SHOCKING NUMBERS — Manufactured Housing Production Decline Steepens as Industry Impediments Multiply

SHOCKING NUMBERS — MH PRODUCTION DECLINE STEEPENS AS INDUSTRY IMPEDIMENTS MULTIPLY

Washington, D.C., June 5, 2023 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production has declined again in April 2023. Just-released statistics indicate that HUD Code manufacturers produced 6,676 new homes in April 2023, a 34.3% decline from the 10,165 new HUD Code homes produced in April 2022. Cumulative production for 2023 is now 27,850 homes, a 30% decrease from the 39,835 homes produced over the same period during 2022.

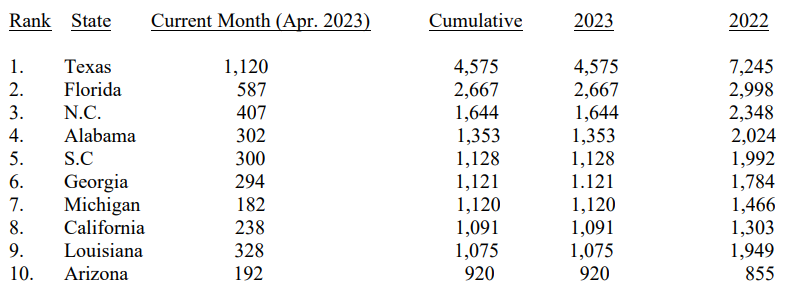

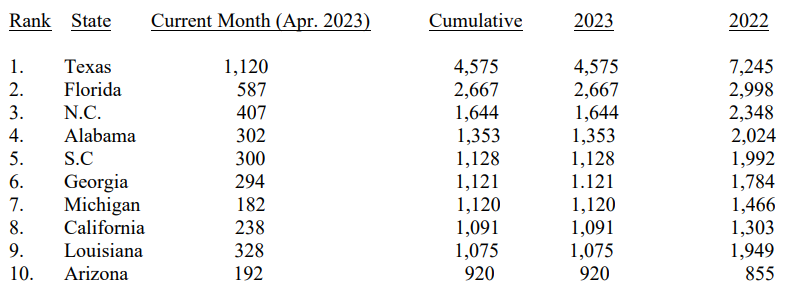

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current year (2023) and prior year (2022) shipments per category as indicated — are:

The production statistics for April 2023 yield multiple changes to the new cumulative index, moving South Carolina and Georgia into 5th and 6th place respectively.

As the production statistics enter the second quarter of 2023, they continue to reflect not only declining year-over-year (YOY) industry production each month, but an alarming trend toward a steepening rate of decline as compared with 2022. Thus, the monthly YOY decline for January 2023 was 23.6%, the YOY decline for February 2023 was 29.1%, the YOY decline for March 2023 was 32.2% and now the YOY decline for April 2023, is 34.3%.

As was stressed in the MHARR production report published on May 3, 2023, this deepening decline is occurring not only at a time of unprecedented (and growing) demand for affordable housing, but at a time when sales of new site-built homes have increased year-over-year (up 11.8% in April 2023). This significant and worsening decline illustrates the market impact of two sets of major converging problems for the industry. On the one hand, as was noted in MHARR’s May 3, 2023 production report (and explained in detail in MHARR’s July 2022 White Paper), there is the long-term negative impact of unresolved discriminatory/exclusionary zoning and the absence of competitively-priced consumer financing for the vast bulk of the HUD Code manufactured housing market (nearly 80%) represented by personal property (chattel) financing.

Now, though, these longer-term obstructions to industry growth have been joined by another more immediate short-term shock to the market – specifically the threat of draconian U.S. Department of Energy (DOE) “energy conservation” standards that will significantly increase the acquisition price of manufactured homes. Those standards, as noted by a May 9, 2023 Wall Street Journal editorial, deserve to be “killed.” But while the enforcement of the DOE standards has been temporarily delayed, it is no coincidence whatsoever that new manufactured home sales began to show signs of weakness in the immediate aftermath of the publication of the May 31, 2022 final DOE rule and entered negative growth territory a few months later.

That is why MHARR strongly urged the Manufactured Housing Institute (MHI) to file legal action against the DOE rule immediately after its May 31, 2022 publication. While MHI ultimately did file suit against the DOE rule, it waited until February 2023 to do so, leaving more than eight months for fear and concern over the cost-impact of the DOE rule to overtake the market and help collapse sales far below previous levels. Weakness and delay in Washington, D.C., accordingly – especially in the representation of the post-production sector of the industry – has helped to fuel the present decline and will continue to hamper the industry without further change. Decisive action to address and resolve these matters is needed and long overdue.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-

based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: www.manufacturedhousingassociation.org

SHOCKING NUMBERS — MH PRODUCTION DECLINE STEEPENS AS INDUSTRY IMPEDIMENTS MULTIPLY

Washington, D.C., June 5, 2023 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production has declined again in April 2023. Just-released statistics indicate that HUD Code manufacturers produced 6,676 new homes in April 2023, a 34.3% decline from the 10,165 new HUD Code homes produced in April 2022. Cumulative production for 2023 is now 27,850 homes, a 30% decrease from the 39,835 homes produced over the same period during 2022.

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current year (2023) and prior year (2022) shipments per category as indicated — are:

The production statistics for April 2023 yield multiple changes to the new cumulative index, moving South Carolina and Georgia into 5th and 6th place respectively.

As the production statistics enter the second quarter of 2023, they continue to reflect not only declining year-over-year (YOY) industry production each month, but an alarming trend toward a steepening rate of decline as compared with 2022. Thus, the monthly YOY decline for January 2023 was 23.6%, the YOY decline for February 2023 was 29.1%, the YOY decline for March 2023 was 32.2% and now the YOY decline for April 2023, is 34.3%.

As was stressed in the MHARR production report published on May 3, 2023, this deepening decline is occurring not only at a time of unprecedented (and growing) demand for affordable housing, but at a time when sales of new site-built homes have increased year-over-year (up 11.8% in April 2023). This significant and worsening decline illustrates the market impact of two sets of major converging problems for the industry. On the one hand, as was noted in MHARR’s May 3, 2023 production report (and explained in detail in MHARR’s July 2022 White Paper), there is the long-term negative impact of unresolved discriminatory/exclusionary zoning and the absence of competitively-priced consumer financing for the vast bulk of the HUD Code manufactured housing market (nearly 80%) represented by personal property (chattel) financing.

Now, though, these longer-term obstructions to industry growth have been joined by another more immediate short-term shock to the market – specifically the threat of draconian U.S. Department of Energy (DOE) “energy conservation” standards that will significantly increase the acquisition price of manufactured homes. Those standards, as noted by a May 9, 2023 Wall Street Journal editorial, deserve to be “killed.” But while the enforcement of the DOE standards has been temporarily delayed, it is no coincidence whatsoever that new manufactured home sales began to show signs of weakness in the immediate aftermath of the publication of the May 31, 2022 final DOE rule and entered negative growth territory a few months later.

That is why MHARR strongly urged the Manufactured Housing Institute (MHI) to file legal action against the DOE rule immediately after its May 31, 2022 publication. While MHI ultimately did file suit against the DOE rule, it waited until February 2023 to do so, leaving more than eight months for fear and concern over the cost-impact of the DOE rule to overtake the market and help collapse sales far below previous levels. Weakness and delay in Washington, D.C., accordingly – especially in the representation of the post-production sector of the industry – has helped to fuel the present decline and will continue to hamper the industry without further change. Decisive action to address and resolve these matters is needed and long overdue.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-

based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: www.manufacturedhousingassociation.org