MHARR Highlights Key Industry Issues in MEETING with HUD Assistant Secretary

MHARR HIGHLIGHTS KEY INDUSTRY ISSUES

IN MEETING WITH HUD ASSISTANT SECRETARY

MHARR Washington officials, on June 29, 2023, met with HUD Assistant Secretary and Federal Housing Commissioner, Julia Gordon. Ms. Gordon is the HUD appointed official with direct supervisory authority over both the federal manufactured housing program and Federal Housing Administration (FHA)-supported lending for manufactured home consumer loans. In a wide-ranging discussion, MHARR addressed a number of significant industry concerns with the Assistant Secretary.

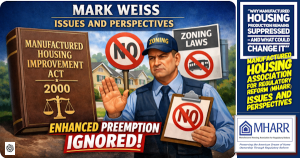

At the outset, MHARR reiterated its view that production and sales of inherently affordable HUD Code manufactured homes are being artificially and significantly suppressed by three main factors – discriminatory zoning exclusion; a nearly complete lack of federal support for manufactured home consumer chattel lending; and looming excessive and high-cost federal energy regulation. In turn, MHARR addressed each of these major pending issues (and more) with Assistant Secretary/Commissioner Gordon.

- Renewed Attack on Discriminatory and Exclusionary Zoning Laws

Targeting Manufactured Housing and Manufactured Housing Consumers

MHARR stressed that HUD, in the wake of the Manufactured Housing Improvement Act of 2000 and its enhanced federal preemption, does, in fact, have the legal authority and power to prevent localities from discriminatorily excluding HUD Code manufactured homes. That authority was expressly confirmed by key congressional proponents of the 2000 Reform Law in a 2003 communication to then-HUD Secretary Mel Martinez, emphasizing that enhanced preemption was designed and intended to allow HUD to negate the discriminatory exclusion of both manufactured homes and manufactured homeowners from American communities.

Given the fact that no state or local government would dare discriminate against homeowners based on race, religion, nationality, or a host of other prohibited factors, and given the fact that today’s modern, affordable and energy-efficient manufactured homes are otherwise equal to – or better than – other homes in terms of quality and cost-effective performance, zoning discrimination targeting federally-regulated manufactured housing must inevitably revolve around one factor. And that factor is that manufactured homes are constructed in accordance with a cost-saving (and fully-enforced) federal code, versus the International Residential Code and International Building Code (and variants thereof) enforced against site-built and other types of factory-built housing at the state and local level.

Given this undeniable reality, MHARR officials emphasized to the Assistant Secretary that HUD not only has an obligation, but an affirmative duty to stand up for its own federal code and the manufactured homes that are built to that code.

In accordance with this duty and both the express language of the enhanced preemption provision of the 2000 Reform Law and the legislative history of that provision, MHARR urged HUD to revisit its position on zoning preemption and take strong action to prevent such extremely damaging discrimination from continuing. Such action can and should – if necessary – include legal action (and resort to the highest federal court(s) necessary) in order to stop baseless zoning discrimination against manufactured housing consumers.

- Improving Availability and Competition in Manufactured Home Consumer Financing

MHARR officials next addressed consumer financing and the baseless absence of federal support for manufactured home personal property (chattel) lending. While Assistant Secretary Gordon does not have authority over Fannie Mae and Freddie Mac which still — after 15 years — have failed to implement the Duty to Serve (DTS) mandate with respect to manufactured home chattel loans, she does have authority over the FHA Title I program for federally-supported manufactured home chattel consumer loans. That program, however, as acknowledged in 2022 by Ginnie Mae (the independent Title I guarantor), has withered away to negligible levels of lending activity, due to Ginnie Mae’s excessive and unnecessary “10-10” rule, which has needlessly discouraged smaller, independent lenders from participating in the Title I program.

Ginnie Mae, however, in 2022, issued a Request for Input (RFI) concerning Title I and steps that could be taken to revitalize that program, including possible changes to the 10-10 rule. MHARR, at that time, reiterated its longstanding call for either the elimination or substantial modification of the “10-10” rule. In response to inquiries by MHARR, the Commissioner indicated that Ginnie Mae could take further action in this area by the end of 2023. MHARR strongly encouraged such steps by Ginnie Mae and FHA to revitalize the Title I program, to help increase competition and lower interest rates paid by chattel loan consumers.

- Scrapping the Devastating DOE Energy Rule

Beyond zoning and consumer financing matters, MHARR addressed the destructive impact that impending U.S. Department of Energy (DOE) energy standards are having on the manufactured housing market and both the production and availability of affordable manufactured homes for American consumers of affordable housing. Among other things, MHARR emphasized that since the announcement of the final DOE energy rule, manufactured home production and sales had collapsed by nearly one-third, and continue at levels that are far below those seen in recent years.

