lipstick on the proverbial “pig” that is their current failed approach to DTS, need to candidly acknowledge their failure and develop DTS implementation programs for mainstream, affordable manufactured housing that is not focused on changing those homes to be “more like” site-built homes, but is instead designed to “serve the masses” – i.e., each and every qualified potential purchaser — based on the current market and the industry’s current products. And the fact that this has not happened already – after 12 years of supposed DTS “implementation” within the manufactured housing market — proves that Fannie and Freddie have learned absolutely nothing from their “subprime” debacle and related market meltdown, or are knowingly repeating the same mistake(s) as explained further below.

In this regard, an objective look at the evidence showing the failure of DTS with respect to the HUD Code market over the past decade-plus is quite revealing, particularly in light of efforts by Fannie, Freddie and their supporters/apologists within the industry, to downplay or ignore that data and information.

For example, according to recently published reports, Fannie Mae financed a grand total of six of the Manufactured Housing Institute’s highly-touted “new class” of more costly “hybrid” manufactured homes in 2019, of which, exactly two counted for DTS credit. (See, Fannie Mae 2019 DTS Compliance Report, 2019 Manufactured Housing Loan Product, p.5: “In 2019 we [Fannie Mae] purchased six MH Advantage Loans, of which two were eligible for Duty to Serve credit.”) Freddie Mac, for its part, apparently financed none of the supposed “new class” of manufactured homes in 2019.

Meanwhile, together, both Fannie and Freddie provided DTS support for precisely zero manufactured homes financed through personal property (or “chattel”) loans in 2019, continuing their sterling record of doing exactly nothing under DTS for the vast bulk (approximately 80%) of manufactured homebuyers for the umpteenth year in a row, and for the entire twelve years that have passed since Congress’ enactment of the DTS mandate.

Nevertheless, both Fannie and Freddie will tell you — and as FHFA unbelievably certified to Congress a few months ago — both Enterprises are supposedly acting “in full compliance” with DTS vis-à-vis manufactured housing and consumer purchase loans for mainstream HUD Code manufactured housing. And if you believe that, there’s a bridge for sale in New York City.

And, beyond that? Well, there’s actually more from the world of damning statistics to round out the picture. According to FHFA’s own “dashboard” of DTS data, Fannie Mae and Freddie Mac, together, served a grand total of 30% of the manufactured housing real estate borrowers who were making an initial new home purchase (i.e., not re-financing borrowers) in 2017. For 2018 and 2019, the comparable figure is 34% each year. Given the fact that the real estate segment of the manufactured housing market, according to U.S. Census Bureau data, constituted approximately 17% of the overall manufactured housing market in 2017 and 2018, and 19% in 2019, that means Fannie and Freddie, for new home purchasers under DTS, have supported no more than 5.0 to 6.4% of the total HUD Code market comprised of new home purchasers.

Put differently, this means that more than a decade after Congress instructed the GSEs to finally begin serving the affordable manufactured housing market in a market-significant way – following decades of refusal, evasion and malign neglect – Fannie and Freddie (with the blessing and consent of FHFA) have left 94 to 95% of the total manufactured housing finance market for new homes completely unserved – with no real change in sight anytime soon. You wouldn’t know that, though, from the self-congratulatory hot air and chest-thumping emanating from Fannie, Freddie and their supporters/apologists within the industry. Supposedly, then, serving 5 or 6% of the market (at best) and leaving 94 or 95% unserved, qualifies as “compliance” with the law. Try making that kind of argument to your nearest friendly taxing authority – that paying a tiny fraction of your bill is “compliance” – and see how far you get.

And what kind of impact does all this have on the industry and Americans in need of inherently affordable, non-subsidized housing and homeownership? The statistics, again, paint a bleak picture. According to the August 30, 2020 edition of “Housing Market 2020,” the National Association of Realtors (NAR) “report for July [2020] shows national sales growth of single-family [i.e., site-built] homes, townhomes, condominiums and co-ops, lept 24.7% from June’s to a new sales total of 5.86 million homes in July” and “July’s 24.7% leap is on top of June’s big jump of 20.7%….” In sharp contrast to the site-built market, which has apparently shaken off the economic effects of the Covid-19 pandemic and is expanding significantly, manufactured housing production for the last two HUD-reported months of May and June, 2020, were both down from the corresponding months in 2019, with May 2020 down 22% and June down by 2.5%. So, while the site-built housing market is recovering and posting new gains, the HUD Code housing market continues to underperform – particularly in relation to the growing national need for affordable housing and homeownership.

