Manufactured Housing Association for Regulatory Reform (MHARR) October 26, 2023 Washington, D.C. Industry Updates – an Exclusive Report and Analysis

MHARR ADDRESSES STATE ASSOCIATIONS ON INDUSTRY DECLINE

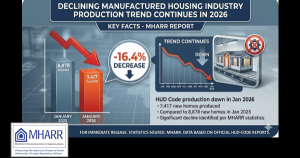

At a recent meeting of manufactured housing industry state association executives, MHARR addressed developing industry issues in Washington, D.C., as well as the major causes suppressing long-term industry growth and underlying the double-digit manufactured housing production decline of the past year. These issues, which were explained both verbally and in greater detail in a written report, are summarized below.

- CHASSIS REMOVAL/DUTY TO SERVE

Removal of the “permanent chassis” requirement from federal manufactured housing law has been an issue since MHARR was formed in 1985. At that time, MHARR supported a legislative effort and court action to delete the “permanent chassis” language from the statutory definition of manufactured housing. While those efforts did not produce a change (following the withdrawal of Manufactured Housing Institute – MHI – support), the matter has lingered since then, with the removal issue surfacing from time to time. Now, a bill is pending in the House of Representatives (H.R. 5198) to drop the permanent chassis provision and the ROAD to Housing draft bill in the Senate (proposed by Senator Tim Scott (R-S.C.)) would similarly delete that clause, among other things.

On September 7, 2023, MHARR published a comprehensive White Paper dealing with this issue from a historical, legislative and regulatory perspective, addressing the current bill and “draft” legislation. (See, copy attached). The essence of the White Paper is straightforward. Quite simply, MHARR has supported removal of the permanent chassis clause before, and could do so again. The key is to ensure – and obtain guarantees – that the permanent chassis language will be “surgically removed” from the statute, with nothing else being changed once the legislative process (and related regulatory process) begins. It is important to recognize that the housing market and especially the competition facing manufactured housing within the affordable segment of the single-family housing market, have changed substantially since the 1980s and 90s. As a result, a change of this sort could expose the industry to significant jeopardy if the removal is not handled correctly. Guarantees from legislative sponsors (and HUD) that other changes to federal manufactured housing law (and regulations) would be opposed and prevented are essential, but MHARR (nor other stakeholders, based on input) have seen anything indicating that any such guarantees (or assurances) have been made.

Even if such a surgical removal with appropriate guarantees could be accomplished, however, it must be noted that the regulatory and technical processes involved in chassis removal/elimination could substantially increase the current cost of mainstream manufactured homes, as illustrated by increasing concerns recently voiced by members of the industry’s post-production sector and especially land-lease communities. Estimated cost impacts of this type should be determined and published in advance of any such statutory/regulatory change.

In summary, there has been nothing from MHI (which has publicly endorsed and supported this effort) – or anyone else – in writing, publicly explaining how this potential statutory and regulatory minefield could/would be navigated. Nor has MHI presented or offered a cost-benefit analysis of such a change or an analysis of the factory and post-factory costs (as explained above) that would be entailed by such a change. MHARR’s White Paper analysis explains some of the questions and issues that could arise, but by no means all, given the unpredictable nature of the legislative, regulatory and later technical and marketing processes.

Aside from the chassis removal issue, the Senate discussion draft includes two finance-related provisions affecting “small dollar” mortgages under $70,000. Why these provisions have been included at this time is unclear, but given changes in the manufactured housing consumer finance market in recent years, MHARR believes it would be much more beneficial to use this legislative vehicle to put increased pressure on the Federal Housing Finance Agency (FHFA), Fannie Mae and Freddie Mac, under the Duty to Serve mandate, to actually begin serving the bulk of the manufactured housing market financed via personal property loans. That could be accomplished through the simple expedient of changing the word “may” consider chattel loans, as contained in the DTS statute, to state “shall include” chattel loans (now that MHI has publicly exposed this matter in public comments at a July 18, 2023 FHFA “listening session.”) Use of the mandatory term “shall” would stop the Enterprises from continuing to treat DTS support for the vast bulk of the manufactured housing market as somehow being optional or discretionary – which it is not.