MHARR stressed that the DOE standards, by law, were required to have been developed fully in conjunction with both HUD and the Manufactured Housing Consensus Committee (MHCC), but were not. Accordingly, MHARR has always maintained that the DOE “final” standards are illegitimate, in violation of multiple provisions of applicable law, and should be withdrawn while both HUD and DOE go “back to the drawing board,” to develop standards that are both cost-effective and appropriate for affordable manufactured housing. In response, Assistant Secretary Gordon indicated that HUD anticipated publishing a proposed energy rule of its own (presumably based on 2022 recommendations by the MHCC), along with regulatory compliance and enforcement criteria, by the end of 2023. Regardless of any such action by HUD, however, MHARR continues to maintain that the current DOE final energy standards must be withdrawn before they destroy the essential and fundamental affordability of HUD Code manufactured homes.

When that proposed rule is published, it will be carefully scrutinized by MHARR, which will file and comments and, if necessary, take other steps to ensure that any manufactured housing energy standards – published by HUD or any other federal agency – are cost-effective and fully in compliance with all applicable law.

- Chassis Removal in Sen. Tim Scott’s Draft “ROAD to Housing” Act

Finally, MHARR apprised the Assistant Secretary of its serious concerns with the draft “ROAD to Housing Act” released recently by South Carolina Senator (and 2024 presidential candidate) Tim Scott. While MHARR has begun an in-depth review and analysis of this draft, a recent report by industry journal MHProNews, has raised serious questions about the potential minefields that could be opened by consideration of the draft bill during the legislative process and thereafter, during the related regulatory process. And while MHARR’s preliminary findings are consistent with these areas of concern, the Association will nevertheless support the removal of the ”built on a permanent chassis” requirement only – i.e., the removal of those five words from the statutory (and corresponding regulatory) definition only, with no other changes of either addition, deletion, or modification.

Given such serious concerns and the minefields that could be opened by this legislative “draft,” MHARR asked the Assistant Secretary if HUD had a position on the draft, particularly in light of HUD’s strenuous opposition (both legislatively and legally) to a similar attempt to remove the same clause prior to the enactment of the comprehensive reforms of the Manufactured Housing Improvement Act of 2000. While the Assistant Secretary indicated that HUD would be unlikely to take a position on “draft” legislation that has not yet been introduced, MHARR nevertheless stressed the importance of ensuring that any removal of the “permanent chassis” provision is accompanied by legislative and regulatory guarantees to ensure that no other element(s) of the statutory or regulatory definition are changed.

MHARR will continue to carefully monitor these and other upcoming developments affecting the federal regulation of manufactured housing and related costs, going forward.

cc: Other Interested HUD Code Manufactured Housing Industry Members

MHARR HIGHLIGHTS KEY INDUSTRY ISSUES

IN MEETING WITH HUD ASSISTANT SECRETARY

MHARR Washington officials, on June 29, 2023, met with HUD Assistant Secretary and Federal Housing Commissioner, Julia Gordon. Ms. Gordon is the HUD appointed official with direct supervisory authority over both the federal manufactured housing program and Federal Housing Administration (FHA)-supported lending for manufactured home consumer loans. In a wide-ranging discussion, MHARR addressed a number of significant industry concerns with the Assistant Secretary.

At the outset, MHARR reiterated its view that production and sales of inherently affordable HUD Code manufactured homes are being artificially and significantly suppressed by three main factors – discriminatory zoning exclusion; a nearly complete lack of federal support for manufactured home consumer chattel lending; and looming excessive and high-cost federal energy regulation. In turn, MHARR addressed each of these major pending issues (and more) with Assistant Secretary/Commissioner Gordon.

- Renewed Attack on Discriminatory and Exclusionary Zoning Laws

Targeting Manufactured Housing and Manufactured Housing Consumers

MHARR stressed that HUD, in the wake of the Manufactured Housing Improvement Act of 2000 and its enhanced federal preemption, does, in fact, have the legal authority and power to prevent localities from discriminatorily excluding HUD Code manufactured homes. That authority was expressly confirmed by key congressional proponents of the 2000 Reform Law in a 2003 communication to then-HUD Secretary Mel Martinez, emphasizing that enhanced preemption was designed and intended to allow HUD to negate the discriminatory exclusion of both manufactured homes and manufactured homeowners from American communities.

Given the fact that no state or local government would dare discriminate against homeowners based on race, religion, nationality, or a host of other prohibited factors, and given the fact that today’s modern, affordable and energy-efficient manufactured homes are otherwise equal to – or better than – other homes in terms of quality and cost-effective performance, zoning discrimination targeting federally-regulated manufactured housing must inevitably revolve around one factor. And that factor is that manufactured homes are constructed in accordance with a cost-saving (and fully-enforced) federal code, versus the International Residential Code and International Building Code (and variants thereof) enforced against site-built and other types of factory-built housing at the state and local level.

Given this undeniable reality, MHARR officials emphasized to the Assistant Secretary that HUD not only has an obligation, but an affirmative duty to stand up for its own federal code and the manufactured homes that are built to that code.

