MHARR Calls for Congress to Pursue Oversight Hearings on Manufactured Housing Regulators

Attached for your review and information is a copy of a self-explanatory communication from MHARR to the incoming chairman of the House Subcommittee on Housing and Insurance. The purpose of this communication is to seek – and begin setting the groundwork for – a congressional oversight hearing for the federal manufactured housing program and related matters including, but not limited to, consumer financing support for manufactured homebuyers.

Further details relating to this initiative will be addressed at MHARR’s upcoming Board of Directors meeting in conjunction with the South-Central Manufactured Housing Show in Biloxi, Mississippi.

cc: Other Interested HUD Code Manufactured Housing Industry Members

January 23, 2023

VIA FEDERAL EXPRESS

Honorable Warren Davidson

Chairman

U.S. House of Representatives Subcommittee on Housing And Insurance

O’Neill House Office Building

200 C Street, S.W.

Washington, D.C. 20515

Dear Chairman Davidson:

On behalf of the members of the Manufactured Housing Association for Regulatory Reform (MHARR), I would like to take this opportunity to congratulate you on your selection to serve as Chairman of the House Subcommittee on Housing and Insurance.

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing. MHARR’s members are primarily smaller and medium-sized companies, located throughout the United States. The homes produced and marketed by these MHARR members, as confirmed by multiple government studies, are the most affordable source of non-subsidized home-ownership in the United States. Manufactured homes, accordingly, provide millions of Americans – and especially lower and moderate-income families – with access to the American Dream of home-ownership that they might not have otherwise.

As you may be aware, manufactured housing is the only type of residential construction that is directly and comprehensively regulated by the federal government. Under the National Manufactured Housing Construction and Safety Standards Act of 1974, as amended by the Manufactured Housing Improvement Act of 2000 (42 U.S.C. 5401, et seq.), that regulatory authority is vested primarily in the U.S. Department of Housing and Urban Development (HUD) and its Secretary as part of a congressionally-mandated federal-state partnership. Further, to promote the utilization of affordable manufactured housing in accordance with the express purposes of this law, Congress has also enacted legislation to advance the widespread availability of competitive consumer financing for such homes through, among other things, Title I and Title II manufactured home loans insured by the Federal Housing Administration (FHA) and Ginnie Mae, as well as the “Duty to Serve” provision of the Housing and Economic Recovery Act of 2008 (HERA) with respect to support for both personal property and real estate manufactured housing loans by Fannie Mae and Freddie Mac.

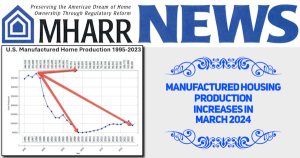

Unfortunately, many significant aspects of these good and beneficial laws have not been fully and properly implemented by HUD and other related federal agencies/entities. Thus, at a time when affordable housing and homeownership is desperately needed by lower and moderate-income American families and manufactured housing production, as a result, should be in the hundreds-of-thousands of units each year, industry production levels have failed to meet historical averages since at least 2006 and have been mired near – or below – 100,000 homes per year over that entire period. Sadly, moreover, much of this stagnation – at a time of rapidly expanding need and demand – is directly attributable to unnecessary and excessive federal regulation and a parallel lack of congressionally-mandated support for manufactured home financing due to the failure of HUD, Fannie Mae and Freddie Mac to fully and properly implement the aforesaid federal laws.

Effective and consistent congressional oversight of the HUD manufactured housing program and its regulatory practices (as well as the aforesaid consumer financing laws) is thus essential, and is of particular importance to the entrepreneurial businesses which comprise MHARR. As has been demonstrated repeatedly by academic and government research, including research conducted by the U.S. Small Business Administration (SBA), smaller businesses (and their customers) are disproportionately harmed by regulatory overreach and related regulatory compliance costs. Specific congressional oversight of the HUD manufactured housing program, however, and its failure to comply, in material respects, with applicable federal law, has not been the subject of a dedicated Housing Subcommittee hearing since February 2012.

For these reasons, we strongly believe that a hearing by your subcommittee is necessary to ensure that HUD (and other related agencies/entities) are complying with all aspects of applicable federal law. Accordingly, we look forward to working with you and your staff to address both renewed oversight and the multiple significant issues affecting the federal program and the manufactured housing industry. Toward this end, we will contact your office soon to arrange an introductory meeting to further brief you on these critical matters.

Again, congratulations on your appointment as Chairman, we look forward to meeting with you soon.

