MHARR Washington Update – March 15, 2023, Report and Analysis

REPORT AND ANALYSISIN THIS REPORT: MARCH 15, 2023

- DOE “ENERGY” RULE LAWSUIT FILED AFTER NINE MONTH DELAY

- FHFA CONTINUES TO THUMB ITS NOSE AT CONGRESS ON DTS

- HUD CONTINUES TO IGNORE ANTI-MH ZONING DISCRIMINATION

- HUD CODE PRODUCTION PLUMMETS

- MHARR SEEKS CONGRESSIONAL OVERSIGHT HEARINGS

- “NEW” IECC PROCESS WOULD WORSEN DOE ENERGY RULE

- MHARR WHITE PAPER CORROBORATED ONCE AGAIN

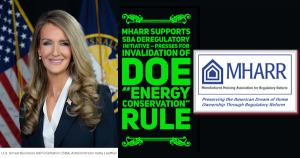

MHARR-PROMOTED LAWSUIT FINALLY FILED AGAINST DOE ENERGY RULE

Some nine months after the publication of a market-killing U.S. Department of Energy (DOE) final rule for manufactured housing “energy” standards – and more than six months after MHARR urged the Manufactured Housing Institute (MHI) to pursue legal action to stop the May 31, 2023 implementation of that rule (and simultaneously offered to join and support such litigation) — MHI and the Texas Manufactured Housing Association (TMHA) have filed such an action in the United States District Court for the Western District of Texas. The DOE rule, as conceded by that agency, would add thousands of dollars to the retail cost of a new manufactured home, even without considering testing, enforcement and regulatory compliance costs, which have never been calculated or even estimated. Indeed, 2021-2022 MHARR estimates showed that the DOE standards would add between $6,000 and $12,000 to the retail cost of a new HUD Code home. Even those staggering figures, however, would be higher today, given continuing high rates of inflation and increases in living costs.

The pending lawsuit, accordingly, filed on February 14, 2023, seeks to stay implementation of the DOE final rule and other related relief. In both substance and approach, this court action tracks steps specifically urged by MHARR in August 2022.

In MHARR’s August 2022 Issues and Perspectives column, “Why the DOE Energy Rule Should be DOA,” MHARR detailed the legal bases and practical rationale for such a court action, as well as claims and arguments, both substantive and procedural (addressed in multiple sets of MHARR comments to DOE and the Manufactured Housing Consensus Committee), that could be asserted in such an action. It also stressed the urgent need for timely litigation in order to secure relief well in advance of the implementation date.

Among other things, MHARR called for an action under the federal Administrative Procedure Act, based on DOE’s failure to fully and properly calculate, account for, and consider all of the anticipated costs of the rule. This included, but was not limited to, DOE’s failure to propose and estimate the costs of testing, compliance and enforcement of the final standards, its use of artificially low inflation indices for the defective “cost analysis” that it did perform, and its failure to consider other factors that would result in costs substantially exceeding anticipated benefits. MHARR also urged litigation based on DOE’s failure to fully and properly consult with HUD and the Manufactured Housing Consensus Committee (MHCC) as directed by Congress in the Energy Independence and Security Act of 2007 and, just as importantly, DOE’s thoroughly corrupted “negotiated rulemaking” process, which MHARR consistently opposed (unlike MHI) and which irretrievably tainted the final rule from step-one.

As set out by MHARR, the objective of such a court action was to invalidate the DOE final rule – and the entirety of the rulemaking process which led to that rule, beginning in 2008 – and to compel DOE to go back to “square one” with respect to manufactured housing energy standards in full and proper consultation with both HUD and the MHCC, from the start, as mandated by Congress.

As this has unfolded, however, the MHI filing, which apparently follows the failure of other legislative and Executive Branch approaches pursued by that organization – the futility of which MHARR anticipated and explained in its August 2022 analysis — appears to be a last resort, rather than the first step toward obtaining meaningful relief as urged by MHARR in its detailed blueprint. Consequently, while MHARR credits MHI for taking the necessary step of initiating court action against the DOE rule, that case should have been instituted months ago in order to avoid the type of chaos which has now begun to engulf the industry with, among other things:

(1) Uncertainty among manufacturers as to whether they must prepare for compliance with the DOE standards as of May 31, 2023;

(2) Corresponding uncertainty among IPIAs and DAPIAs regarding enforcement of the DOE standards and the scope of their authority (if any) in the absence of corresponding HUD standards (with at least one IPIA/DAPIA stating in a communication to manufacturers that it will not require compliance with DOE standards not incorporated within the HUD Code);

(3) A lack of any specific, valid action by HUD; and

(4) The absence of any type of testing, enforcement or other regulatory mechanism in advance of the May 31, 2023 implementation date.

Given the foregoing, the pending lawsuit must be about more than just delaying implementation of the final DOE standards rule. Rather, it must be about vacating that rule, based on its myriad fatal defects, and sending the entire rulemaking process back to the very start, so that there can be proper consultation with HUD and the MHCC, and complete elimination of the inherent taint that DOE’s thoroughly-corrupted “negotiated rulemaking” process infused into the process leading to the destructive May 2022 DOE final standard.