- EXCLUSIONARY ZONING

Exclusionary zoning mandates around the country (in addition to the ongoing failure to fully implement the Duty to Serve mandate) continue to suppress the utilization of affordable manufactured homes at a time when housing costs and monthly mortgage payments are at an all-time high. In short, at a time when affordable manufactured housing should be leading the broader housing market based on affordability, manufactured home production is declining at a double-digit pace. The enhanced federal preemption provision of the 2000 Reform Law gave HUD the authority to federally preempt any state or local “requirement” that impairs the utilization of federally-regulated manufactured housing. Key congressional proponents of the 2000 Reform Law wrote HUD in 2003 to leave no doubt that the “combined changes [to the law] have given HUD the legal authority to preempt local requirements or restrictions which discriminate against the siting of manufactured homes … simply because they are HUD Code homes.” HUD, however, has been stalling on this key issue for nearly a quarter-century. Accordingly, the industry should press HUD to take a blatant case of discrimination against HUD Code homes to court and seek a broad preemption ruling. Absent action by HUD, the industry should aggressively target HUD’s failure to fully implement the enhanced preemption of the 2000 Reform Law.

- DOE ENERGY STANDARDS

As MHARR anticipated (see e.g., August 2022 MHARR Issues and Perspectives), MHI court action against the Department of energy has forced the DOE to acknowledge the obvious – that it had not properly calculated or considered the full costs (and, therefore, the full cost-benefit) of its May 31, 2022 manufactured housing energy standards rule as affirmatively required by law. As a result, DOE delayed the enforcement dates for its Tier I and Tier II rules, with the ultimate disposition of those rules currently in limbo. While such litigation should have been filed immediately upon promulgation of the DOE rule, as recommended repeatedly by MHARR, the primary questions now, are:

(1) what type of inspection and enforcement mechanism will DOE select or develop?

(2) how, whether and to what extent that mechanism will overlap the existing HUD system?

(3) what the likely costs of that mechanism will be for both industry members and consumers of mainstream manufactured housing? and

(4) whether DOE will develop and publish, via rulemaking, a new or revised cost-benefit analysis incorporating those new cost elements.

Not surprisingly, DOE, on September 26, 2023, filed a motion to dismiss the pending case. Disingenuously trying to take advantage of its own brazen failure to follow the law with respect to the full consideration of all costs and benefits in the publication of its May 31, 2022 final rule, it now claims that an action to overturn that rule is “not ripe.” Regardless of the disposition of this motion, it is essential to maintain consistent litigation pressure against DOE with respect to any iteration of its manufactured housing energy standards as those standards are inherently arbitrary, capricious and an abuse of discretion (as well as extremely and unnecessarily costly) in violation of applicable law.

MHARR, for its part, will continue to aggressively address each of these issues with both HUD and Congress, as appropriate, and will examine each in greater detail at its upcoming Board of Directors meeting.

PROPOSED LEGISLATION IGNORES MAIN CAUSES OF HOUSING CRISIS

A proposed bill, ostensibly designed to help first-time homebuyers access affordable

housing, would not have that effect according to housing experts at the American Enterprise Institute (AEI).

In a recent article, AEI critiqued the legislation titled the “Homes for every Local Protector, Educator and Responder Act of 2023” (HELPER) as being “part of the problem, not the solution.” In so doing, AEI helps to expose and emphasize the continuing baseless exclusion of genuinely affordable manufactured housing from federal affordable housing programs and the corresponding highly negative impacts of that exclusion on lower and moderate-income Americans. In this regard, the AEI study fully confirms the analysis and conclusions of MHARR’s July 2022 White Paper entitled “The Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions.” (See, copy attached).