In accordance with this duty and both the express language of the enhanced preemption provision of the 2000 Reform Law and the legislative history of that provision, MHARR urged HUD to revisit its position on zoning preemption and take strong action to prevent such extremely damaging discrimination from continuing. Such action can and should – if necessary – include legal action (and resort to the highest federal court(s) necessary) in order to stop baseless zoning discrimination against manufactured housing consumers.

- Improving Availability and Competition in Manufactured Home Consumer Financing

MHARR officials next addressed consumer financing and the baseless absence of federal support for manufactured home personal property (chattel) lending. While Assistant Secretary Gordon does not have authority over Fannie Mae and Freddie Mac which still — after 15 years — have failed to implement the Duty to Serve (DTS) mandate with respect to manufactured home chattel loans, she does have authority over the FHA Title I program for federally-supported manufactured home chattel consumer loans. That program, however, as acknowledged in 2022 by Ginnie Mae (the independent Title I guarantor), has withered away to negligible levels of lending activity, due to Ginnie Mae’s excessive and unnecessary “10-10” rule, which has needlessly discouraged smaller, independent lenders from participating in the Title I program.

Ginnie Mae, however, in 2022, issued a Request for Input (RFI) concerning Title I and steps that could be taken to revitalize that program, including possible changes to the 10-10 rule. MHARR, at that time, reiterated its longstanding call for either the elimination or substantial modification of the “10-10” rule. In response to inquiries by MHARR, the Commissioner indicated that Ginnie Mae could take further action in this area by the end of 2023. MHARR strongly encouraged such steps by Ginnie Mae and FHA to revitalize the Title I program, to help increase competition and lower interest rates paid by chattel loan consumers.

- Scrapping the Devastating DOE Energy Rule

Beyond zoning and consumer financing matters, MHARR addressed the destructive impact that impending U.S. Department of Energy (DOE) energy standards are having on the manufactured housing market and both the production and availability of affordable manufactured homes for American consumers of affordable housing. Among other things, MHARR emphasized that since the announcement of the final DOE energy rule, manufactured home production and sales had collapsed by nearly one-third, and continue at levels that are far below those seen in recent years.

MHARR stressed that the DOE standards, by law, were required to have been developed fully in conjunction with both HUD and the Manufactured Housing Consensus Committee (MHCC), but were not. Accordingly, MHARR has always maintained that the DOE “final” standards are illegitimate, in violation of multiple provisions of applicable law, and should be withdrawn while both HUD and DOE go “back to the drawing board,” to develop standards that are both cost-effective and appropriate for affordable manufactured housing. In response, Assistant Secretary Gordon indicated that HUD anticipated publishing a proposed energy rule of its own (presumably based on 2022 recommendations by the MHCC), along with regulatory compliance and enforcement criteria, by the end of 2023. Regardless of any such action by HUD, however, MHARR continues to maintain that the current DOE final energy standards must be withdrawn before they destroy the essential and fundamental affordability of HUD Code manufactured homes.

When that proposed rule is published, it will be carefully scrutinized by MHARR, which will file and comments and, if necessary, take other steps to ensure that any manufactured housing energy standards – published by HUD or any other federal agency – are cost-effective and fully in compliance with all applicable law.

- Chassis Removal in Sen. Tim Scott’s Draft “ROAD to Housing” Act

Finally, MHARR apprised the Assistant Secretary of its serious concerns with the draft “ROAD to Housing Act” released recently by South Carolina Senator (and 2024 presidential candidate) Tim Scott. While MHARR has begun an in-depth review and analysis of this draft, a recent report by industry journal MHProNews, has raised serious questions about the potential minefields that could be opened by consideration of the draft bill during the legislative process and thereafter, during the related regulatory process. And while MHARR’s preliminary findings are consistent with these areas of concern, the Association will nevertheless support the removal of the ”built on a permanent chassis” requirement only – i.e., the removal of those five words from the statutory (and corresponding regulatory) definition only, with no other changes of either addition, deletion, or modification.

Given such serious concerns and the minefields that could be opened by this legislative “draft,” MHARR asked the Assistant Secretary if HUD had a position on the draft, particularly in light of HUD’s strenuous opposition (both legislatively and legally) to a similar attempt to remove the same clause prior to the enactment of the comprehensive reforms of the Manufactured Housing Improvement Act of 2000. While the Assistant Secretary indicated that HUD would be unlikely to take a position on “draft” legislation that has not yet been introduced, MHARR nevertheless stressed the importance of ensuring that any removal of the “permanent chassis” provision is accompanied by legislative and regulatory guarantees to ensure that no other element(s) of the statutory or regulatory definition are changed.

MHARR will continue to carefully monitor these and other upcoming developments affecting the federal regulation of manufactured housing and related costs, going forward.

cc: Other Interested HUD Code Manufactured Housing Industry Members