LATEST DTS REVISIONS CONTINUE TO FLOUT CONGRESS AND FEDERAL LAW

The Federal Housing Finance Agency (FHFA) – the federal agency responsible for the implementation of the Duty to Serve Underserved Markets (DTS) provision of the Housing and Economic Recovery Act of 2008 (HERA) — has published the latest approved revisions to the 2022-2024 DTS “implementation” plans submitted by mortgage giants Fannie Mae and Freddie Mac. While these revisions will have some minor impacts on the manufactured housing market, they totally fail, once again, to address the complete absence of manufactured housing chattel loan support in the Fannie Mae DTS plan, or Freddie Mac’s ongoing delay of any DTS chattel loan support until the last year of its plan (2024) under a token pilot program that could still be deleted prior to implementation, as has been the case with previous supposed chattel loan “pilot” programs. MHARR has consistently cited this failure to provide essential support for the vast bulk of the manufactured housing finance market (i.e., nearly 80%) in comments that it has submitted to FHFA and Congress, and its ongoing engagement with senior FHFA officials.

Under Fannie Mae’s plan revisions, the structure of its DTS lending program for resident-owned, non-profit or government-owned manufactured housing communities would be slightly altered by eliminating specific performance subcategories for the three different types of ownership and instead aggregating all into one over-arching target. Beyond this, the update would also decrease Fannie Mae’s targets for loan purchases of manufactured home communities with “tenant site lease protections” over the entire three-year plan period, based on alleged “constraints in the macroeconomic environment.” Meanwhile, Fannie Mae’s DTS plan makes no provision whatsoever for support of the nearly 80% of manufactured housing purchase loans – disproportionately relied-upon by lower income minority groups – financed and titled as chattel.

For its part, Freddie Mac’s DTS plan revisions will increase targets for purchases of loans on manufactured homes titled as real property and communities with certain “tenant protections,” but does not increase or accelerate its minimal proposed 2024 chattel loan purchase pilot program.

Some 15 years, therefore, after the adoption of the statutory Duty to Serve mandate, Fannie Mae and Freddie Mac have purchased and/or otherwise supported exactly zero manufactured home purchase chattel loans – despite being expressly authorized by Congress to do so. Effectively, then, both Fannie Mae and Freddie Mac – and FHFA as their federal regulator – have totally ignored the nearly 80% of the affordable manufactured housing market served by personal property lending (according to U.S. Census Bureau data) and the millions of Americans who seek (and are being denied) access to the nation’s leading source of affordable homeownership.

This complete and ongoing failure on the part of both Fannie Mae and Freddie Mac is one of the two key constraints on the manufactured housing market, the greater utilization of manufactured housing and the availability of federal programs and federal aid for manufactured homebuyers (the other being discriminatory and exclusionary state and local zoning laws), as addressed in detail in MHARR’s July 2022 White Paper on the “Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions.” As such, this failure deserves thorough congressional oversight, including a hearing requiring Fannie Mae, Freddie Mac and FHFA to provide specific answers and remedies for this longstanding and baseless failure to comply with applicable law.

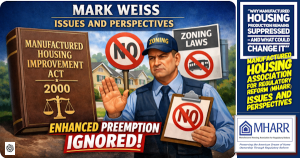

HUD COMPLETELY IGNORES EXCLUSIONARY ZONING AGAINST MH

The U.S. Department of Housing and Urban Development (HUD) has issued the latest proposed iteration of its so-called “Affirmatively Furthering Fair Housing” (AFFH) rule. Under the proposed rule, states and localities would be required to develop and implement “Equity Plans” designed not only to prevent housing discrimination against “protected classes,” but also to “proactively take meaningful actions to overcome patterns of segregation, promote fair housing choice, eliminate disparities in housing-related opportunities and foster inclusive communities….”

Insofar as the AFFH proposed rule – like previous proposed versions — specifically cites restrictive “land use and zoning ordinances” as factors that “impede the development and maintenance of affordable housing commensurate with need,” MHARR has consistently called for use of the regulatory/funding powers conferred by AFFH and the enhanced federal preemption of the Manufactured Housing Improvement Act of 2000, to promote zoning that allows for the liberal siting and utilization of manufactured homes and, where needed, the invalidation of zoning mandates that discriminatorily exclude or restrict the placement of HUD Code homes.

Accordingly, in October 11, 2018 comments on an earlier AFFH proposed rule, MHARR urged HUD to:

“(1) Apply a modified AFFH structure to, among other things, seek the elimination of local zoning or placement ordinances that discriminatorily exclude or limit the placement of HUD-regulated manufactured homes and/or manufactured housing communities in compatible areas;

(2) Seek to prevent the adoption of any additional ordinances or measures of that type and/or effect; and

(3) Failing voluntary local compliance with such criteria, take action to federally preempt such ordinances or measures under the authority provided by both AFFH and the enhanced federal preemption of the 2000 reform law.”

Under AFFH, accordingly, HUD could – and should – use its authority to prevent and reject local zoning ordinances which exclude or otherwise discriminate against HUD-regulated manufactured housing. Such authority, moreover, is supplemental – and in addition to — the authority that HUD already has to federally preempt such ordinances and “requirements” under the enhanced preemption language of the 2000 reform law, and which HUD must exercise, as anticipated and sought by Congress (as is explained in a 2003 communication from congressional proponents of the 2000 reform law to HUD).