Not surprisingly, viewing all of this from the perspective of the individual manufactured housing consumer, things are just as bad – if not worse – than they are collectively over the entire market. Most significantly, in the absence of DTS support by Fannie and Freddie for the vast bulk of the manufactured housing market – and particularly the largest segment of the market, served by personal property loans — manufactured homebuyers, according to a new report published by Freddie Mac (“Manufactured Home Loan Performance (For Originations Between 2009 and 2019”) — are paying unnecessarily and disproportionately higher interest rates for their home loans. As is stated by the Freddie Mac report: “More than 90% of the [manufactured housing] personal property loans reported in the 2018 HMDA [Home Mortgage Disclosure Act report] are … higher-cost originations.” Worse yet, what is not revealed by this particular statistic, is just how many lower and moderate-income American families have been — and are being — totally excluded from homeownership because the cost of purchasing a manufactured home, the nation’s most affordable type of housing, is made much less affordable because of the unavailability of anything other than a higher-interest loan to finance its acquisition. Yet, Fannie, Freddie and FHFA, tell Congress with a straight face, and would have Congress believe, that DTS is being properly and lawfully implemented – a flat-out fiction.

Moreover, if you are looking for confirmation of this evidence and the conclusions that MHARR has drawn with respect to the failed “implementation” of DTS, there is no need to look beyond the words of departing FHFA Duty to Serve Manager, Jim Gray, who, in an August 31, 2020 farewell note to DTS stakeholders, candidly acknowledged: “[W]e have not made as much progress [under DTS] as many of us would have liked; so much remains to be done to reach these [DTS] markets.” While this acknowledgment by the de facto head of DTS implementation at FHFA is accurate as far as it goes, it unfortunately misses the most important and significant point. And that is simply that DTS, as it has been “implemented” to date by Fannie and Freddie, is not designed to work within the existing HUD Code market and, as currently constituted, cannot and will not work in that market to reach the “masses” of potential purchasers or, put differently, to provide support for the mainstream HUD Code market on a market-significant basis – as MHARR has asserted and maintained for some time.

What has instead occurred, for anyone willing to acknowledge and confront the facts as they are – not as some would like to portray them – is that the institutional resistance within Fannie Mae and Freddie Mac to serving the vast, overwhelming bulk of the truly affordable, mainstream HUD Code manufactured housing market, remains as strong as ever, notwithstanding DTS. This institutional resistance is manifested not only by Fannie and Freddie’s outright refusalto serve the mainstream HUD Code chattel market in any respect, but also in their parallel effort to divert as much of DTS as possible (within the manufactured housing market) to much higher cost

“ChoiceHome” and “MH Advantage” hybrid homes. This is nothing more than a “do-over” of the same hubris and arrogance that led to the subprime crisis and the near-collapse of Fannie and Freddie, as they sought – together with certain lenders – to put people into overpriced mortgages (and homes) that they simply could not afford. The result, once again, is that the credit-worthy lower and moderate-income Americans who Fannie and Freddie were created to serve, are once again kicked to the side, while both mortgage giants seek and pursue a more “upscale” clientele.

So, as so often happens, Congress has provided the industry and its consumers with a good law – a law that could and should be a game-changer for the entire HUD Code market — but the Washington, D.C. “swamp” (as with the 2000 reform law), is doing its utmost to twist, distort and negate that law with the tacit acceptance, or even outright enthusiasm, of some supposedly “representing” the industry’s post-production sector (i.e., retailers, communities, finance companies, etc.). This is unacceptable. DTS is not a device for changing the fundamental nature of HUD Code manufactured housing or further degrading competition within the manufactured housing market. It is, rather, a remedy, mandated by statute, directing both Fannie Mae and Freddie Mac to finally serve lower and moderate-income manufactured housing consumers in a manner and in numbers that are consistent with their respective Charters and their fundamental mission to promote homeownership among all segments of society.

It has long been said that the first step in solving a problem is to recognize that there is a problem in the first place. In this instance, Fannie Mae and Freddie Mac, despite having already been through the subprime debacle – promoting excessive loans on over-priced homes to people who clearly could not afford them – are now, through the same type of hubris and arrogance, seeking to avoid DTS support for truly affordable HUD Code homes, while trying, and failing, to push the market toward much higher-priced, non-mainstream, “hybrid homes. Instead, Fannie, Freddie and their regulators at FHFA, should – and must – acknowledge the unavoidable reality that their job under DTS, at least as far as manufactured housing is concerned, is not getting done, and that has to fundamentally change as soon as possible, given the fact that they, together, have already wasted twelve years.

Mark Weiss

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

“MHARR-Issues and Perspectives” is available for re-publication in full (i.e., without alteration or substantive modification) without further permission and with proper attribution to MHARR.