According to the AEI analysis, the bill would exempt some 400,000 to one million current and prospective teachers, law enforcement officers and other first responders from having to make any downpayment or purchase mortgage insurance in connection with the purchase of a first-time new home. The bill would also allow up to a 6% seller assistance allowance for closing costs.

In an environment that is characterized by a significant housing (and particularly affordable housing) shortage, however, the authors contend that increasing the number of potential purchasers, by easing qualification requirements – without concurrently increasing housing supply – will lead, as a matter of basic economics, to even higher housing prices than the record levels already affecting the market. The study thus states: “When the inventory of homes for sale is tight, credit easing cannot bring in many new buyers since there are already too many buyers chasing too few homes. However, credit easing will cause the surplus of buyers to use their newly minted buying power to bid up the price of houses.”

In short, “credit easing” de facto subsidies, like subprime mortgages, will do more to harm the housing market and homebuyers as a whole, than the better approach of ensuring the availability and production of truly affordable homes, including mainstream HUD Code manufactured homes. And how could the availability and production of manufactured homes be increased? Among other things, by ending discriminatory zoning exclusion and thereby increasing the number of jurisdictions, communities and areas where affordable mainstream manufactured homes could be used and placed. The availability of mainstream manufactured housing could also be expanded by fully implementing DTS in a market-significant manner and ending the financing discrimination that is currently practiced against manufactured home purchasers.

Both such actions – which would be well within the power and authority of the federal government based on existing law – would expand the availability of affordable mainstream manufactured housing well beyond the anemic production levels that have characterized most of the current century and, in so doing, would help to reduce the overall cost of single-family housing and homeownership across the board.

Rather than fine-tuning statutory definitions or engaging in other efforts that simply “tinker around the edges,” the industry should press for both the federal preemption of the discriminatory zoning exclusion of manufactured homes as well as the full, market-significant implementation of the Duty to Serve with respect to all types of manufactured housing consumer loans. As MHARR has emphasized for over a decade, however, all of the negative issues affecting the industry’s post-production sector could have been effectively addressed – and potentially resolved by now – if the post-production sector had established an independent, national post-production representation. As it stands today, though, none of these issues are being effectively addressed in the nation’s capital.

MHARR PROVIDES STRAIGHT TALK AT STATE ASSOCIATION MEETINGS

In its ongoing effort to engage with individual industry state associations, MHARR participated in the 2023 annual meeting of the Manufactured Housing Association of Maine (MHAM) on October 18, 2023.

Interactions such as these are crucial because they provide an opportunity for MHARR to directly inform members of the industry’s post-production sector (e.g., retailers, communities, installers, developers, insurers and financing providers) of the intricacies of national issues that will have (or are having) significant long-term effects and impacts on all segments of the industry. Such interactions are also important because they provide valuable state-level input to MHARR in addressing those (and other) industry issues in Washington, D.C., particularly given the absence of an independent national post-production association in the nation’s capital.

As part of its presentations to individual state associations, MHARR has explained, in greater detail, its view of the major drivers of industry market under-achievement, including discriminatory zoning exclusion and HUD’s corresponding failure to utilize the enhanced federal preemption of the 2000 Reform Law to eliminate such exclusion; the failure of Fannie Mae and Freddie Mac to implement the Duty to Serve Underserved markets (DTS) with respect to the vast bulk of the mainstream manufactured housing consumer financing market represented by chattel loans; and impending discriminatory, high-cost energy regulation by the U.S. Department of Energy (DOE), among other things.

In addition to such personal interactions, MHARR – as it has since its inception in 1985 — routinely provides industry state associations with all of its issue-related publications and information, and maintains an open website where additional materials and content can be accessed.

MHARR is currently scheduled to address other state associations during the remainder of 2023 and looks forward to visiting with even more such individual groups in 2024.

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

The “MHARR Washington Update” is available for re-publication in whole or in part without further permission and with proper attribution to MHARR.

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: www.manufacturedhousingassociation.org

Attachments