Insofar, then, as discriminatory and exclusionary zoning continues to needlessly and baselessly restrict the role that manufactured housing otherwise would – and should – fulfill in meeting the nation’s need for affordable homeownership and non-discriminatory access for all Americans to such homeownership, and continues to prevent manufactured housing from fully and effectively participating in all federal government housing and homeownership programs, again as detailed in MHARR’s July 2022 White Paper, MHARR will submit comments in this rulemaking, once again urging the adoption of provisions that would allow for the invalidation and/or preemption of such zoning mandates.

Comments in response to the AFFH proposed rule are due on or before April 10, 2023. MHARR urges all manufactured housing industry members to submit comments and will publish its own submission in advance for use and/or citation by other industry members. The broader industry should and, indeed, must take all available opportunities, such as this, to address and remedy these fundamental roadblocks to greater industry production and a more readily-available supply of affordable housing for all Americans.

MANUFACTURED HOUSING PRODUCTION PLUNGES

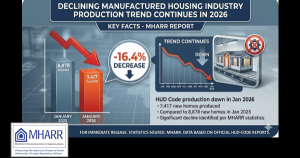

While the need for affordable housing and homeownership in the United States has never been greater, with millions more such homes required according to multiple market analyses, HUD Code manufactured housing production took a precipitous fall during the final quarter of 2022 and the first reporting month of 2023, according to official data compiled on behalf of the U.S. Department of Housing and Urban Development (HUD). Year-over-year production of HUD Code homes across the United States fell during each month of the Fourth Quarter, with the production decline becoming more severe as the quarter progressed. Thus, year-over-year production declined 6% in October 2022, 12% in November 2022 and 20% in December 2022. While total annual HUD Code production during 2022 still increased, due to strong growth early in the year, the Fourth Quarter saw an average decline of 12% year-over-year for the quarter as a whole, thus eclipsing the overall annual industry production growth rate of 6.7%. And, as if to put an exclamation point on the Fourth Quarter data, production statistics for January 2023 showed an even more precipitous 23.6% year-over-year decline, thus marking four straight months of steepening production declines.

While the cumulative annual growth in 2022 cannot be dismissed, the 20% production decline in December 2022, together with significantly weaker year-over-year industry production during the entire Fourth Quarter, extending now into 2023, should be a red flag regarding industry-specific impediments, such as discriminatory zoning exclusion and limitations, as well as the ongoing absence of federal support for fully-competitive consumer lending within the manufactured housing market in general and the personal property lending market in particular, which continue to suppress production levels well below where they should be, even in a virtually full-employment economy. Thus, while others in the industry may try to place a positive “spin” on these statistics, the fact remains that the industry, with these known, significant and unremedied post-production constraints, continues to underperform in a nation with: (1) a major documented shortfall of affordable housing; and (2) continuing significant inflation, which has placed site-built housing beyond the means of many American families.

This substantial production decline, in the face of accelerating need and demand, should be a sign to the industry and particularly its self-proclaimed post-production national representation, that a much more aggressive and effective approach is needed to address and, more importantly, remedy the discriminatory zoning and consumer financing constraints that continue to suppress the market and, more broadly, the availability of affordable manufactured housing for all Americans.

MHARR PRESSES FOR CONGRESSIONAL OVERSIGHT HEARINGS

In a recent communication to Rep. Warren Davidson (R-OH), Chairman of the House Financial Services Committee’s Subcommittee on Housing and Insurance, MHARR has called for full-scale congressional oversight hearings regarding the HUD manufactured housing program, the non-implementation of the Duty to Serve Underserved Markets (DTS) mandate by Fannie Mae and Freddie Mac.

The last time that an oversight hearing was held regarding the HUD program and specifically its failure to implement certain key aspects of the Manufactured Housing Improvement Act of 2000, was in February 2012, more than a decade ago. During the ensuing years, HUD has done virtually nothing to rectify these key failures and fully facilitate the availability and acceptability of HUD Code manufactured housing as the law requires. In particular, HUD continues to allow – and, by that inaction, implicitly endorses and facilitates – discriminatory zoning mandates around the country which specifically exclude or otherwise severely restrict the availability of the affordable manufactured housing that HUD itself regulates and is statutorily directed to advance. Federal government research, moreover, shows that these mandates disproportionately impact not only lower-income Americans, but also members of minority communities, in violation of federal fair housing law and the housing policies of the Biden Administration.

Insofar as discriminatory zoning is one of the two principal causes underlying the industry’s continuing failure to achieve its full potential as an affordable housing resource, as demonstrated in MHARR’s July 2022 White Paper, Congress should conduct a searching inquiry into the current state of the federal program, focusing on HUD’s failure to implement the enhanced preemption of the 2000 reform law and its impact on both American consumers of affordable housing and the industry itself. In addition, such a hearing should explore other key aspects of the 2000 reform law that HUD has failed to implement, including but not limited to:

(1) Its continuing failure to appoint a non-career program administrator;

(2) Its manipulation of appointments to the Manufactured Housing Consensus Committee;

(3) The lack of balanced small manufacturer representation on the MHCC; and

(4) Unlawful limitation on interested party participation in MHCC proceedings.