Sincerely,

Mark Weiss

President and CEO

cc: Hon. Maxine Waters

Hon. Marcia Fudge

Hon. Sandra Thompson

MHARR Members

Attached for your review and information is a copy of a self-explanatory communication from MHARR to the incoming chairman of the House Subcommittee on Housing and Insurance. The purpose of this communication is to seek – and begin setting the groundwork for – a congressional oversight hearing for the federal manufactured housing program and related matters including, but not limited to, consumer financing support for manufactured homebuyers.

Further details relating to this initiative will be addressed at MHARR’s upcoming Board of Directors meeting in conjunction with the South-Central Manufactured Housing Show in Biloxi, Mississippi.

cc: Other Interested HUD Code Manufactured Housing Industry Members

January 23, 2023

VIA FEDERAL EXPRESS

Honorable Warren Davidson

Chairman

U.S. House of Representatives Subcommittee on Housing And Insurance

O’Neill House Office Building

200 C Street, S.W.

Washington, D.C. 20515

Dear Chairman Davidson:

On behalf of the members of the Manufactured Housing Association for Regulatory Reform (MHARR), I would like to take this opportunity to congratulate you on your selection to serve as Chairman of the House Subcommittee on Housing and Insurance.

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing. MHARR’s members are primarily smaller and medium-sized companies, located throughout the United States. The homes produced and marketed by these MHARR members, as confirmed by multiple government studies, are the most affordable source of non-subsidized home-ownership in the United States. Manufactured homes, accordingly, provide millions of Americans – and especially lower and moderate-income families – with access to the American Dream of home-ownership that they might not have otherwise.

As you may be aware, manufactured housing is the only type of residential construction that is directly and comprehensively regulated by the federal government. Under the National Manufactured Housing Construction and Safety Standards Act of 1974, as amended by the Manufactured Housing Improvement Act of 2000 (42 U.S.C. 5401, et seq.), that regulatory authority is vested primarily in the U.S. Department of Housing and Urban Development (HUD) and its Secretary as part of a congressionally-mandated federal-state partnership. Further, to promote the utilization of affordable manufactured housing in accordance with the express purposes of this law, Congress has also enacted legislation to advance the widespread availability of competitive consumer financing for such homes through, among other things, Title I and Title II manufactured home loans insured by the Federal Housing Administration (FHA) and Ginnie Mae, as well as the “Duty to Serve” provision of the Housing and Economic Recovery Act of 2008 (HERA) with respect to support for both personal property and real estate manufactured housing loans by Fannie Mae and Freddie Mac.

Unfortunately, many significant aspects of these good and beneficial laws have not been fully and properly implemented by HUD and other related federal agencies/entities. Thus, at a time when affordable housing and homeownership is desperately needed by lower and moderate-income American families and manufactured housing production, as a result, should be in the hundreds-of-thousands of units each year, industry production levels have failed to meet historical averages since at least 2006 and have been mired near – or below – 100,000 homes per year over that entire period. Sadly, moreover, much of this stagnation – at a time of rapidly expanding need and demand – is directly attributable to unnecessary and excessive federal regulation and a parallel lack of congressionally-mandated support for manufactured home financing due to the failure of HUD, Fannie Mae and Freddie Mac to fully and properly implement the aforesaid federal laws.

Effective and consistent congressional oversight of the HUD manufactured housing program and its regulatory practices (as well as the aforesaid consumer financing laws) is thus essential, and is of particular importance to the entrepreneurial businesses which comprise MHARR. As has been demonstrated repeatedly by academic and government research, including research conducted by the U.S. Small Business Administration (SBA), smaller businesses (and their customers) are disproportionately harmed by regulatory overreach and related regulatory compliance costs. Specific congressional oversight of the HUD manufactured housing program, however, and its failure to comply, in material respects, with applicable federal law, has not been the subject of a dedicated Housing Subcommittee hearing since February 2012.

For these reasons, we strongly believe that a hearing by your subcommittee is necessary to ensure that HUD (and other related agencies/entities) are complying with all aspects of applicable federal law. Accordingly, we look forward to working with you and your staff to address both renewed oversight and the multiple significant issues affecting the federal program and the manufactured housing industry. Toward this end, we will contact your office soon to arrange an introductory meeting to further brief you on these critical matters.

Again, congratulations on your appointment as Chairman, we look forward to meeting with you soon.

Sincerely,

Mark Weiss

President and CEO

cc: Hon. Maxine Waters

Hon. Marcia Fudge

Hon. Sandra Thompson

MHARR Members