MHARR – ISSUES AND PERSPECTIVES

By Mark Weiss

MARCH 2025

“THE GOOD, THE BAD AND THE UGLY”

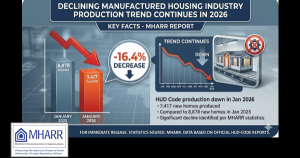

As 2025 begins, the production outlook for the HUD Code manufactured housing industry remains essentially static. While the nation continues to experience an unprecedented shortfall in the availability of affordable housing and homeownership, with a deficit widely acknowledged to surpass 7 million homes, industry production in 2024 barely exceeded the 100,000 home benchmark, at an annual total of 103,314 new manufactured homes. This follows a year (2023) during which total industry production, at 89,169 homes, fell far below the 100,000-home annual threshold, and itself falls far below the nearly 30-year (1995-2024) industry average annual production level of 145,563 homes/year. The question for the industry, consequently, is why – in an environment where the need for affordable housing and homeownership exceeds demand by millions of units – is the nation’s premier source of inherently affordable housing and homeownership mired at production levels that were routinely (and significantly) exceeded earlier in its history?

The answer to this question is astoundingly simple. While some may point to an aggregate of reasons for the industry’s chronic under-performance since the turn of the (21st) century, arguing that it is attributable to an array of factors, that would miss the point. The point is that not all such factors have an equal — or even significant – long-term macro-economic impact on the industry. Thus, while an inventory of these factors might be interesting, it would do little to advance the availability of affordable mainstream manufactured homes at levels more in line with existing demand. Instead, it is necessary to “drill down” into those factors. Doing so, it is evident that the most impactful factors underlying the industry’s chronic under-performance are, in reality, quite simple, being organically connected to the fundamental economic determinants of supply and demand. Indeed, these factors are so elemental that they were long-ago identified by Congress and, even more importantly, targeted by Congress for remediation through specific legislation.

So what are those most impactful factors? As MHARR has already examined and documented, the most significant policy bottlenecks thwarting the growth and expansion of the mainstream manufactured housing industry on a national basis – in addition to the pending draconian U.S. Department of Energy (DOE) manufactured housing “energy” standards – are: (1) discriminatory and exclusionary zoning which prevents manufactured homes from being placed in large areas of the country; and (2) the lack of federal securitization and secondary market support for manufactured home personal property loans comprising more than 70% of the current manufactured housing finance market.

The combination of these two factors (bottlenecks) has uniquely undermined both essential components of the mainstream manufactured housing economy (i.e., supply and demand). Put differently, while discriminatory and exclusionary zoning has destroyed or limited demand for manufactured homes in large areas (by making the siting of manufactured homes either impossible or extremely difficult), the unavailability of federally-supported consumer financing within the industry’s dominant personal property lending sector has limited the supply of competitive-rate consumer financing for the industry’s most affordable homes. And, since consumers (for the most part) cannot purchase a home they cannot finance at an affordable rate, the lack of supply of competitive-rate consumer financing for manufactured homes effectively suppresses the supply of manufactured homes per se.

So, that is the “bad.” The industry is producing the highest value, highest quality homes in its entire history, yet because of these two primary market-limiting factors within the industry’s post-production sector (i.e., exclusionary zoning and lack of federal support for market-competitive loans within the personal property sector) the industry remains mired in a decades-long production slump with no end in sight.

Now, the “good.” There is good news – potentially — regarding these elemental, long-term industry bottlenecks. That good news is the arrival of the second Trump Administration and a renewed possibility of achieving fundamental change within the federal government regarding enforcement of the two laws that directly relate to and impact the two principal industry bottlenecks.

As MHARR has previously documented, the full implementation and enforcement of two existing laws by the federal government would address and, in all likelihood, substantially resolve both of the primary industry bottlenecks.

First, with respect to exclusionary/discriminatory zoning, the enhanced federal preemption of the Manufactured Housing Improvement Act of 2000 (2000 Reform Law) was specifically designed by Congress to extend the reach of federal preemption beyond inconsistent state and/or local construction and safety standards, and to specifically include and address other state or local “requirements” (such as exclusionary zoning) that impair federal superintendence of the manufactured housing industry, including increasing the availability of affordable manufactured homes for “all Americans.” And how do we know this? Because members of Congress who were essential to the development and passage of the 2000 Reform Law said so in a 2003 letter to then-HUD Secretary Mel Martinez.