In addition, Congress should aggressively explore the continuing failure of GNMA, as a HUD entity, to restore the full operation and viability of the Federal Housing Administration’s (FHA) Title I manufactured housing program by significantly modifying its current 10-10 policy, which has reduced the Title I program to negligible levels of participation.

Beyond such issues relating to HUD, Congress should hold a full-scale oversight hearing regarding the other major long-term issue identified in MHARR’s White Paper that has acted to constrain the manufactured housing market – the non-implementation of the Duty to Serve mandate with respect to manufactured housing personal property loans, some 15 years after the enactment of DTS. As both Fannie Mae and Freddie Mac, as well as their federal regulator, the Federal Housing Finance Agency (FHFA), are well aware, the vast majority of manufactured housing consumer loans – nearly 80% — are (and have been for years) personal property or chattel loans. Yet, Fannie Mae and Freddie Mac, with the express approval of FHFA, have continually excluded chattel loans from their DTS “implementation” plans. And because of the overwhelming prevalence of such loans with the HUD Code sector, Fannie, Freddie and FHFA are effectively not “serving” the HUD Code market at all, in direct violation of DTS. Moreover, insofar as minority applicants for manufactured home personal property loans, in the absence of DTS support, are rejected at rates disproportionate to other borrowers, the ongoing failure to fully implement DTS has serious implications for racial equality. Again, therefore, congressional oversight is long overdue and clearly necessary.

MHARR is in the process of following-up on this initiative, and will provide further reports as developments unfold.

NEW IECC PROCESS WILL LEAD TO CONTINUING MH PRICE INCREASES UNDER DOE ENERGY RULE

Notwithstanding industry action to oppose the May 31, 2023 imposition of excessive and discriminatory DOE energy standards based on the 2021 version of the International Energy Conservation Code (IECC), the industry cannot afford to lose sight of even more serious problems that could lie ahead under the manufactured housing “energy standards” process dictated by section 413 of the Energy Independence and Security Act of 2007 (EISA). Under that provision, DOE is directed to continually update its manufactured housing energy conservation standards based on revisions to the IECC, which are developed over a three-year cycle. As a result, MHARR has been carefully monitoring ongoing proceedings, under the auspices of the International Code Council (ICC), that will ultimately lead to the next iteration of the IECC in 2024 and the prospects are – and should be — a matter of major concern for the industry.

Based on its initial findings, MHARR has begun an in-depth analysis – both procedural and substantive — of the IECC 2024 updating process, which was purportedly revamped by ICC after credible allegations of manipulation and abuse by climate/energy special interests in connection with the 2021 IECC. The results of MHARR’s analysis will soon be shared with the industry, consumers and others.

From MHARR’s monitoring to date, it is evident that the 2024 IECC process is being dominated by climate extremists placed on the development committee by ICC. Moreover, ICC itself, has simultaneously skewed the entire IECC process through biased policies and related public pronouncements. By structuring the IECC committee as it has and by “putting its thumb on the scale” of the new IECC development process from the start with such policies and pronouncements, ICC has undermined any semblance of credibility, legitimacy, or objectivity in the development of the IECC which, in turn, demonstrates yet again, that the IECC is not now – and never will be – an appropriate basis for manufactured housing energy standards, EISA section 413 notwithstanding.

MHARR WHITE PAPER CORROBORATED AND VINDICATED

The central premise of MHARR’s July 2022 White Paper, “The Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions” has been corroborated yet again.

In that White Paper, MHARR asserted that federal spending and assistance programs for “affordable housing” were not reaching the ground with respect to manufactured housing and not providing any tangible assistance for either current or future manufactured homebuyers because of the continuing failure to fully address and rectify two key impediments: (1) discriminatory zoning exclusion and restrictions on the placement of HUD Code homes; and (2) the failure of Fannie Mae and Freddie Mac to implement the Duty to Serve Underserved Markets with respect to the chattel loans which comprise nearly 80% of the manufactured housing consumer financing market.

Now, a recent news release from the Federal Housing Finance Agency (FHFA) – the federal regulator for Fannie Mae and Freddie Mac – further corroborates the White Paper’s fundamental premise. In that news release, published February 28, 2023, FHFA announced that Fannie Mae and Freddie Mac would contribute $545 million for “affordable housing initiatives.” According to FHFA, these amounts would be conveyed by Fannie and Freddie to the HUD-administered Housing Trust Fund, which provides funding to “states and state-designated entities for the production or preservation of affordable housing” and the Capital Magnet Fund, administered by the Treasury Department, which “competitively awards money to finance affordable housing activities….”

While these funds have yet to be disbursed, there is virtually no doubt that they will bypass. HUD Code manufactured housing, as there has been no apparent designation of a manufactured housing producer as a “designated entity” for purposes of the HUD Housing Trust Fund and no competitive award, known to MHARR, for a manufactured housing producer under the Capital Magnet Fund. And this continues to be the case with nearly all of the billions of dollars in public funding and assistance for “affordable housing” that are being doled-out by the Biden Administration.

