Persistent Manufactured Housing Association for Regulatory Reform (MHARR) Efforts Pay Dividends on Reforming Destructive Ginnie Mae Rule

PERSISTENT MHARR EFFORTS PAY DIVIDENDS ON REFORMING DESTRUCTIVE GINNIE MAE RULE

Washington, D.C., March 5, 2024 – Persistent efforts by the Manufactured Housing Association for Regulatory Reform (MHARR) to reform the draconian “10-10” rule imposed by Ginnie Mae in 2010 to limit lender eligibility under the Federal Housing Administration’s Title I manufactured home federal loan insurance program, have finally paid dividends.

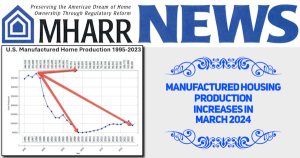

While the Title I program had formerly been an important source of consumer financing for manufactured home purchases – providing government-backed support for the personal property or chattel loans that comprise some 70-80% of all manufactured home purchase loans – the program had shriveled to insignificance under the “10-10” rule. That rule, by imposing large net worth and related requirements for authorized Title I lenders, limited eligibility to only a few companies — most notably the Berkshire-Hathaway/Clayton Homes, Inc.-affiliated lenders, Vanderbilt Mortgage and Finance, Inc. and 21st Mortgage – leading to negligible origination levels.

A more than decade-long MHARR effort to eliminate and modify the destructive 10-10 rule culminated in a 2022 meeting with senior Ginnie Mae officials where MHARR reasserted its call for the adoption of reasonable and appropriate criteria for Title I originators. Soon thereafter, Ginnie Mae issued a Request for Input (RFI) on Title I eligibility, in response to which MHARR submitted comprehensive comments, on September 21, 2022, seeking the substantial modification of the 10-10 rule, in order to revitalize Title I.

Now, in an “All Participants Memorandum,” issued on February 28, 2024 (copy attached), Ginnie Mae has eliminated the 10-10 rule and replaced it with an eligibility rule requiring $2.5 million in net worth for eligible Title I originator applicants, a 75% reduction. By reducing the draconian 10-10 criteria, the Title I program can potentially attract a larger number of smaller lenders and increase both participation and competition to the ultimate benefit of consumers. An increase in loan volume under the Title I public lending program is even more important now, in light of the continuing failure of both Fannie Mae and Freddie Mac to implement the “Duty to Serve Underserved Markets” (DTS) with respect to the dominant manufactured home consumer chattel lending sector – which has created a major bottleneck impacting the industry and consumers as explained in MHARR’s March 1, 2024 News Release packet.

Contemporaneously with the Federal Housing Administration (FHA) Title I APM, the U.S. Department of Housing and Urban Development (HUD) also published a Federal Register notice amending regulations for Title I-insured loan limits in accordance with the Housing and Economic Recovery Act of 2008 (HERA). Among other things, HUD announced that as of March 29, 2024, the index for adjusting future Title I loan limits will be based on “sales prices, unit sizes and property data collected by the [U.S.] Census Bureau.” Such information will be supplemented with two additional metrics as set forth in the final rule. First, HUD “will set loan limits at 15% above the average home price according to the Census data for the given type of loan.” Second, HUD will also “utilize an inflation factor” to account for inflation that occurs after collection of the Census data. As an example, Title I loan limits for home-only loans on single-section homes under these metrics would increase from $69,678, the HERA limit, to $106,405. Meanwhile the limit for home only multi-section loans will increase to $195,322

copy attached. APM_24-01-2.pdf

Copy attached TitleII ndexing.pdf

While these actions are positive, they do not alter the unavoidable fact that HUD still is not doing enough to promote and advance the utilization and acceptance of HUD-regulated manufactured homes as required by Congress in the Manufactured Housing Improvement Act of 2000 (2000 Reform Law). In part, this is because HUD, for more than two decades, has dodged its responsibility to utilize the enhanced federal preemption of the 2000 Reform Law – as specifically envisioned by both houses of Congress and as expressed in 2003 correspondence from key congressional proponents of that law to the Secretary of HUD – to invalidate discriminatory zoning edicts that exclude affordable manufactured homes, regulated by HUD itself, from jurisdictions across the United States. This continuing failure by HUD not only deprives Americans of the nation’s most affordable homeownership resource at a time of unprecedented affordable housing scarcity and need, but also works in a discriminatory fashion to most harmfully affect members of minority groups as documented by the Consumer Financial Protection Bureau.

