Despite Steep Production Decline, Manufactured Housing Institute Gives Fannie Mae and Freddie Mac a Pass

Washington, D.C., August 3, 2023 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined again in June 2023. Just-released statistics indicate that HUD Code manufacturers produced 8,169 new homes in June 2023, a 28.1% decline from the 11,373 new HUD Code homes produced in June 2022. Cumulative production for 2023 is now 43,888 homes, a 28.8% decrease from the 61,659 homes produced over the same period during 2022.

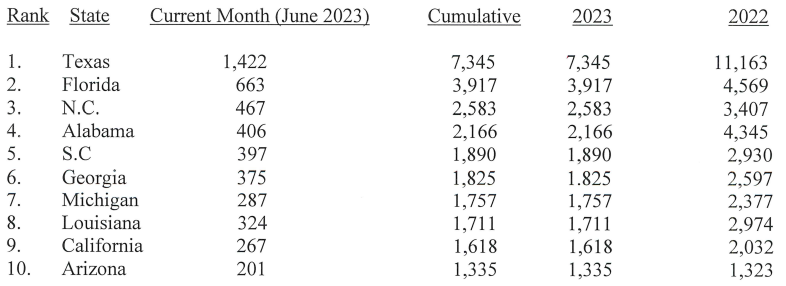

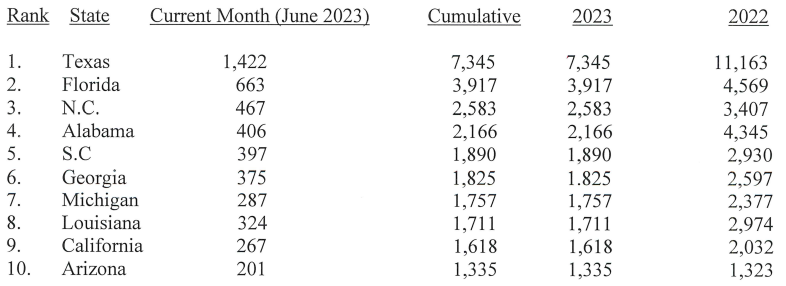

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current year (2023) and prior year (2022) shipments per category as indicated — are:

The statistics for June 2023 produce one change from last month, moving Georgia into 6th place, ahead of Michigan.

The continuing steep production decline illustrated by these statistics, is the result, in substantial part, of the complete failure of Fannie Mae and Freddie Mac to provide securitization and secondary market support for manufactured housing chattel loans under the Duty to Serve (DTS) mandate. For 15 years since the enactment of DTS, the mortgage giants have failed to provide any support for these loans, despite the fact that they represent some 80% of the manufactured housing market and provide access to the industry’s most affordable homes. If DTS were implemented, in a market-significant manner, that factor, in itself, would draw new lenders into the HUD Code financing market and reduce interest rates through increased competition and lowered risk.

Yet despite the fact that Fannie Mae and Freddie Mac continue to flout Congress and the law with respect to the vast bulk of the HUD Code market, the Manufactured Housing Institute (MHI), representing the industry’s post-production sector, in recent remarks to a DTS “Listening Session,” “commended” Fannie Mae and Freddie Mac for their “efforts” regarding DTS. So, instead of exerting maximum pressure on Fannie and Freddie to finally begin serving the core of the industry’s retail consumer base, the national representative of the industry’s post-production sector effectively gave the two entities a pass for their continuing failure to serve the vast bulk of the industry and its consumers. This is unacceptable and only helps to excuse and prolong an unacceptable status quo.

MHARR, for its part, continues to press the Federal Housing Finance Agency (FHFA) for the full, complete and robust implementation of DTS in all HUD Code consumer financing markets.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-

|based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

Washington, D.C., August 3, 2023 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined again in June 2023. Just-released statistics indicate that HUD Code manufacturers produced 8,169 new homes in June 2023, a 28.1% decline from the 11,373 new HUD Code homes produced in June 2022. Cumulative production for 2023 is now 43,888 homes, a 28.8% decrease from the 61,659 homes produced over the same period during 2022.

A further analysis of the official industry statistics shows that the top ten shipment states from January 2023 — with monthly, cumulative, current year (2023) and prior year (2022) shipments per category as indicated — are:

The statistics for June 2023 produce one change from last month, moving Georgia into 6th place, ahead of Michigan.

The continuing steep production decline illustrated by these statistics, is the result, in substantial part, of the complete failure of Fannie Mae and Freddie Mac to provide securitization and secondary market support for manufactured housing chattel loans under the Duty to Serve (DTS) mandate. For 15 years since the enactment of DTS, the mortgage giants have failed to provide any support for these loans, despite the fact that they represent some 80% of the manufactured housing market and provide access to the industry’s most affordable homes. If DTS were implemented, in a market-significant manner, that factor, in itself, would draw new lenders into the HUD Code financing market and reduce interest rates through increased competition and lowered risk.

Yet despite the fact that Fannie Mae and Freddie Mac continue to flout Congress and the law with respect to the vast bulk of the HUD Code market, the Manufactured Housing Institute (MHI), representing the industry’s post-production sector, in recent remarks to a DTS “Listening Session,” “commended” Fannie Mae and Freddie Mac for their “efforts” regarding DTS. So, instead of exerting maximum pressure on Fannie and Freddie to finally begin serving the core of the industry’s retail consumer base, the national representative of the industry’s post-production sector effectively gave the two entities a pass for their continuing failure to serve the vast bulk of the industry and its consumers. This is unacceptable and only helps to excuse and prolong an unacceptable status quo.

MHARR, for its part, continues to press the Federal Housing Finance Agency (FHFA) for the full, complete and robust implementation of DTS in all HUD Code consumer financing markets.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-

|based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.