The industry and consumers of affordable housing should be unwilling to tolerate the artificial constraints that have been placed on the manufactured housing market by government zoning restrictions and the failure of federally-regulated Fannie Mae and Freddie Mac to implement DTS with respect to the vast majority of the manufactured housing market, and should aggressively demand the correction and resolution of both matters.

REPORT AND ANALYSISIN THIS REPORT: MARCH 15, 2023

- DOE “ENERGY” RULE LAWSUIT FILED AFTER NINE MONTH DELAY

- FHFA CONTINUES TO THUMB ITS NOSE AT CONGRESS ON DTS

- HUD CONTINUES TO IGNORE ANTI-MH ZONING DISCRIMINATION

- HUD CODE PRODUCTION PLUMMETS

- MHARR SEEKS CONGRESSIONAL OVERSIGHT HEARINGS

- “NEW” IECC PROCESS WOULD WORSEN DOE ENERGY RULE

- MHARR WHITE PAPER CORROBORATED ONCE AGAIN

MHARR-PROMOTED LAWSUIT FINALLY FILED AGAINST DOE ENERGY RULE

Some nine months after the publication of a market-killing U.S. Department of Energy (DOE) final rule for manufactured housing “energy” standards – and more than six months after MHARR urged the Manufactured Housing Institute (MHI) to pursue legal action to stop the May 31, 2023 implementation of that rule (and simultaneously offered to join and support such litigation) — MHI and the Texas Manufactured Housing Association (TMHA) have filed such an action in the United States District Court for the Western District of Texas. The DOE rule, as conceded by that agency, would add thousands of dollars to the retail cost of a new manufactured home, even without considering testing, enforcement and regulatory compliance costs, which have never been calculated or even estimated. Indeed, 2021-2022 MHARR estimates showed that the DOE standards would add between $6,000 and $12,000 to the retail cost of a new HUD Code home. Even those staggering figures, however, would be higher today, given continuing high rates of inflation and increases in living costs.

The pending lawsuit, accordingly, filed on February 14, 2023, seeks to stay implementation of the DOE final rule and other related relief. In both substance and approach, this court action tracks steps specifically urged by MHARR in August 2022.

In MHARR’s August 2022 Issues and Perspectives column, “Why the DOE Energy Rule Should be DOA,” MHARR detailed the legal bases and practical rationale for such a court action, as well as claims and arguments, both substantive and procedural (addressed in multiple sets of MHARR comments to DOE and the Manufactured Housing Consensus Committee), that could be asserted in such an action. It also stressed the urgent need for timely litigation in order to secure relief well in advance of the implementation date.

Among other things, MHARR called for an action under the federal Administrative Procedure Act, based on DOE’s failure to fully and properly calculate, account for, and consider all of the anticipated costs of the rule. This included, but was not limited to, DOE’s failure to propose and estimate the costs of testing, compliance and enforcement of the final standards, its use of artificially low inflation indices for the defective “cost analysis” that it did perform, and its failure to consider other factors that would result in costs substantially exceeding anticipated benefits. MHARR also urged litigation based on DOE’s failure to fully and properly consult with HUD and the Manufactured Housing Consensus Committee (MHCC) as directed by Congress in the Energy Independence and Security Act of 2007 and, just as importantly, DOE’s thoroughly corrupted “negotiated rulemaking” process, which MHARR consistently opposed (unlike MHI) and which irretrievably tainted the final rule from step-one.

As set out by MHARR, the objective of such a court action was to invalidate the DOE final rule – and the entirety of the rulemaking process which led to that rule, beginning in 2008 – and to compel DOE to go back to “square one” with respect to manufactured housing energy standards in full and proper consultation with both HUD and the MHCC, from the start, as mandated by Congress.

As this has unfolded, however, the MHI filing, which apparently follows the failure of other legislative and Executive Branch approaches pursued by that organization – the futility of which MHARR anticipated and explained in its August 2022 analysis — appears to be a last resort, rather than the first step toward obtaining meaningful relief as urged by MHARR in its detailed blueprint. Consequently, while MHARR credits MHI for taking the necessary step of initiating court action against the DOE rule, that case should have been instituted months ago in order to avoid the type of chaos which has now begun to engulf the industry with, among other things:

(1) Uncertainty among manufacturers as to whether they must prepare for compliance with the DOE standards as of May 31, 2023;

(2) Corresponding uncertainty among IPIAs and DAPIAs regarding enforcement of the DOE standards and the scope of their authority (if any) in the absence of corresponding HUD standards (with at least one IPIA/DAPIA stating in a communication to manufacturers that it will not require compliance with DOE standards not incorporated within the HUD Code);

(3) A lack of any specific, valid action by HUD; and

(4) The absence of any type of testing, enforcement or other regulatory mechanism in advance of the May 31, 2023 implementation date.

Given the foregoing, the pending lawsuit must be about more than just delaying implementation of the final DOE standards rule. Rather, it must be about vacating that rule, based on its myriad fatal defects, and sending the entire rulemaking process back to the very start, so that there can be proper consultation with HUD and the MHCC, and complete elimination of the inherent taint that DOE’s thoroughly-corrupted “negotiated rulemaking” process infused into the process leading to the destructive May 2022 DOE final standard.