Second, with respect to securitization and secondary market support for manufactured home personal property loans, the applicability of the statutory Duty to Serve Underserved Markets (DTS) provision of the Housing and Economic Recovery Act of 2008 (HERA) to the personal property sector of the HUD Code market also does not require any guesswork. Rather, the DTS provision expressly states that its mandate applies both to manufactured home loans secured by real estate and to homes financed solely as personal property. Again, the provisions that the industry must have enforced are not implied, contextual, or arguable. Rather, they were fully briefed for Congress when the 2000 Reform Law and DTS were under consideration, and were fully included in each law, verbatim, in black and white. The problem, therefore, has not been the existence of remedial law, but instead the implementation or, rather, non-implementation of that remedial law by HUD on the one hand and by the Federal Housing Finance Agency (FHFA) – the federal regulator for Fannie Mae and Freddie Mac – on the other.

Since both of these bottleneck issues, as noted above, fall squarely within the industry’s post-production sector, they are – and have always been – the primary responsibility of the industry’s national post-production representation, the Manufactured Housing Institute (MHI). While MHARR has acted within both of these policy areas, MHARR does not draw dues from post-production sector businesses and – unlike MHI (which collects dues from retailers, communities, finance companies, insurers, installers, transporters and others) — does not claim to act as a national-level representative of those businesses. MHI, meanwhile, does collect dues from the post-production sector and does claim to represent that sector. MHI, however, has not taken decisive or effective action to remedy either of these industry bottlenecks.

The first Administration of President Trump presented the industry with a profound opportunity to address both such issues. President Trump entered office in 2017 with an agenda that included both regulatory reform and the promotion of affordable homeownership. MHARR, for its part, took immediate and aggressive steps to spur HUD action on discriminatory and exclusionary zoning and to seek full implementation of DTS within the HUD Code chattel sector by FHFA. MHI, meanwhile, seemed to focus its efforts on hosting HUD Secretary Ben Carson at MHI conferences and events, while placing homes within HUD’s “Innovative Housing Showcase” in Washington, D.C. Such “public relations” efforts, however, failed to move the needle either with HUD on zoning preemption or with FHFA, Fannie Mae, or Freddie Mac on chattel sector DTS.

Without anything resembling an aggressive full court press on these fundamental industry bottlenecks by the industry’s self-proclaimed national post-production sector representative, President Trump’s first term passed without any significant progress on either issue. Fortunately for the industry, however, with the second term of President Trump, it will now get perhaps the rarest of rare opportunities, a second chance to aggressively seek and demand effective action to remedy the bottlenecks that continue to suppress the more widespread utilization of affordable mainstream HUD Code manufactured homes. But that effort will once again require aggressive action by the entire industry – which leads us to the “ugly.”

The “ugly” is whether MHI is even institutionally capable of mounting a truly aggressive push to rectify the industry’s primary “bottleneck” issues. History (i.e., President Trump’s first term) would say that it is not. Even worse, this failure is consistent with a prediction made years ago by the industry pioneers who founded MHARR. Specifically, when MHARR led the successful late 1990’s effort to comprehensively reform the original National Manufactured Housing Construction and Safety Standards Act of 1974, MHARR’s founders predicted that if the industry did not create an independent Washington, D.C.-based national representative for the post-production sector, there would be trouble down the road for the industry as a whole. Unfortunately, the post-production sector failed to heed this warning, and that failure is now coming back to haunt the industry.

If there were an independent national post-production industry representative, would that representative stand idly by while manufactured homes were excluded from large portions of the country? Or would it force action on such a crucial issue? Would it glad-hand FHFA, Fanie Mae and Freddie Mac – for nearly 20 years – while more than 70% of the industry’s consumers (served by personal property loans) were excluded from any benefit whatsoever under DTS? Would it be a cheerleader for benefits for community landlords and purchasers from the Government Sponsored Enterprises (GSEs) while individual consumers and homeowners are shortchanged and left out in the cold, creating a public outcry that is damaging to the industry as a whole? And this is not to mention a myriad of other post-production sector issues facing the industry and consumers in Washington, D.C.

The most likely answer is “no.” Instead, an independent national post-production representative would discern the fundamental harm flowing from both the exclusionary zoning and DTS issues, and would have acted firmly and aggressively already to seek and obtain a re-solution to both, instead of letting the entire industry languish in an economic environment otherwise primed for substantial growth.

In the final analysis, the industry faces fundamental challenges to its growth, expansion and evolution. Those challenges are existential, and must be addressed and successfully resolved. The fact that they continue to linger, after decades, is proof in itself that the present representational structure of the industry – with a broad “umbrella” organization collecting dues from all segments of the industry — is not up to the challenge that they present and, therefore, must be reconsidered and changed. The ultimate question is whether the broader industry will confront this most vexing problem.

Mark Weiss

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

“MHARR-Issues and Perspectives” is available for re-publication in full (i.e., without alteration or substantive modification) without further permission and with proper attribution and/or link back to MHARR.