Finally, and most importantly, in addition to changing lending regulations and authorizing billions of dollars in federal spending that never “reach the ground” in a meaningful manner, as documented in MHARR’s July 2022 White Paper – “The Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions” — HUD needs to act now, under existing federal statutory and regulatory authority, to make affordable manufactured housing an available resource and option for all Americans, regardless of where they reside. Moreover, the Manufactured Housing Institute (MHI), as the national representative for the industry’s post-production sector, must aggressively begin to press HUD to fully and properly implement the enhanced federal preemption of the 2000 Reform Law in order to open all such areas for affordable HUD Code manufactured homes.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

PERSISTENT MHARR EFFORTS PAY DIVIDENDS ON REFORMING DESTRUCTIVE GINNIE MAE RULE

Washington, D.C., March 5, 2024 – Persistent efforts by the Manufactured Housing Association for Regulatory Reform (MHARR) to reform the draconian “10-10” rule imposed by Ginnie Mae in 2010 to limit lender eligibility under the Federal Housing Administration’s Title I manufactured home federal loan insurance program, have finally paid dividends.

While the Title I program had formerly been an important source of consumer financing for manufactured home purchases – providing government-backed support for the personal property or chattel loans that comprise some 70-80% of all manufactured home purchase loans – the program had shriveled to insignificance under the “10-10” rule. That rule, by imposing large net worth and related requirements for authorized Title I lenders, limited eligibility to only a few companies — most notably the Berkshire-Hathaway/Clayton Homes, Inc.-affiliated lenders, Vanderbilt Mortgage and Finance, Inc. and 21st Mortgage – leading to negligible origination levels.

A more than decade-long MHARR effort to eliminate and modify the destructive 10-10 rule culminated in a 2022 meeting with senior Ginnie Mae officials where MHARR reasserted its call for the adoption of reasonable and appropriate criteria for Title I originators. Soon thereafter, Ginnie Mae issued a Request for Input (RFI) on Title I eligibility, in response to which MHARR submitted comprehensive comments, on September 21, 2022, seeking the substantial modification of the 10-10 rule, in order to revitalize Title I.

Now, in an “All Participants Memorandum,” issued on February 28, 2024 (copy attached), Ginnie Mae has eliminated the 10-10 rule and replaced it with an eligibility rule requiring $2.5 million in net worth for eligible Title I originator applicants, a 75% reduction. By reducing the draconian 10-10 criteria, the Title I program can potentially attract a larger number of smaller lenders and increase both participation and competition to the ultimate benefit of consumers. An increase in loan volume under the Title I public lending program is even more important now, in light of the continuing failure of both Fannie Mae and Freddie Mac to implement the “Duty to Serve Underserved Markets” (DTS) with respect to the dominant manufactured home consumer chattel lending sector – which has created a major bottleneck impacting the industry and consumers as explained in MHARR’s March 1, 2024 News Release packet.

Contemporaneously with the Federal Housing Administration (FHA) Title I APM, the U.S. Department of Housing and Urban Development (HUD) also published a Federal Register notice amending regulations for Title I-insured loan limits in accordance with the Housing and Economic Recovery Act of 2008 (HERA). Among other things, HUD announced that as of March 29, 2024, the index for adjusting future Title I loan limits will be based on “sales prices, unit sizes and property data collected by the [U.S.] Census Bureau.” Such information will be supplemented with two additional metrics as set forth in the final rule. First, HUD “will set loan limits at 15% above the average home price according to the Census data for the given type of loan.” Second, HUD will also “utilize an inflation factor” to account for inflation that occurs after collection of the Census data. As an example, Title I loan limits for home-only loans on single-section homes under these metrics would increase from $69,678, the HERA limit, to $106,405. Meanwhile the limit for home only multi-section loans will increase to $195,322

copy attached. APM_24-01-2.pdf

Copy attached TitleII ndexing.pdf

While these actions are positive, they do not alter the unavoidable fact that HUD still is not doing enough to promote and advance the utilization and acceptance of HUD-regulated manufactured homes as required by Congress in the Manufactured Housing Improvement Act of 2000 (2000 Reform Law). In part, this is because HUD, for more than two decades, has dodged its responsibility to utilize the enhanced federal preemption of the 2000 Reform Law – as specifically envisioned by both houses of Congress and as expressed in 2003 correspondence from key congressional proponents of that law to the Secretary of HUD – to invalidate discriminatory zoning edicts that exclude affordable manufactured homes, regulated by HUD itself, from jurisdictions across the United States. This continuing failure by HUD not only deprives Americans of the nation’s most affordable homeownership resource at a time of unprecedented affordable housing scarcity and need, but also works in a discriminatory fashion to most harmfully affect members of minority groups as documented by the Consumer Financial Protection Bureau.

Finally, and most importantly, in addition to changing lending regulations and authorizing billions of dollars in federal spending that never “reach the ground” in a meaningful manner, as documented in MHARR’s July 2022 White Paper – “The Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions” — HUD needs to act now, under existing federal statutory and regulatory authority, to make affordable manufactured housing an available resource and option for all Americans, regardless of where they reside. Moreover, the Manufactured Housing Institute (MHI), as the national representative for the industry’s post-production sector, must aggressively begin to press HUD to fully and properly implement the enhanced federal preemption of the 2000 Reform Law in order to open all such areas for affordable HUD Code manufactured homes.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.