LATEST DTS REVISIONS CONTINUE TO FLOUT CONGRESS AND FEDERAL LAW

The Federal Housing Finance Agency (FHFA) – the federal agency responsible for the implementation of the Duty to Serve Underserved Markets (DTS) provision of the Housing and Economic Recovery Act of 2008 (HERA) — has published the latest approved revisions to the 2022-2024 DTS “implementation” plans submitted by mortgage giants Fannie Mae and Freddie Mac. While these revisions will have some minor impacts on the manufactured housing market, they totally fail, once again, to address the complete absence of manufactured housing chattel loan support in the Fannie Mae DTS plan, or Freddie Mac’s ongoing delay of any DTS chattel loan support until the last year of its plan (2024) under a token pilot program that could still be deleted prior to implementation, as has been the case with previous supposed chattel loan “pilot” programs. MHARR has consistently cited this failure to provide essential support for the vast bulk of the manufactured housing finance market (i.e., nearly 80%) in comments that it has submitted to FHFA and Congress, and its ongoing engagement with senior FHFA officials.

Under Fannie Mae’s plan revisions, the structure of its DTS lending program for resident-owned, non-profit or government-owned manufactured housing communities would be slightly altered by eliminating specific performance subcategories for the three different types of ownership and instead aggregating all into one over-arching target. Beyond this, the update would also decrease Fannie Mae’s targets for loan purchases of manufactured home communities with “tenant site lease protections” over the entire three-year plan period, based on alleged “constraints in the macroeconomic environment.” Meanwhile, Fannie Mae’s DTS plan makes no provision whatsoever for support of the nearly 80% of manufactured housing purchase loans – disproportionately relied-upon by lower income minority groups – financed and titled as chattel.

For its part, Freddie Mac’s DTS plan revisions will increase targets for purchases of loans on manufactured homes titled as real property and communities with certain “tenant protections,” but does not increase or accelerate its minimal proposed 2024 chattel loan purchase pilot program.

Some 15 years, therefore, after the adoption of the statutory Duty to Serve mandate, Fannie Mae and Freddie Mac have purchased and/or otherwise supported exactly zero manufactured home purchase chattel loans – despite being expressly authorized by Congress to do so. Effectively, then, both Fannie Mae and Freddie Mac – and FHFA as their federal regulator – have totally ignored the nearly 80% of the affordable manufactured housing market served by personal property lending (according to U.S. Census Bureau data) and the millions of Americans who seek (and are being denied) access to the nation’s leading source of affordable homeownership.

This complete and ongoing failure on the part of both Fannie Mae and Freddie Mac is one of the two key constraints on the manufactured housing market, the greater utilization of manufactured housing and the availability of federal programs and federal aid for manufactured homebuyers (the other being discriminatory and exclusionary state and local zoning laws), as addressed in detail in MHARR’s July 2022 White Paper on the “Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions.” As such, this failure deserves thorough congressional oversight, including a hearing requiring Fannie Mae, Freddie Mac and FHFA to provide specific answers and remedies for this longstanding and baseless failure to comply with applicable law.

HUD COMPLETELY IGNORES EXCLUSIONARY ZONING AGAINST MH

The U.S. Department of Housing and Urban Development (HUD) has issued the latest proposed iteration of its so-called “Affirmatively Furthering Fair Housing” (AFFH) rule. Under the proposed rule, states and localities would be required to develop and implement “Equity Plans” designed not only to prevent housing discrimination against “protected classes,” but also to “proactively take meaningful actions to overcome patterns of segregation, promote fair housing choice, eliminate disparities in housing-related opportunities and foster inclusive communities….”

Insofar as the AFFH proposed rule – like previous proposed versions — specifically cites restrictive “land use and zoning ordinances” as factors that “impede the development and maintenance of affordable housing commensurate with need,” MHARR has consistently called for use of the regulatory/funding powers conferred by AFFH and the enhanced federal preemption of the Manufactured Housing Improvement Act of 2000, to promote zoning that allows for the liberal siting and utilization of manufactured homes and, where needed, the invalidation of zoning mandates that discriminatorily exclude or restrict the placement of HUD Code homes.

Accordingly, in October 11, 2018 comments on an earlier AFFH proposed rule, MHARR urged HUD to:

“(1) Apply a modified AFFH structure to, among other things, seek the elimination of local zoning or placement ordinances that discriminatorily exclude or limit the placement of HUD-regulated manufactured homes and/or manufactured housing communities in compatible areas;

(2) Seek to prevent the adoption of any additional ordinances or measures of that type and/or effect; and

(3) Failing voluntary local compliance with such criteria, take action to federally preempt such ordinances or measures under the authority provided by both AFFH and the enhanced federal preemption of the 2000 reform law.”

Under AFFH, accordingly, HUD could – and should – use its authority to prevent and reject local zoning ordinances which exclude or otherwise discriminate against HUD-regulated manufactured housing. Such authority, moreover, is supplemental – and in addition to — the authority that HUD already has to federally preempt such ordinances and “requirements” under the enhanced preemption language of the 2000 reform law, and which HUD must exercise, as anticipated and sought by Congress (as is explained in a 2003 communication from congressional proponents of the 2000 reform law to HUD).

Insofar, then, as discriminatory and exclusionary zoning continues to needlessly and baselessly restrict the role that manufactured housing otherwise would – and should – fulfill in meeting the nation’s need for affordable homeownership and non-discriminatory access for all Americans to such homeownership, and continues to prevent manufactured housing from fully and effectively participating in all federal government housing and homeownership programs, again as detailed in MHARR’s July 2022 White Paper, MHARR will submit comments in this rulemaking, once again urging the adoption of provisions that would allow for the invalidation and/or preemption of such zoning mandates.

Comments in response to the AFFH proposed rule are due on or before April 10, 2023. MHARR urges all manufactured housing industry members to submit comments and will publish its own submission in advance for use and/or citation by other industry members. The broader industry should and, indeed, must take all available opportunities, such as this, to address and remedy these fundamental roadblocks to greater industry production and a more readily-available supply of affordable housing for all Americans.

MANUFACTURED HOUSING PRODUCTION PLUNGES

While the need for affordable housing and homeownership in the United States has never been greater, with millions more such homes required according to multiple market analyses, HUD Code manufactured housing production took a precipitous fall during the final quarter of 2022 and the first reporting month of 2023, according to official data compiled on behalf of the U.S. Department of Housing and Urban Development (HUD). Year-over-year production of HUD Code homes across the United States fell during each month of the Fourth Quarter, with the production decline becoming more severe as the quarter progressed. Thus, year-over-year production declined 6% in October 2022, 12% in November 2022 and 20% in December 2022. While total annual HUD Code production during 2022 still increased, due to strong growth early in the year, the Fourth Quarter saw an average decline of 12% year-over-year for the quarter as a whole, thus eclipsing the overall annual industry production growth rate of 6.7%. And, as if to put an exclamation point on the Fourth Quarter data, production statistics for January 2023 showed an even more precipitous 23.6% year-over-year decline, thus marking four straight months of steepening production declines.

While the cumulative annual growth in 2022 cannot be dismissed, the 20% production decline in December 2022, together with significantly weaker year-over-year industry production during the entire Fourth Quarter, extending now into 2023, should be a red flag regarding industry-specific impediments, such as discriminatory zoning exclusion and limitations, as well as the ongoing absence of federal support for fully-competitive consumer lending within the manufactured housing market in general and the personal property lending market in particular, which continue to suppress production levels well below where they should be, even in a virtually full-employment economy. Thus, while others in the industry may try to place a positive “spin” on these statistics, the fact remains that the industry, with these known, significant and unremedied post-production constraints, continues to underperform in a nation with: (1) a major documented shortfall of affordable housing; and (2) continuing significant inflation, which has placed site-built housing beyond the means of many American families.

This substantial production decline, in the face of accelerating need and demand, should be a sign to the industry and particularly its self-proclaimed post-production national representation, that a much more aggressive and effective approach is needed to address and, more importantly, remedy the discriminatory zoning and consumer financing constraints that continue to suppress the market and, more broadly, the availability of affordable manufactured housing for all Americans.

MHARR PRESSES FOR CONGRESSIONAL OVERSIGHT HEARINGS

In a recent communication to Rep. Warren Davidson (R-OH), Chairman of the House Financial Services Committee’s Subcommittee on Housing and Insurance, MHARR has called for full-scale congressional oversight hearings regarding the HUD manufactured housing program, the non-implementation of the Duty to Serve Underserved Markets (DTS) mandate by Fannie Mae and Freddie Mac.

The last time that an oversight hearing was held regarding the HUD program and specifically its failure to implement certain key aspects of the Manufactured Housing Improvement Act of 2000, was in February 2012, more than a decade ago. During the ensuing years, HUD has done virtually nothing to rectify these key failures and fully facilitate the availability and acceptability of HUD Code manufactured housing as the law requires. In particular, HUD continues to allow – and, by that inaction, implicitly endorses and facilitates – discriminatory zoning mandates around the country which specifically exclude or otherwise severely restrict the availability of the affordable manufactured housing that HUD itself regulates and is statutorily directed to advance. Federal government research, moreover, shows that these mandates disproportionately impact not only lower-income Americans, but also members of minority communities, in violation of federal fair housing law and the housing policies of the Biden Administration.

Insofar as discriminatory zoning is one of the two principal causes underlying the industry’s continuing failure to achieve its full potential as an affordable housing resource, as demonstrated in MHARR’s July 2022 White Paper, Congress should conduct a searching inquiry into the current state of the federal program, focusing on HUD’s failure to implement the enhanced preemption of the 2000 reform law and its impact on both American consumers of affordable housing and the industry itself. In addition, such a hearing should explore other key aspects of the 2000 reform law that HUD has failed to implement, including but not limited to:

(1) Its continuing failure to appoint a non-career program administrator;

(2) Its manipulation of appointments to the Manufactured Housing Consensus Committee;

(3) The lack of balanced small manufacturer representation on the MHCC; and

(4) Unlawful limitation on interested party participation in MHCC proceedings.

In addition, Congress should aggressively explore the continuing failure of GNMA, as a HUD entity, to restore the full operation and viability of the Federal Housing Administration’s (FHA) Title I manufactured housing program by significantly modifying its current 10-10 policy, which has reduced the Title I program to negligible levels of participation.

Beyond such issues relating to HUD, Congress should hold a full-scale oversight hearing regarding the other major long-term issue identified in MHARR’s White Paper that has acted to constrain the manufactured housing market – the non-implementation of the Duty to Serve mandate with respect to manufactured housing personal property loans, some 15 years after the enactment of DTS. As both Fannie Mae and Freddie Mac, as well as their federal regulator, the Federal Housing Finance Agency (FHFA), are well aware, the vast majority of manufactured housing consumer loans – nearly 80% — are (and have been for years) personal property or chattel loans. Yet, Fannie Mae and Freddie Mac, with the express approval of FHFA, have continually excluded chattel loans from their DTS “implementation” plans. And because of the overwhelming prevalence of such loans with the HUD Code sector, Fannie, Freddie and FHFA are effectively not “serving” the HUD Code market at all, in direct violation of DTS. Moreover, insofar as minority applicants for manufactured home personal property loans, in the absence of DTS support, are rejected at rates disproportionate to other borrowers, the ongoing failure to fully implement DTS has serious implications for racial equality. Again, therefore, congressional oversight is long overdue and clearly necessary.

MHARR is in the process of following-up on this initiative, and will provide further reports as developments unfold.

NEW IECC PROCESS WILL LEAD TO CONTINUING MH PRICE INCREASES UNDER DOE ENERGY RULE

Notwithstanding industry action to oppose the May 31, 2023 imposition of excessive and discriminatory DOE energy standards based on the 2021 version of the International Energy Conservation Code (IECC), the industry cannot afford to lose sight of even more serious problems that could lie ahead under the manufactured housing “energy standards” process dictated by section 413 of the Energy Independence and Security Act of 2007 (EISA). Under that provision, DOE is directed to continually update its manufactured housing energy conservation standards based on revisions to the IECC, which are developed over a three-year cycle. As a result, MHARR has been carefully monitoring ongoing proceedings, under the auspices of the International Code Council (ICC), that will ultimately lead to the next iteration of the IECC in 2024 and the prospects are – and should be — a matter of major concern for the industry.

Based on its initial findings, MHARR has begun an in-depth analysis – both procedural and substantive — of the IECC 2024 updating process, which was purportedly revamped by ICC after credible allegations of manipulation and abuse by climate/energy special interests in connection with the 2021 IECC. The results of MHARR’s analysis will soon be shared with the industry, consumers and others.

From MHARR’s monitoring to date, it is evident that the 2024 IECC process is being dominated by climate extremists placed on the development committee by ICC. Moreover, ICC itself, has simultaneously skewed the entire IECC process through biased policies and related public pronouncements. By structuring the IECC committee as it has and by “putting its thumb on the scale” of the new IECC development process from the start with such policies and pronouncements, ICC has undermined any semblance of credibility, legitimacy, or objectivity in the development of the IECC which, in turn, demonstrates yet again, that the IECC is not now – and never will be – an appropriate basis for manufactured housing energy standards, EISA section 413 notwithstanding.

MHARR WHITE PAPER CORROBORATED AND VINDICATED

The central premise of MHARR’s July 2022 White Paper, “The Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions” has been corroborated yet again.

In that White Paper, MHARR asserted that federal spending and assistance programs for “affordable housing” were not reaching the ground with respect to manufactured housing and not providing any tangible assistance for either current or future manufactured homebuyers because of the continuing failure to fully address and rectify two key impediments: (1) discriminatory zoning exclusion and restrictions on the placement of HUD Code homes; and (2) the failure of Fannie Mae and Freddie Mac to implement the Duty to Serve Underserved Markets with respect to the chattel loans which comprise nearly 80% of the manufactured housing consumer financing market.

Now, a recent news release from the Federal Housing Finance Agency (FHFA) – the federal regulator for Fannie Mae and Freddie Mac – further corroborates the White Paper’s fundamental premise. In that news release, published February 28, 2023, FHFA announced that Fannie Mae and Freddie Mac would contribute $545 million for “affordable housing initiatives.” According to FHFA, these amounts would be conveyed by Fannie and Freddie to the HUD-administered Housing Trust Fund, which provides funding to “states and state-designated entities for the production or preservation of affordable housing” and the Capital Magnet Fund, administered by the Treasury Department, which “competitively awards money to finance affordable housing activities….”

While these funds have yet to be disbursed, there is virtually no doubt that they will bypass. HUD Code manufactured housing, as there has been no apparent designation of a manufactured housing producer as a “designated entity” for purposes of the HUD Housing Trust Fund and no competitive award, known to MHARR, for a manufactured housing producer under the Capital Magnet Fund. And this continues to be the case with nearly all of the billions of dollars in public funding and assistance for “affordable housing” that are being doled-out by the Biden Administration.

The industry and consumers of affordable housing should be unwilling to tolerate the artificial constraints that have been placed on the manufactured housing market by government zoning restrictions and the failure of federally-regulated Fannie Mae and Freddie Mac to implement DTS with respect to the vast majority of the manufactured housing market, and should aggressively demand the correction and resolution of both matters.